Boomers comparing today’s cash rate to 17% in 1980s doesn’t stand

Bring up today’s cash rate and Boomers will often retort with the 17 per cent rate of the 1980s. But it turns out their argument simply doesn’t stack up.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Since the Reserva Bank raised rates recently for the first time in more than 11 years, something of a debate has emerged over how the current rate rise cycle stacks up against those in the past, particularly the late 1980s when interest rates hit 17 per cent.

Like housing prices as a broader issue, the debate divided some Australians along generational lines, with Baby Boomers stacking up on one side and much of Gen X and Millennials on the other.

As you might have guessed some of the commentary was reduced to little more than hyperbole and sound bites, about things like “too much smashed avocado on toast” and “it was different back in my day”.

But as the debate continues around dining tables and barbecues around the nation, we have sought to try to quantify the different perspectives. What interest rate-hiking cycle in the past 60 years presented the greatest challenge to households in terms of the relative increase in interest repayments?

Historic rate rise cycles

It would be easy to look at the rate rise cycles of the mid to late 1980s and see the large mortgage rate increases, and call it case closed. But like many things in life, when you start to look a bit closer things get quite a bit more complex.

In order to more accurately gauge the increase in pressure on households created by rising rates, we’ll be comparing mortgage rates at the start of a rate rise cycle and at their peak. For the current rate rise cycle, we’ll go through multiple scenarios based on various forecasts from economists and also market pricing.

This will be based on the relative percentage increase in interest repayments rather than the headline move in interest rates. After all a 1 per cent rise in rates in 1989 only increased interest repayments by 6.25 per cent, compared with 37.8 per cent today.

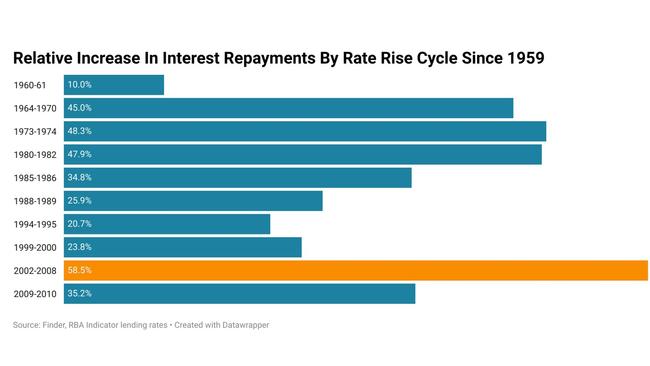

But before we get to the main event, it’s worth exploring which of the rate rise cycles in the 63 years of comparable data, represents the largest relative increase in mortgage repayments.

It may not seem like it at first glance, but the largest relative increase in interest repayments was actually the rate rise cycle between 2002 and 2008, during which they rose by 58.5 per cent.

It should however be noted that this rate rise cycle occurred over a period of six years, rather the one to two years that defines the other examples.

By contrast, during the rate rise cycle that led to 17 per cent interest rates in 1989, interest repayments rose by 25.9 per cent.

There are other metrics which illustrate the challenge that 17 per cent mortgage rates presented to households at that time. But in terms of the relative increase in interest repayments during the 1988-1989 rate rise cycle, it’s roughly in the middle of the data set.

How high will rates go this cycle?

The current range in economist predictions for where the cash rate will peak is arguably the widest it’s ever been, with predictions ranging from a terminal rate of 1.6 per cent to 3 per cent.

Westpac – Chief Economist Bill Evans is one of the most respected readers of monetary policy tea leaves in the country. In his view the cash rate will peak at 2.25 per cent in 2023.

Commonwealth Bank – Of the nation’s big 4 banks, CBA are predicting the lowest peak in the RBA cash rate at just 1.6 per cent in early 2023.

ANZ – On a long term time horizon, ANZ’s Head of Australian Economics, David Plank, believes that the cash rate will peak at somewhere north of 3 per cent toward the middle of the decade. For the purposes of today’s comparison we will call it an even 3 per cent

NAB – Chief Economist Alan Oster believes that the RBA will move gradually to raise rates as it assesses the impact of higher rates on households and businesses, predicting a peak of 2.6 per cent by 2024.

The Market – The RBA cash rate futures market is pricing in the largest rate rises of the five sources covered here today. With a 2.85 per cent cash rate pencilled in by year end and a peak rate of around 3.56 per cent toward the end of 2023.

How do these predictions compare with past rate rise cycles?

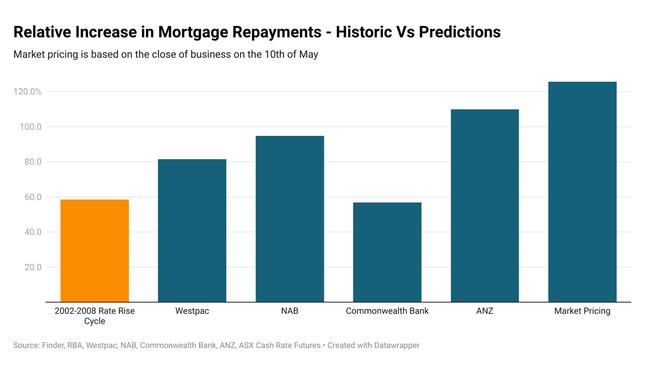

Only the Commonwealth Bank’s scenario of a 1.6 per cent peak cash rate comes in below the 2002-2008 rate rise cycle in terms of the relative rise in mortgage repayments, with repayments increasing by 56.8 per cent vs 58.5 per cent across the previous peak rate cycle.

From there it only becomes more challenging for mortgage holders, with interest repayments pencilled in to increase between 81 per cent and 109 per cent depending on which of the big banks interest rate scenarios you go by.

As for the current market pricing, interest repayments on the average owner occupier mortgage would increase by 125 per cent.

In short, Australians have never seen interest repayments on their mortgages rise so much in a single rate rise cycle, making this a truly unprecedented event should any of the big bank scenarios come to pass with the exception of that of the Commonwealth Bank.

There is no doubt that the late 1980s and early 1990s presented a highly challenging environment for mortgage holders, many of us grew up on the tales of the necessity of sacrifice during that time from our parents.

But purely based on the magnitude interest repayments are predicted to increase, the potential upcoming challenge for existing mortgage holders is something else entirely.

Ultimately, tough times may lay ahead for mortgage holders and perhaps a ceasefire in the intergenerational battle is warranted. While this battle will probably never be fully settled, today’s mortgage holders may have more than enough of a challenge to regale their children and grandchildren with when they reach the age of those who experienced 17 per cent interest rates.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as Boomers comparing today’s cash rate to 17% in 1980s doesn’t stand