Closing Bell: ASX hangs in there thanks to strength in tech stocks

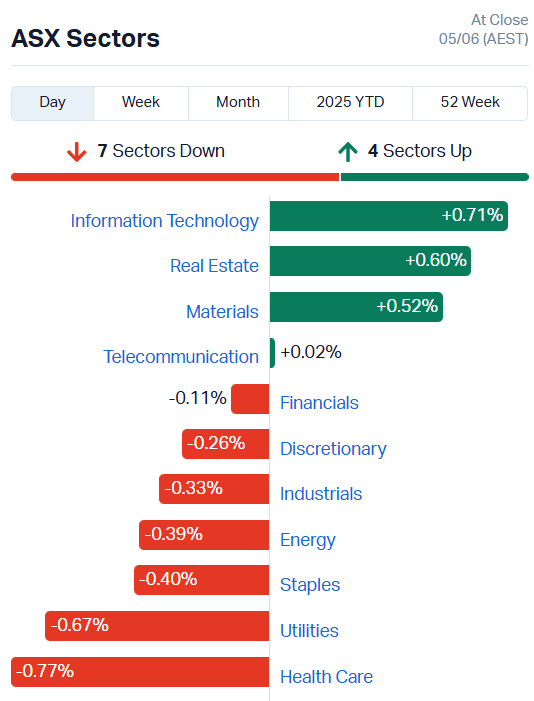

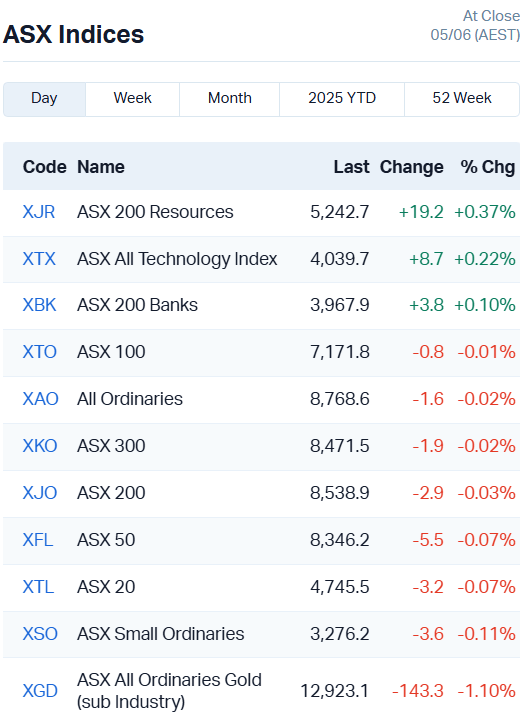

ASX finishes down just 0.03pc, resisting weakness in gold and healthcare stocks as tech stocks and battery metal miners offset losses.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Despite a strong start, the ASX has paired back gains to finish down 2.9 points or 0.03pc

Weakness came from the Health Care sector and gold stocks

Info Tech sector rides semiconductor fever higher, up 0.71pc

Despite a strong start to the day, the ASX had fallen below yesterday’s levels by about lunch time, dipping about a dozen points.

Bullish sentiment in tech stocks kept the damage to a minimum – the ASX managed to claw back losses to fall just 2.9 points by the end of the day.

Healthcare stocks were the main drivers of weakness, shedding 0.77%. The sector is down about 6.94% for the year to date, marking it as the worst-performing sector on the ASX for the year so far.

In fact, only the Energy sector has suffered anywhere near as much, having fallen 6.72% in the first six months of the 2025 calendar year.

A 0.28% dip in gold prices weighed on our Aussie precious metal stocks, driving the ASX All Ords Gold index lower by more than 1%.

Despite our usually upbeat gold miners dragging, the Materials sector put in a solid performance, lifting 0.52% as a handful of lithium and rare earth miners powered higher.

Min Res (ASX:MIN) surged 14%, Lynas Rare Earths (ASX:LYC) and Pilbara Minerals (ASX:PLS) 11%. Arafura Rare Earths (ASX:ARU) jumped 9% and Iluka Resources (ASX:ILU) 7%.

While the Aussie bourse didn’t make any progress toward new highs today, it’s still sitting just 0.89% off those levels, having gained 1.54% over the last five trading days.

Three ASX companies make EU’s strategic project list

The shares of three Australian mining companies are on the up after their projects made it onto the European Union’s first list of 13 Strategic Projects outside the trading block’s geographical borders.

While mining giant Rio Tinto (ASX:RIO) is only up about 0.30% on the news, its Jadar lithium project made the cut, Evion Group (ASX:EVG) and Sarytogan Graphite (ASX:SGA) have surged 25% and 17% each.

The two small cap resource companies are graphite-focused, with EVG at the permitting stage for its Maniry graphite project in Madagascar and SGA holding the highest-grade graphite resource of any ASX-listed company. It’s also the second largest contained graphite resource on the ASX, at 60Mt of contained graphite.

The EU’s latest initiative complements the list of 47 Strategic Projects selected within the EU in March.

The goal is to secure supplies of minerals critical to national security and continued economic prosperity, with a particular focus on electro mobility, renewable energy, defence and aerospace sectors.

“Securing reliable supplies of critical raw materials is a strategic priority for Europe’s resilience and competitiveness as it is essential for the modernisation of our economy,” EU Commissioner for International Partnerships Jozef Síkela said.

“The EU offer is to link cooperation in this area with skills, quality jobs, access to clean energy and essential services, and with good practices and high standards.

“This is what the Global Gateway is about, and our projects prove it in action. With this approach, we contribute to prosperity and stability in both Europe and our partner countries, strengthening economic security and diversifying supply chains.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EV1 | Evolutionenergy | 0.015 | 88% | 4831423 | $2,901,204 |

| ADD | Adavale Resource Ltd | 0.0015 | 50% | 400066 | $2,287,279 |

| AUH | Austchina Holdings | 0.0015 | 50% | 27230 | $3,025,384 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 5558647 | $6,684,681 |

| OB1 | Orbminco Limited | 0.0015 | 50% | 10000000 | $2,897,568 |

| CDE | Codeifai Limited | 0.02 | 43% | 5730545 | $4,564,445 |

| IS3 | I Synergy Group Ltd | 0.007 | 40% | 157336 | $2,503,651 |

| AOA | Ausmon Resorces | 0.002 | 33% | 375000 | $1,966,820 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 21903039 | $4,880,668 |

| FGH | Foresta Group | 0.008 | 33% | 1118453 | $15,917,439 |

| HLX | Helix Resources | 0.002 | 33% | 393336 | $5,046,291 |

| ZEU | Zeus Resources Ltd | 0.012 | 33% | 20152873 | $5,766,058 |

| EVEDA | EVE Health Group Ltd | 0.03 | 30% | 2108010 | $3,032,828 |

| GTR | Gti Energy Ltd | 0.0045 | 29% | 38969586 | $10,496,324 |

| AMS | Atomos | 0.005 | 25% | 117868 | $4,860,074 |

| CHM | Chimeric Therapeutic | 0.005 | 25% | 5634619 | $8,060,777 |

| ENT | Enterprise Metals | 0.0025 | 25% | 100108 | $2,356,635 |

| EVG | Evion Group NL | 0.02 | 25% | 3182621 | $6,958,720 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 50000 | $2,162,928 |

| TMX | Terrain Minerals | 0.0025 | 25% | 22788 | $4,497,113 |

| LOC | Locatetechnologies | 0.11 | 25% | 700761 | $19,908,829 |

| TEE | Topendenergylimited | 0.054 | 23% | 596361 | $12,288,375 |

| ATX | Amplia Therapeutics | 0.061 | 22% | 8552116 | $19,397,633 |

| VMM | Viridismining | 0.35 | 21% | 429693 | $25,003,897 |

| HWK | Hawk Resources. | 0.018 | 20% | 2009615 | $4,063,942 |

Making news…

GTI Energy (ASX:GTR) says early numbers from its Lo Herma uranium project in Wyoming look promising, pointing to a potential low-cost in-situ recovery (ISR) operation producing around 800,000 pounds of uranium a year.

The scoping study was run by Wyoming-based experts BRS Engineering and outlines a seven-year plan with a total production target of nearly 6 million pounds.

It’s still early days, though – most of the resource is in the lower-confidence “Inferred” category, so there’s no guarantee the uranium’s all there or that it’ll stack up economically just yet.

AXP Energy (ASX:AXP) has achieved what it described as “reliable system uptime” for its gas-to-Bitcoin mining operation, using an oil and gas well in the Pathfinder field of Colorado to power a bitcoin mining site.

With the off-grid gas-to-power site now operational, the company is looking to roll out its technology in additional locations to support the bitcoin mining sector.

As mentioned above, the EU has recognised Evion Group’s (ASX:EVG) Maniry graphite project in Madagascar as a strategic future supplier of critical minerals.

The EU’s recognition provides pathways to funding, grants and preferred offtake partners for the company. EVG’s executive team will meet with EU officials in the near term to outline a development plan.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXI | Axiom Properties | 0.018 | -40% | 15000 | $12,981,410 |

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 1444004 | $3,234,328 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 2830000 | $6,828,269 |

| GMN | Gold Mountain Ltd | 0.0015 | -25% | 1347106 | $11,239,518 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 294907 | $9,673,198 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 655257 | $15,867,318 |

| DAF | Discovery Alaska Ltd | 0.008 | -20% | 977000 | $2,342,347 |

| EM2 | Eagle Mountain | 0.004 | -20% | 537797 | $5,675,186 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 200001 | $9,929,183 |

| SAN | Sagalio Energy Ltd | 0.004 | -20% | 160000 | $1,023,301 |

| 1AD | Adalta Limited | 0.0025 | -17% | 6146114 | $3,020,120 |

| BIT | Biotron Limited | 0.0025 | -17% | 330026 | $3,981,738 |

| FRX | Flexiroam Limited | 0.005 | -17% | 612700 | $9,104,392 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 629358 | $18,378,447 |

| OVT | Ovanti Limited | 0.0025 | -17% | 3982026 | $8,380,545 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 2113333 | $9,525,167 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 987350 | $4,697,146 |

| GCM | Green Critical Min | 0.0185 | -16% | 47106388 | $43,189,923 |

| EPM | Eclipse Metals | 0.016 | -16% | 22225074 | $54,450,562 |

| OLY | Olympio Metals Ltd | 0.033 | -15% | 637320 | $3,434,625 |

| QEM | QEM Limited | 0.051 | -15% | 57568 | $11,450,021 |

| AON | Apollo Minerals Ltd | 0.006 | -14% | 8368133 | $6,499,198 |

| ICR | Intelicare Holdings | 0.006 | -14% | 3390374 | $3,403,317 |

| SRJ | SRJ Technologies | 0.012 | -14% | 1200956 | $8,478,093 |

| PEB | Pacific Edge | 0.091 | -13% | 4482 | $85,251,177 |

Making news…

Eagle Mountain Mining (ASX:EM2) managing director Charlie Bass has stepped down from the role, effective end of business June 6.

Bass is stepping down to pursue private interests, but says he remains a “strong believer in Eagle Mountain’s future” and will continue to support EM2 as its largest shareholder.

IN CASE YOU MISSED IT

Albion Resources (ASX:ALB) has locked in heritage for a maiden campaign over an underexplored end of the Yandal Greenstone Belt.

TG Metals (ASX:TG6) has defined a resource of 227,140oz contained gold at its Van Uden project after updating it to JORC 2012 compliance.

Trek Metals (ASX:TKM) is preparing to start drilling at its Christmas Creek gold project in Western Australia.

Taruga Minerals (ASX:TAR) is narrowing down potential lead and silver drill targets at the Thowagee polymetallic project in WA.

Asra Resources (ASX: ASR) has welcomed a highly experienced geological consultant to its technical team as CEO Paul Stephen transitions to MD.

Elevate Uranium (ASX:EL8) has grown its exploration footprint beyond the Koppies resource after delineating a zone measuring 11km by 7.5km.

Investors have demonstrated their confidence in Caprice Resources’ (ASX:CRS) and its plans to advance gold exploration at its Murchison gold projects by providing firm commitments for a $7m placement.

EMVision Medical Devices (ASX:EMV) has appointed Ramsay Health Care Australia CEO Carmel Monaghan as a non-executive director of the board.

Binding commitments to raise $4m in a placement have furnished Brazilian Critical Minerals (ASX:BCM) with funds for pre-development work at its Ema rare earth project

Nimy (ASX:NIM) has hit sizeable intervals of gallium host rock at the Block 3 gallium project in WA, reinforcing the company’s geological model.

QX Resources (ASX:QXR) has executed a binding term sheet to farm-out a 75% stake in the iron ore rights of its Western Shaw project in WA’s Pilbara region.

TRADING HALTS

Dalaroo Metals (ASX:DLM) – acquisition of gold project in Côte d’Ivoire

Firebrick Pharma (ASX:FRE) – cap raise

FireFly Metals (ASX:FFM) – cap raise

Resolution Minerals (ASX:RML) – material acquisition

S2 Resources (ASX:S2R) – cap raise

At Stockhead, we tell it like it is. While GTI Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX hangs in there thanks to strength in tech stocks