RBA governor Michele Bullock flags possible rate cuts to prop up growth if Trump tariffs smash the world economy

Donald Trump’s looming trade war could smash global growth and hit Australia, but RBA Governor Michele Bullock says she’s ready to defend economic growth with rate cuts.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The Reserve Bank of Australia could cut interest rates to defend the Australian economy if US President Donald Trump’s looming global trade war crushes growth.

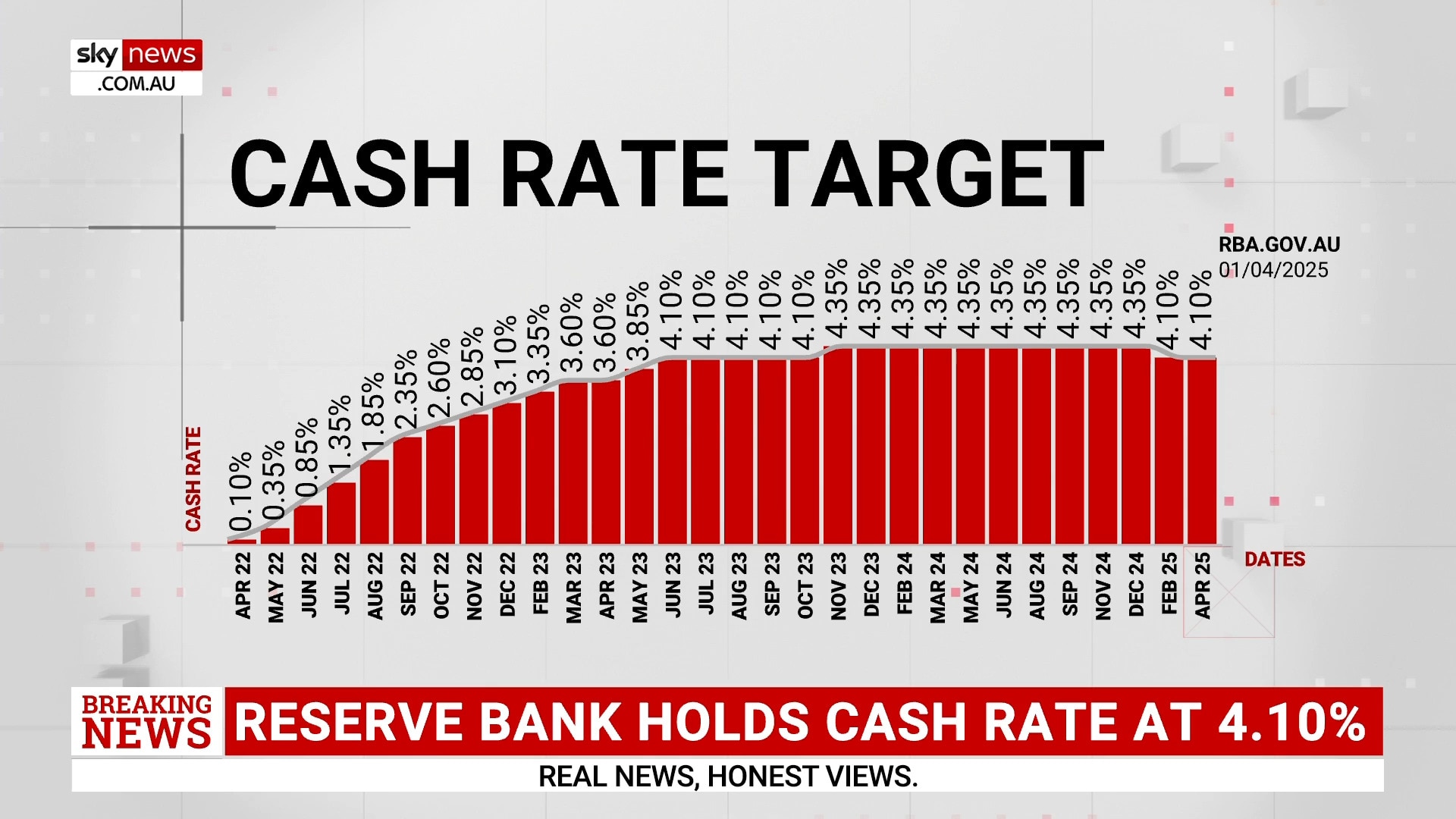

RBA governor Michele Bullock confirmed the potential defensive measures at a press conference in Sydney on Tuesday afternoon following the board’s decision to hold the official cash rate at 4.1 per cent.

“When we went into the pandemic, interest rates were about 1.5 per cent,” she said.

“They’re now much higher than that.

“If it turns out that there is a big growth impact on Australia, we do have room to move the exchange rate to support.

“Now, it does depend on what happens.”

Rate cuts generally trigger economic growth because it becomes cheaper to borrow money, encouraging investment and spending.

Ms Bullock flagged the cuts as central bankers across the world tried to gauge the impact of the US tariffs on global growth and inflation.

President Trump has promised his reciprocal tariff plan on April 2 will include all nations, despite rumours only 10 to 15 countries would be affected.

So far he has imposed tariffs on aluminium, steel and the automotive industry, as well as increased tariffs on all goods coming in from China.

There are tariffs on Canada and Mexico that are due to start early next week.

Ms Bullock said Australia was in a good position to meet the uncertainty triggered by President Trump’s tariff policy with falling inflation and low unemployment.

But she warned a ‘stagflation’ environment, in which growth slows and inflation rises concurrently, would be “challenging”.

“If growth slows but inflation picks up … then we’re in a slightly difficult world.”

Ms Bullock said the board had not yet recorded an impact on inflation in Australia resulting from the looming tariffs, but the board would “watch and wait and see what happens.”

NewsWire asked Ms Bullock whether market forecasts of three rate cuts between now and mid-2026 were still in play in light on Trump’s protectionist policies and their inflationary impacts.

Ms Bullock said the answer depended “on a number of things”.

“It depends on how other countries respond,” she said.

“Do they respond with similar sorts of tariffs themselves? So that obviously will have impacts on world supply chains, efficiency of production in various economies.

“It also depends very much on what China does … it’s not only going to be quite heavily impacted from a trade sense, but it is also our most important trading partner.

“And at least at the moment, the Chinese authorities have indicated that they are going to make sure that they keep momentum in their economy.”

She said China still had a 5 per cent growth target.

“So at least our scenario analysis at the moment suggests that if China continue on that path, then yes, there will be a bit of an impact on us in terms of growth,” Ms Bullock said.

“But it’s not going to be as big as some other countries might suffer in these sorts of circumstances.”

Ms Bullock said the Board was “gradually getting more confidence” in its fight to return inflation sustainably to the 2-3 per cent target band.

“We haven’t got 100 per cent confidence, but if you look at our forecasts and you look at how inflation is tracking, relative to forecasts, we’re

actually doing pretty well,” she said.

She also said the Board did not forecast a recession in Australia over the next 12 months.

In its statement on monetary policy from Tuesday, the RBA confirmed President Trump’s threat to expand his tariffs against Australia and its trading partners had weighed heavily on their decision.

“On the macroeconomic policy front, recent announcements from the United States on tariffs are having an impact on confidence globally and this would likely be amplified if the scope of tariffs widens, or other countries take retaliatory measures,” the board wrote.

“Geopolitical uncertainties are also pronounced.”

“These developments are expected to have an adverse effect on global activity, particularly if households and firms delay expenditures pending greater clarity on the outlook.”

The board also cited fears of instability in Australia’s inflation rate.

“Inflation, however, could move in either direction,” the RBA board said.

“Many central banks have eased monetary policy since the start of the year, but they have become increasingly attentive to the evolving risks from recent global policy developments.”

The hold was widely expected, with money markets saying there was only about a 20 per cent chance of a cut in April.

Independent economist Saul Eslake said the RBA would weigh up quarterly jobs and inflation data, due out at the end of April, before deciding its next move.

“The new monetary policy committee will be waiting for more data on the extent to which inflation and in particular its preferred measure of ‘underlying’ inflation has continued to fall,” he said.

AMP chief economist Shane Oliver said while the RBA would be unlikely to cut interest rates in the middle of an election, the numbers didn’t stack up for a back-to-back rate cuts.

“I think the RBA is in a cautious mode. Back in February when they cut, they made it quite clear they were wary of cutting again, as they are still concerned inflation is too high and they are still worried about a tight jobs market,” Dr Oliver said.

“I don’t think we’ve seen enough to alter that, as the unemployment rate is still 4.1 per cent, and even though inflation is running below the RBA’s forecast, we know the monthly numbers can be quite volatile, adding to the case to wait for the quarterly.

The interest rate hold comes after the RBA cut the official cash rate from 4.35 to 4.10 per cent in February.

Ms Bullock used her last press conference in February to call for mortgage holders to “be patient” when it comes to future rate cuts.

She had Bullock issued the stark warning following a question from NewsWire, acknowledging she had received letters from struggling homeowners suffering through an extended period of crippling interest rate rises.

“I understand you are hurting, and I understand mortgage rates have increased a lot … but we need to get inflation down because that is the other thing that is really hurting you,” she said.

“If we don’t get inflation down, interest rates won’t come down, and you’ll be stuck with inflation and high interest rates.”

Originally published as RBA governor Michele Bullock flags possible rate cuts to prop up growth if Trump tariffs smash the world economy