ASX tech May winners: Silicon surge sends Aussie tech sector skyward by 22pc

ASX tech stocks roared back to life in May, riding a wave of global AI hype, easing trade tensions, and strong earnings.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX tech rockets 22pc in May

Earnings from tech's 'Magnificent 7' helped matters

Elsight, Eroad, Etherstack and Yojee were notable gainers

The ASX tech sector didn’t just rally in May, it rocketed.

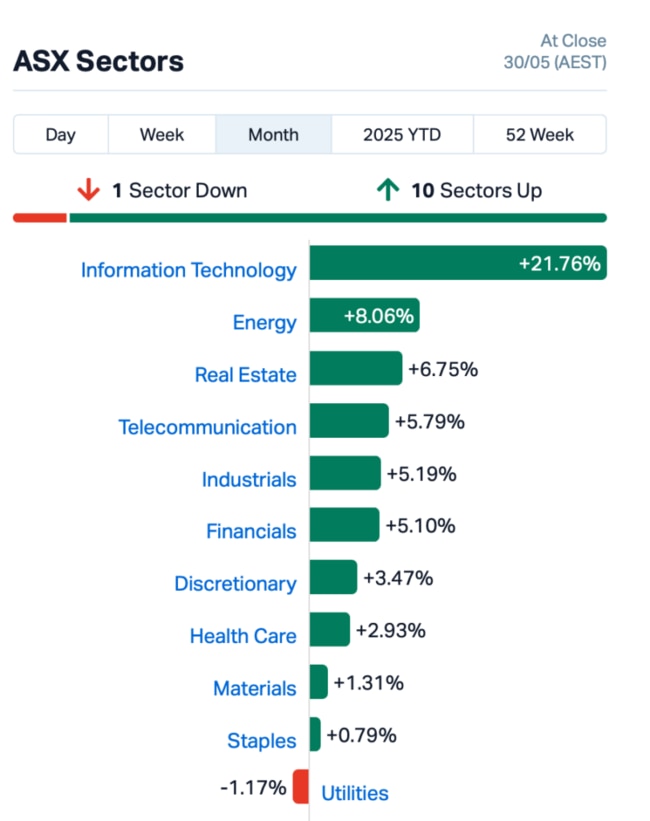

Up more than 22%, it was one of the biggest monthly leaps in recent memory, outpacing every other sector on the index and riding a wave of global tailwinds that swept through Wall Street and into Martin Place.

May performance by sector

So what lit the rocket under Aussie tech?

Well, a combo of softening US-China trade tensions, a rate cut by the RBA, and red-hot earnings from the global tech elite – all wrapped in a volatile month where every diplomatic handshake or tariff tweet sent markets bouncing.

Wall Street turns silicon slick

Over in the US, it was an AI-fuelled tech fest.

The Nasdaq jumped 9.5% in May, its best showing since November last year. The S&P 500 had a solid 6.15% lift, and the Dow chipped in with a 4% gain.

The key driver was de-escalation.

Starting May 14, Washington slashed tariffs on Chinese goods from 145% to 30%. Beijing responded by trimming its own to 10%.

Also, earnings from the “Magnificent Seven” – Microsoft, Nvidia, Apple, Alphabet, Amazon, Meta, and Tesla – blew past expectations.

According to FactSet, their collective Q1 earnings grew 27.7%, smashing estimates and fuelling confidence in AI, cloud, and consumer spending.

But the mood wasn’t all champagne and confetti.

Trump reignited tariff threats by month’s end, accusing China of dragging its feet on export compliance, especially around rare earths.

The backpedalling stirred new worries, but not enough to undo the market’s momentum.

Confidence is back, at least for now. And when global investors are feeling bold, ASX tech stocks often get caught in the updraft.

ASX tech winners in May

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| 4DS | 4Ds Memory Limited | 0.059 | 97% | $118,137,090 |

| ELS | Elsight Ltd | 0.770 | 71% | $139,940,732 |

| ERD | Eroad Limited | 1.390 | 65% | $260,500,778 |

| ESK | Etherstack PLC | 0.440 | 54% | $58,155,681 |

| YOJ | Yojee Limited | 0.270 | 54% | $86,413,050 |

| 360 | Life360 Inc. | 33.330 | 52% | $5,806,753,611 |

| EOS | Electro Optic Sys. | 1.845 | 51% | $355,996,623 |

| CAT | Catapult Grp Int Ltd | 5.850 | 43% | $1,427,690,903 |

| XPN | Xpon Technologies | 0.010 | 43% | $4,142,532 |

| SPX | Spenda Limited | 0.007 | 40% | $32,306,508 |

| VNL | Vinyl Group Ltd | 0.130 | 38% | $163,717,420 |

| TNE | Technology One | 41.060 | 37% | $13,346,815,417 |

| RCL | Readcloud | 0.135 | 35% | $20,738,668 |

| DCC | Digitalx Limited | 0.070 | 35% | $84,253,672 |

| W2V | Way2Vatltd | 0.008 | 33% | $11,302,865 |

| VIG | Victor Group Hldgs | 0.082 | 32% | $53,482,587 |

| GTI | Gratifii | 0.099 | 32% | $33,540,151 |

| JCS | Jcurve Solutions | 0.033 | 32% | $10,901,333 |

| AI1 | Adisyn Ltd | 0.066 | 32% | $47,726,289 |

| AD8 | Audinate Group Ltd | 7.950 | 29% | $658,524,993 |

| IKE | Ikegps Group Ltd | 0.920 | 29% | $148,177,677 |

| CGO | CPT Global Limited | 0.063 | 26% | $2,639,534 |

| SMP | Smartpay Holdings | 0.945 | 25% | $227,426,856 |

| NVU | Nanoveu Limited | 0.048 | 23% | $38,578,586 |

| OCL | Objective Corp | 19.230 | 23% | $1,838,200,431 |

| VR1 | Vection Technologies | 0.022 | 22% | $38,878,882 |

| ASV | Assetvisonco | 0.039 | 22% | $28,835,101 |

| BCC | Beam Communications | 0.120 | 21% | $10,370,631 |

| WTC | Wisetech Global Ltd | 107.150 | 21% | $36,396,942,187 |

| FL1 | First Lithium Ltd | 0.078 | 20% | $6,212,981 |

| OAK | Oakridge | 0.072 | 20% | $1,943,849 |

| MP1 | Megaport Limited | 13.520 | 18% | $2,242,455,288 |

| SP3 | Specturltd | 0.013 | 18% | $4,005,952 |

| EOL | Energy One Limited | 14.750 | 18% | $462,123,149 |

| XF1 | Xref Limited | 0.135 | 17% | $29,712,118 |

| EVS | Envirosuite Ltd | 0.084 | 17% | $121,691,110 |

| SLX | Silex Systems | 3.600 | 17% | $802,416,290 |

| BVS | Bravura Solution Ltd | 2.550 | 16% | $1,143,302,705 |

| EML | EML Payments Ltd | 1.130 | 16% | $431,773,255 |

| CDA | Codan Limited | 18.000 | 14% | $3,237,408,113 |

| DTI | DTI Group Ltd | 0.007 | 14% | $3,139,860 |

| RDY | Readytech Holdings | 2.380 | 13% | $290,693,379 |

| OLL | Openlearning | 0.017 | 13% | $8,205,469 |

| AXE | Archer Materials | 0.300 | 13% | $76,454,104 |

| ID8 | Identitii Limited | 0.009 | 13% | $7,002,122 |

| XRO | Xero Ltd | 184.290 | 12% | $28,534,797,978 |

| RUL | Rpmglobal Hldgs Ltd | 3.070 | 12% | $686,816,448 |

| HCL | Highcom Ltd | 0.200 | 11% | $20,536,534 |

| BEO | Beonic Ltd | 0.200 | 11% | $14,172,202 |

| NXT | Nextdc Limited | 13.110 | 11% | $8,415,067,423 |

| SNS | Sensen Networks Ltd | 0.031 | 11% | $24,584,162 |

| SMN | Structural Monitor. | 0.430 | 10% | $66,394,171 |

| RKT | Rocketdna Ltd. | 0.011 | 10% | $10,070,756 |

| ZMM | Zimi Ltd | 0.011 | 10% | $4,702,982 |

| TYR | Tyro Payments | 0.885 | 10% | $467,587,600 |

| AR9 | Archtis Limited | 0.070 | 9% | $20,157,701 |

| DUG | DUG Tech | 1.120 | 9% | $150,816,513 |

| IRE | IRESS Limited | 8.660 | 9% | $1,608,257,371 |

| ROC | Rocketboots | 0.088 | 9% | $12,815,075 |

| KYP | Kinatico Ltd | 0.195 | 8% | $84,257,937 |

| SEN | Senetas Corporation | 0.020 | 8% | $33,120,382 |

| 5GN | 5G Networks Limited | 0.140 | 8% | $41,697,847 |

| COS | Cosol Limited | 0.785 | 8% | $142,861,205 |

| ODA | Orcoda Limited | 0.079 | 7% | $14,813,623 |

| IRI | Integrated Research | 0.440 | 6% | $78,035,192 |

| FCL | Fineos Corp Hold PLC | 2.320 | 6% | $785,319,223 |

| DXN | DXN Limited | 0.036 | 6% | $10,753,331 |

| VGL | Vista Group Int Ltd | 3.470 | 6% | $828,755,302 |

| GTK | Gentrack Group Ltd | 11.390 | 5% | $1,170,937,010 |

| QOR | Qoria Limited | 0.415 | 5% | $542,232,890 |

| FLX | Felix Group | 0.210 | 5% | $42,944,940 |

| XYZ | Block Inc | 96.510 | 5% | $5,298,308,114 |

| UBN | Urbanise.Com Ltd | 0.840 | 4% | $66,058,362 |

| LVE | Love Group Global | 0.125 | 4% | $5,066,771 |

| ASB | Austal Limited | 5.520 | 4% | $2,274,372,238 |

| PHX | Pharmx Technologies | 0.080 | 4% | $47,880,543 |

| PPK | PPK Group Limited | 0.315 | 3% | $28,605,937 |

| WBT | Weebit Nano Ltd | 1.820 | 3% | $419,949,381 |

| OEC | Orbital Corp Limited | 0.092 | 2% | $14,994,954 |

| RKN | Reckon Limited | 0.490 | 2% | $55,514,468 |

| DTL | Data#3 Limited | 7.430 | 2% | $1,158,714,331 |

| NXL | Nuix Limited | 2.480 | 2% | $813,603,994 |

| DSE | Dropsuite Ltd | 5.880 | 1% | $418,227,407 |

| PRO | Prophecy Internation | 0.430 | 1% | $31,712,042 |

Making news for the right reasons or just hitting milestones, here were some of the month's notable gainers…

Elsight’s share price ripped higher in May after it secured a second major contract from a European defence drone maker, worth US$5.35m on top of an earlier US$4.28m deal announced in April.

That brings the customer’s total commitment to US$9.63m, with all units set for delivery this year.

Elsight's Halo tech is being embedded into defence drone programs, and more than US$1m of the April order has already been delivered and booked as revenue.

On top of that, Elsight was selected by Northrop Grumman for a prestigious US defence accelerator, just 8 companies chosen from over 225 applicants.

That program gives it direct access to Northrop’s tech and procurement teams, and a fast-track to potential US DoD contracts.

Transport tech firm Eroad surged after delivering a strong FY25 result and setting upbeat guidance for the year ahead.

It flipped to a profit, pulled in NZ$16m in free cash flow (a huge jump from NZ$1.3m last year), and saw revenue climb to NZ$194.4m, up nearly 7%.

Annual recurring revenue (ARR) also rose to NZ$175.1m.

But it was the outlook that really got investors paying attention.

Eroad is guiding to FY26 revenue of at least NZ$205m, and ARR of at least NZ$188m, with free cash flow yield of 8–10%.

It’s also targeting medium-term ARR growth of 11–13%.

Radio tech firm Etherstack popped in May after locking in a record US$7m in cash receipts for the first half of FY25, its strongest half-year since listing.

Most of that came from project revenue already delivered, and it reckons H1 revenue alone could beat all of last year’s full result.

It’s also flagged more big deals likely coming soon from long-term clients, and its recurring revenue from support and “comms-as-a-service” is steadily growing.

All up, investors saw strong cash, solid outlook, and momentum.

Logistics tech minnow Yojee surged in May off the back of two big catalysts.

First, it presented at the IFCBAA national freight conference, putting its next-gen freight forwarding software in front of key industry players.

Second, WiseTech’s massive $2.1bn acquisition of E2open lit a fire under the whole sector, showing just how hot logistics tech is right now.

Now read: WiseTech’s $2bn power play, and one small logistics tech stock stirring interest

Yojee’s building its own momentum too, with an AI assistant baked into its platform, and a pilot deal with global player Röhlig Logistics kicking off in Singapore.

All up, investors saw a small-cap riding a big wave, and jumped on board.

ASX tech losers in May

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| DUB | Dubber Corp Ltd | 0.016 | -61% | $41,973,880 |

| 1TT | Thrive Tribe Tech | 0.001 | -50% | $2,031,723 |

| DTZ | Dotz Nano Ltd | 0.048 | -36% | $28,323,086 |

| BLG | Bluglass Limited | 0.011 | -31% | $22,198,234 |

| FCT | Firstwave Cloud Tech | 0.013 | -28% | $22,275,743 |

| OPL | Opyl Limited | 0.019 | -27% | $4,464,398 |

| EIQ | Echoiq Ltd | 0.245 | -26% | $158,070,989 |

| SIS | Simble Solutions | 0.003 | -25% | $2,628,991 |

| BRN | Brainchip Ltd | 0.205 | -24% | $435,534,473 |

| SKO | Serko | 2.720 | -22% | $338,912,408 |

| SPA | Spacetalk Ltd | 0.160 | -22% | $12,395,156 |

| DWG | Dataworks Group | 0.130 | -21% | $13,289,126 |

| HTG | Harvest Tech Grp Ltd | 0.016 | -20% | $14,335,148 |

| KNO | Knosys Limited | 0.035 | -19% | $7,564,854 |

| NOV | Novatti Group Ltd | 0.022 | -19% | $11,950,156 |

| RWL | Rubicon Water | 0.210 | -18% | $50,545,971 |

| FBR | FBR Ltd | 0.005 | -17% | $28,447,261 |

| NOR | Norwood Systems Ltd. | 0.020 | -17% | $10,318,553 |

| JAN | Janison Edu Group | 0.140 | -15% | $36,384,355 |

| IFG | Infocusgroup Hldltd | 0.006 | -14% | $1,574,561 |

| NVQ | Noviqtech Limited | 0.027 | -13% | $6,791,487 |

| HYD | Hydrix Limited | 0.014 | -13% | $3,818,764 |

| EPX | Ept Global Limited | 0.023 | -12% | $15,150,929 |

| AJX | Alexium Int Group | 0.008 | -11% | $12,691,429 |

| 8CO | 8Common Limited | 0.016 | -11% | $3,585,518 |

| IOD | Iodm Limited | 0.130 | -10% | $77,070,523 |

| CYB | Aucyber Limited | 0.080 | -10% | $16,751,735 |

| 3DP | Pointerra Limited | 0.055 | -8% | $44,279,224 |

| ACE | Acusensus Limited | 0.970 | -8% | $135,825,086 |

| CF1 | Complii Fintech Ltd | 0.025 | -7% | $14,284,841 |

| ICE | Icetana Limited | 0.014 | -7% | $6,133,997 |

| MX1 | Micro-X Limited | 0.056 | -7% | $37,363,326 |

| WHK | Whitehawk Limited | 0.014 | -7% | $10,378,849 |

| XRG | Xreality Group Ltd | 0.030 | -6% | $19,906,426 |

| SOR | Strategic Elements | 0.032 | -6% | $15,236,274 |

| HSN | Hansen Technologies | 5.100 | -6% | $1,047,697,081 |

| AT1 | Atomo Diagnostics | 0.017 | -6% | $11,321,179 |

| X2M | X2M Connect Limited | 0.019 | -5% | $7,375,455 |

| TZL | TZ Limited | 0.059 | -5% | $16,556,232 |

| BDT | Birddog | 0.047 | -4% | $7,589,843 |

| CXZ | Connexion Mobility | 0.026 | -4% | $21,216,424 |

| CML | Connected Minerals | 0.130 | -4% | $5,376,568 |

| IFM | Infomedia Ltd | 1.210 | -2% | $471,132,514 |

| AVA | AVA Risk Group Ltd | 0.103 | -2% | $30,499,563 |

| DDR | Dicker Data Limited | 8.230 | -2% | $1,473,911,938 |

| CCR | Credit Clear | 0.230 | -2% | $97,669,188 |

| PPS | Praemium Limited | 0.730 | -2% | $348,732,077 |

| DRO | Droneshield Limited | 1.315 | -2% | $1,127,576,305 |

| ATA | Atturralimited | 0.860 | -2% | $328,224,812 |

| CPU | Computershare Ltd | 40.220 | -1% | $23,657,729,209 |

| NVX | Novonix Limited | 0.420 | -1% | $283,058,021 |

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Originally published as ASX tech May winners: Silicon surge sends Aussie tech sector skyward by 22pc