Proof Australia is actually in a recession

There is only one thing keeping Australia out of a technical recession and it’s not economic growth.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

There is only one thing keeping Australia out of a technical recession and it’s not economic growth.

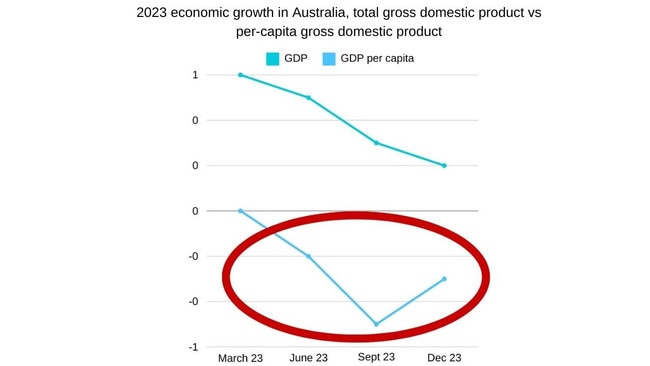

Gross domestic product (GDP) data released last week revealed the economy grew by just 0.2 per cent in the December quarter, slightly down on the 0.3 per cent growth that was recorded in the September quarter.

But looking behind the numbers, the growth in the economy is actually due to the fact that over one million migrants arrived in Australia in the 2023 calendar year.

That is the highest annual migration figure in Australia’s history and a huge reversal after Covid brought migration to a halt.

This increased population is helping to fuel consumer spending in the economy, but when the impact of migration is stripped out of the growth figures, the numbers reveal that on a per capita basis, the Australian economy actually contracted by 0.5 per cent in the September quarter and 0.3 per cent in the December quarter.

A recession is defined as two consecutive quarters of negative growth, and on a per capita basis, the figures show that Australia is well and truly in a recession.

In releasing the December GDP figures, the Australian Bureau of Statistics (ABS) noted Australia is in its slowest annual rate of economic growth since the 1990s recession, if the Covid pandemic and the introduction of the GST are excluded.

The sluggish economic growth has continued into 2024, and Commonwealth Bank chief economist Stephen Halmarick told news.com.au that the bank was forecasting GDP numbers similar to the second half of last year for the first half of 2024.

He said the bank suggests the annual rate of growth in the Australian economy for the year to June 30, 2024 will be just one per cent, with the economy to have contracted for the year on a per capita basis.

The soft economy all but rules out the chances of the Reserve Bank of Australia (RBA) increasing interest rates when they meet next Tuesday.

Financial markets put the chances of an interest rate cut next week at about 10 per cent, with most economists tipping that the official cash rate will stay on hold at 4.35 per cent.

Views are mixed as to when interest rates may start to fall, although its likely the RBA will hold off on any rate cuts until at least April, which is when the March quarter inflation figures are due to be released.

Mr Halmarick said that he believes the RBA will want to see both the June quarter inflation and GDP figures before cutting interest rates, and with the timing of the release of that data this suggests official interest rate cuts would start from September this year.

The Commonwealth Bank is forecasting that the RBA will cut the cash rate by 1.5% between September 2024 and May 2025, which would see the cash rate fall to 2.85% at that point.

Originally published as Proof Australia is actually in a recession