Closing Bell: ASX slips as falling oil prices undercut energy and utilities stocks

The ASX slipped 0.24pc as falling oil prices hit Energy and Utilities sectors, while a lift in gold offered some small relief.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX slips 0.24pc in trade

Falling oil prices drive energy and utilities stocks lower

Gold ticks up, lifting ASX All Ords Gold Index 0.85pc

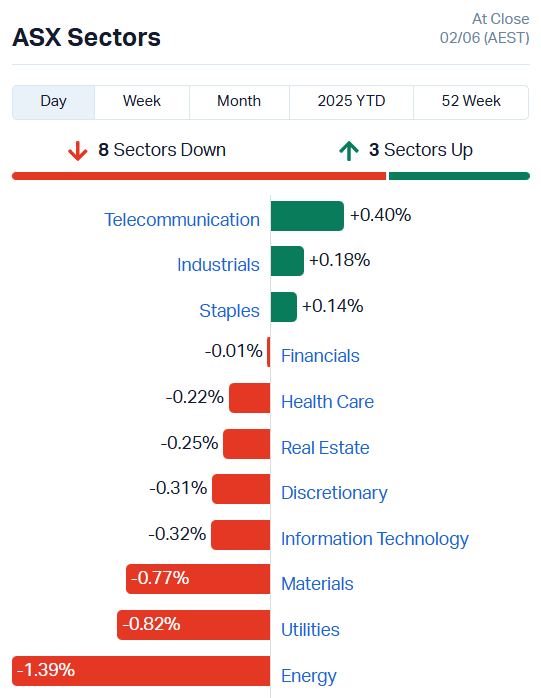

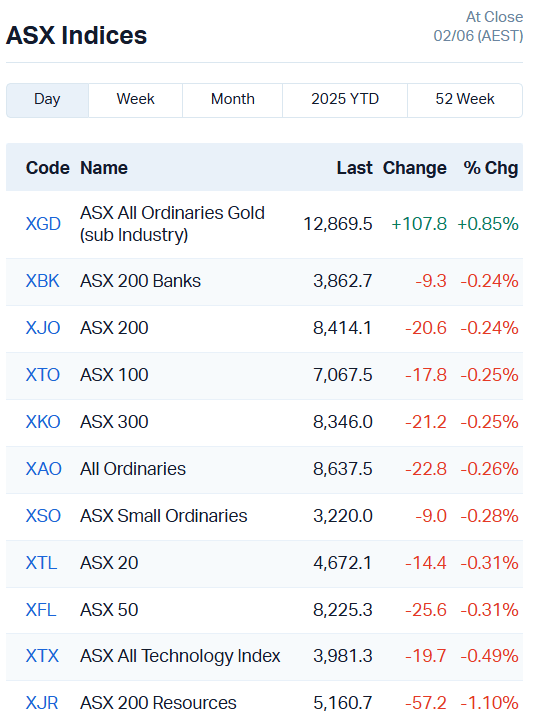

The ASX fell 0.24% during the session, experiencing broad weakness on the back of renewed tariff war concerns.

The market’s trajectory also took a hit from an announcement from OPEC+ that it would continue to increase oil production.

Brent crude oil has fallen more than 12% over the past six months, and more than 19% over the last year.

The oil price dip cut the feet out from under our energy stocks, driving the sector down 1.39%.

Utilities, usually less sensitive to the whims of crude pricing, also fell 0.82%.

There was little movement in the positive at all on the ASX today, with only three sectors in the green.

While gold prices fell to US$3315.40 an ounce last night, they recovered more than 1% today, rising to US$3326.25 an ounce as Trump started banging the tariff drum yet again.

Still, the uptick offered one of the few bright spots for the ASX, lifting the All Ords Gold Index 0.85%.

China signals it's considering “forceful measures”

As Stockhead’s Eddy Sunarto wrote this morning, Trump has re-ignited tensions over US-China trade relations, accusing Beijing of failing to hold up its end of the deal in a post on Truth Social.

While he signalled a desire to resolve the trade spat via a conversation with China’s President Xi Jinping, Chinese officials are already voicing their displeasure.

"China, with a responsible attitude, has earnestly addressed, strictly implemented, and actively upheld the consensus of the trade talks in Geneva," a Chinese Ministry of Commerce official stated.

The official has accused the US of introducing “multiple discriminatory restrictions against China” pointing to controls on AI chip exports, restrictions on sales of chip design software, and the revocation of visas for Chinese students.

“The US has continuously provoked new trade frictions, exacerbating uncertainty and instability in bilateral trade relations,” the official statement read.

"China firmly rejects these unwarranted accusations."

US car makers are deeply concerned about losing access to rare earth magnets, as China currently dominates the market, controlling about 90% of rare earth processing globally.

Uncertainty is running rampant as traders wait to see how far China and Trump will take this new stoush.

Section 899 “revenge” tax draws ire

Already widely criticised for drastically increasing government deficits and reducing the US judicial system's ability to enforce orders on the government, Trump’s new tax bill also contains a “revenge” tax measure that has alarmed international traders.

While the full scope of the proposed changes and their application is unclear, the bill would give the administration powers to impose a tax of up to 20% on foreigners with US-based investments.

It’s designed to be used in cases where the administration believes other countries are imposing unfair or discriminatory taxes against US companies, thus the “revenge tax” moniker.

“We see this legislation as creating the scope for the US administration to transform a trade war into a capital war,” Deutsche Bank analyst George Saravelos said.

If the bill passes, the provision could make foreign investors think twice about parking their money in US assets.

Considering trust in US government bonds is shaky at present, the bill could contribute to a marked pull-back of foreign investment in the country.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BYH | Bryah Resources Ltd | 0.011 | 120% | 49647577 | $4,349,768 |

| CRI | Criticalim | 0.022 | 69% | 84430831 | $34,949,832 |

| OSL | Oncosil Medical | 0.003 | 50% | 100000 | $9,213,164 |

| RNX | Renegade Exploration | 0.0035 | 40% | 9101121 | $3,220,909 |

| OB1 | Orbminco Limited | 0.002 | 33% | 3580335 | $3,596,352 |

| DXN | DXN Limited | 0.0475 | 32% | 4679906 | $10,753,331 |

| LKY | Locksleyresources | 0.105 | 31% | 30947300 | $11,733,333 |

| IIQ | Inoviq Ltd | 0.57 | 30% | 2628030 | $49,118,433 |

| BCC | Beam Communications | 0.155 | 29% | 495488 | $10,370,631 |

| FTL | Firetail Resources | 0.075 | 25% | 5820054 | $22,801,679 |

| 8CO | 8Common Limited | 0.02 | 25% | 446928 | $3,585,518 |

| BLZ | Blaze Minerals Ltd | 0.0025 | 25% | 168753 | $3,133,896 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 5048301 | $12,934,111 |

| IS3 | I Synergy Group Ltd | 0.005 | 25% | 101989 | $2,002,920 |

| KPO | Kalina Power Limited | 0.005 | 25% | 10300784 | $11,731,879 |

| TEM | Tempest Minerals | 0.005 | 25% | 332524 | $2,938,119 |

| VFX | Visionflex Group Ltd | 0.0025 | 25% | 2854782 | $6,735,721 |

| SRJ | SRJ Technologies | 0.016 | 23% | 180380 | $7,872,515 |

| BSN | Basinenergylimited | 0.017 | 21% | 252751 | $1,719,610 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 5624300 | $13,852,835 |

| EAT | Entertainment | 0.006 | 20% | 28943 | $6,543,930 |

| EE1 | Earths Energy Ltd | 0.006 | 20% | 32378 | $2,649,821 |

| GLL | Galilee Energy Ltd | 0.006 | 20% | 185049 | $3,535,964 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 1349753 | $5,223,085 |

| PEX | Peel Mining Limited | 0.08 | 19% | 2529078 | $38,932,664 |

Making news…

Inoviq (ASX:IIQ) has unveiled breakthrough results for its early ovarian cancer screening test, showing 77% sensitivity and 99.6% specificity across all stages, with no early-stage cancers missed in the study.

The AI-powered blood test, which uses exosome tech and runs on high-throughput lab instruments, was presented this week at the big ASCO cancer conference in Chicago. There’s currently no screening test on the market.

Firetail Resources (ASX:FTL) has locked in options to acquire two high-grade gold projects in the US, one in Nevada’s massive Walker Lane belt and the other near the legendary Homestake Mine in South Dakota.

The Excelsior Springs project comes with strong drill hits like 51.8m at 4g/t gold and historic production of over 19,000oz at 41g/t, while the Bella project boasts rock chip samples over 100g/t and sits just 20km from the 42Moz Homestake deposit. FTL is spending just under a million bucks in cash and issuing shares to get the exploration going.

DXN (ASX:DXN) has scored a $4.6 million deal to deliver three modular data centre units to Globalstar in Hawaii by the end of 2025. It won the contract after a competitive tender.

The company said the deal puts DXN deeper into the booming satellite and LEO (Low Earth Orbit) comms space, and marks another step in its push into edge-ready data centres.

Babylon Pump and Power (ASX:BPP)has built out its specialist pumping and hydrotesting offering with the acquisition of BPY Holdings Pty Ltd, a WA-based specialist provider.

The company reckons the move will give it greater rental scale, strengthening its geographic reach and adding a profitable dry hire business to the platform.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ASR | Asra Minerals Ltd | 0.002 | -33% | 9409622 | $8,299,608 |

| HLX | Helix Resources | 0.002 | -33% | 42791991 | $10,092,581 |

| ADD | Adavale Resource Ltd | 0.0015 | -25% | 4120010 | $4,574,558 |

| CZN | Corazon Ltd | 0.0015 | -25% | 1333 | $2,369,145 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 2296906 | $6,507,557 |

| NAE | New Age Exploration | 0.003 | -25% | 176721 | $10,637,596 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 159652 | $9,673,198 |

| SRN | Surefire Rescs NL | 0.0015 | -25% | 1825999 | $4,972,891 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 901582 | $13,153,701 |

| EVEDA | EVE Health Group Ltd | 0.03 | -25% | 956258 | $5,274,483 |

| MIO | Macarthur Minerals | 0.015 | -25% | 18000 | $3,993,310 |

| HWK | Hawk Resources. | 0.013 | -24% | 2923444 | $4,605,801 |

| CVR | Cavalierresources | 0.215 | -23% | 127355 | $16,195,821 |

| GTE | Great Western Exp. | 0.01 | -23% | 2804919 | $7,380,853 |

| VBS | Vectus Biosystems | 0.047 | -22% | 539982 | $3,196,699 |

| BTM | Breakthrough Minsltd | 0.1 | -20% | 2576443 | $5,982,437 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 392525 | $15,867,318 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 1000000 | $7,870,957 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 19757302 | $2,627,462 |

| CDE | Codeifai Limited | 0.008 | -20% | 1118215 | $3,260,318 |

| HPC | Thehydration | 0.008 | -20% | 1419763 | $3,833,009 |

| RGL | Riversgold | 0.004 | -20% | 14854729 | $8,418,563 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1896263 | $23,423,890 |

| 1AI | Algorae Pharma | 0.005 | -17% | 1478761 | $10,124,368 |

| ALY | Alchemy Resource Ltd | 0.005 | -17% | 4137997 | $7,068,458 |

IN CASE YOU MISSED IT

Singular Health Group (ASX:SHG) has completed a share issue for a placement with Marin and Sons, fulfilling the terms of a follow-on investment from SHG’s largest shareholder.

Marin and Sons invested $773k at $0.16 per share on May 15, 2024, with the issue of shares approved by SHG shareholders on March 19, 2025.

In today's Break It Down, host Tylah Tully explains the latest developments in Sweden, where the country is looking at potentially removing a ban on uranium mining. Aura Energy (ASX:AEE) has interest in uranium projects in Sweden, and is working with the coalition to get the ban lifted.

Trading halts

Challenger Gold (ASX:CEL) – cap raise

Eclipse Metals (ASX:EPM) – resource upgrade

Estrella Resources (ASX:ESR) – exploration update

New Frontier Minerals (ASX:NFM) – cap raise

Patriot Resources (ASX:PAT) – copper discovery

QuickFee (ASX:QFE) – debt refinancing and cap raise

Sunshine Metals (ASX:SHN) – drilling results

At Stockhead, we tell it like it is. While Singular Health Group and Aura Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX slips as falling oil prices undercut energy and utilities stocks