RBA’s forecast on inflation and wage growth offers grim reality

The RBA has made a worrying forecast about how long it will take for wages to catch up with inflation - and it’s no wonder we all feel so poor.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Since the election campaign began more than five weeks ago, the Coalition and the Labor Party have both made the cost of living and the future of the economy the centre of their respective strategies.

For the Coalition, this is very familiar territory, with the Morrison government running on the same political narrative of superior economic management the Liberal Party has relied upon for over 25 years.

Meanwhile, Labor have asked the electorate to look at their own household bottom lines rather than headline economic growth or unemployment figures in order to determine how the economy is working for them.

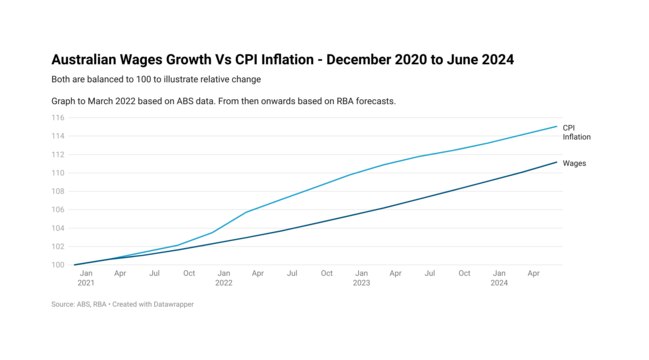

It’s no secret that Australians have rapidly found themselves falling behind the cost of living in recent months. But with inflation predicted to continue to outstrip wages growth for several years to come, perhaps the bigger question is how long will it take for people to catch up with where they were before?

In order to explore how long that might take to occur, we’ll be looking at inflation adjusted wages growth in the years before the pandemic in order get something of a baseline of what level the economy is capable of producing.

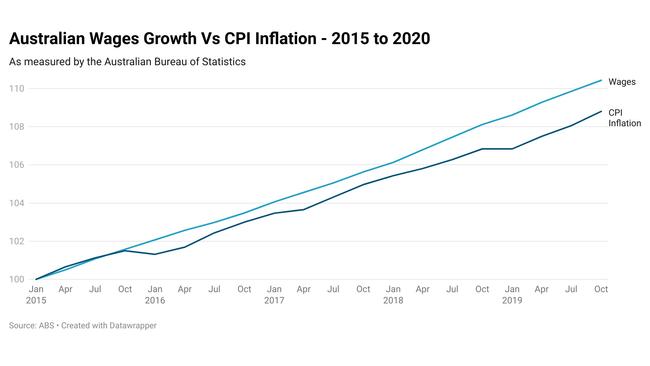

For the purposes of today’s comparison, we’ll be looking at a snapshot of inflation adjusted wages growth in the 5 years prior to the pandemic. During this time inflation adjusted wages rose by around 0.3 per cent each year.

Since inflation started significantly outstripping wages growth from the December quarter of 2020 onwards, households have rapidly fallen behind the rising cost of living.

Between the end of 2020 and the end of March quarter of 2022, inflation outstripped wages growth by 2.75 per cent.

Forecasts of what lay ahead for wages and inflation

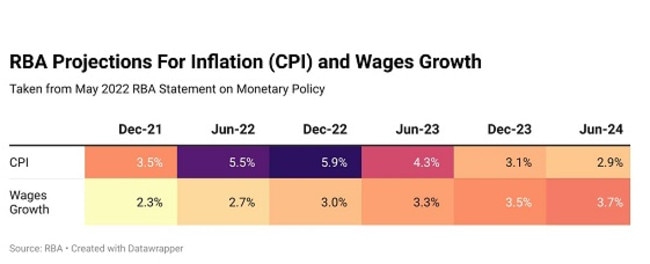

According to the latest forecasts from the RBA, inflation is expected to outstrip wages growth until December 2023. With the inflation expected to exceed wages growth by a peak of 2.9 per cent in December 2022.

Aside from a few brief instances and the introduction of the GST, Australians haven’t seen their wages go backwards so rapidly in decades.

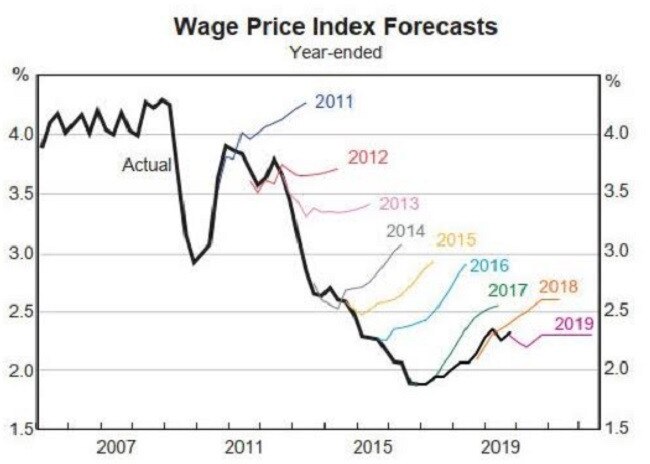

But it’s possible there may be something of a silver lining for workers. The RBA repeatedly underestimated the strength of the economic recovery underway following the pandemic and their track record forecasting wages is not fantastic.

Since 2010, they have repeatedly over-estimated the strength of wages growth, so their predictions being incorrect would not be unprecedented.

How long to catch up?

If the RBA’s predictions for inflation and wages growth are correct, by the conclusion of their forecast period in June 2024, inflation would have outstripped wages growth by around 3.8 per cent. It is however worth bearing in mind that this is based on wages accelerating above wages growth from the December quarter of 2023.

In order to explore how long it will take for our relative purchasing power in inflation adjusted terms, we’ll be looking at two scenarios. In the first, inflation adjusted wages grow at 0.3 per cent per year, the same rate they were growing prior to the pandemic. In the second, we will take the most positive forecast by the RBA of 0.8 per cent per year.

Under the RBA’s positive scenario it would be early 2029 by the time wages caught up with inflation, assuming consistent 0.8 per cent real wages growth.

Under the scenario of the pre-pandemic trend of real wages growing by 0.3 per cent per year, wages would catch up in 2036.

The long term outlook

With all the various issues currently facing the world and Australia, forecasting where things are going with any degree of certainty is at best challenging, at worst an endeavour where the predictor is likely to end up with egg on their face.

But if we are to take the RBA’s forecasts at face value, inflation and the cost of living may remain hot button issues until the end of the decade and perhaps beyond. Even under the most positive scenario where by real wage growth improves by over 250 per cent relative to its pre-pandemic path, we may not see 2020 levels of purchasing power until towards the end of the decade.

While Labor has pledged to place a heavy focus on increasing wages growth, even under some of the most ideal conditions in decades defined by low unemployment and reversing net migration, the best the economy could achieve was a measly 2.4 per cent wage rise.

This environment will need to change dramatically if Australians are to have a hope of their wages keeping up with inflation if it becomes entrenched as it has in the past.

Whether it’s Scott Morrison or Anthony Albanese who holds the reins of power from Sunday onwards, they have their work cut out for them in digging Australian households out of the sizeable hole inflation has dug for us.

Tarric Brooker is a freelance journalist and social commentator. | @AvidCommentator

Originally published as RBA’s forecast on inflation and wage growth offers grim reality