Townsville Enterprise says change needed to reinsurance pool after first cyclone tests scheme

An NQ business advocacy group is calling for changes to the cyclone reinsurance pool, despite initially backing the initiative.

Townsville

Don't miss out on the headlines from Townsville. Followed categories will be added to My News.

Economic development agency Townsville Enterprise has done a U-turn on the $10bn reinsurance pool, labelling the scheme not fit-for-purpose.

Townsville Enterprise Limited, which advocates for North Queensland businesses, was excited about the scheme when it was announced.

However, the agency has pulled a public about-face after significant failings in the aftermath of Cyclone Jasper.

After the cyclone hit Far North Queensland, severe flooding impacted the region for days, but the 48-hour clause in the reinsurance pool means much of the damage is not covered.

Now it is pushing for the government to make changes before it is too late and another community is impacted by severe weather in the wake of a cyclone, with TEL describing it as a “market failure”.

“Given the reinsurance pool is not fit for purpose for Northern Australia and it is only having a small impact to premium increases and not overall cost, we urge the government to intervene to address this market failure,” the agency said in a message to members.

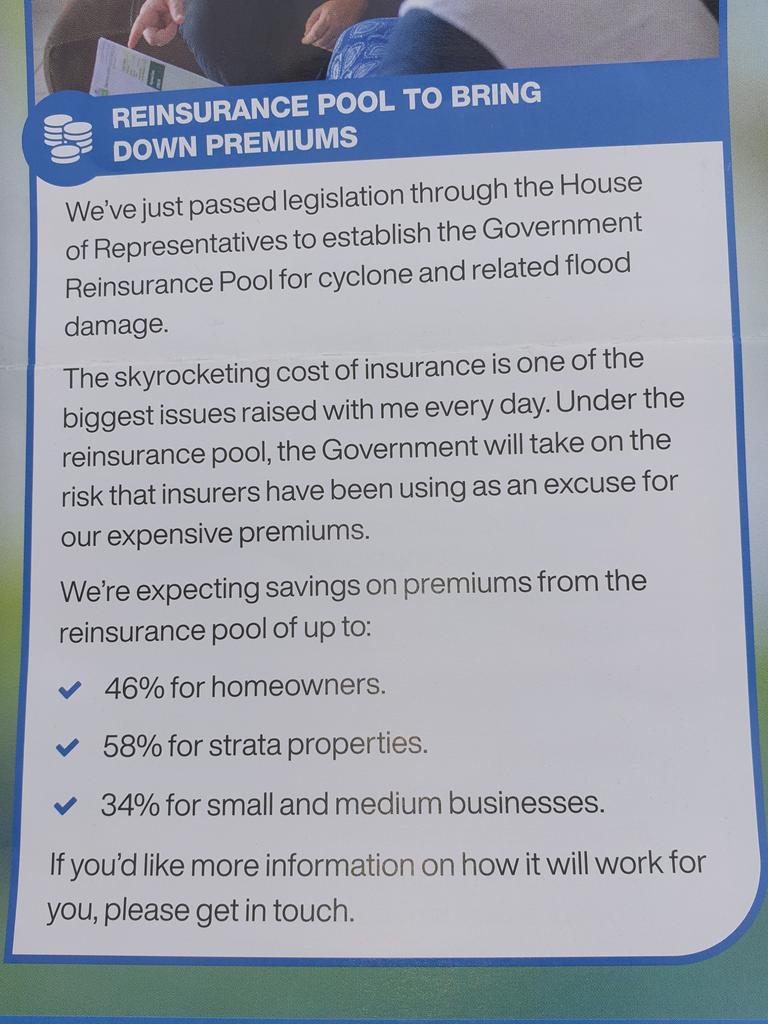

The scheme began on July 1, 2022. It is designed to remove high insurance costs which ballooned across Northern Australia after Cyclone Yasi, an event which caused $1.4bn of damage.

The scheme is backed by a $10bn federal government guarantee, and funded by charging reinsurance premiums to insurers.

Townsville Enterprise has continually pointed out issues in the scheme in its submissions to the federal government, but the agency’s public statements were flattering to the former coalition government.

In a submission to the government in October 2021, Townsville Enterprise corporate services director Tracey Holmes highlighted key concerns of: funding structure, eligibility criteria, strata buildings, accommodation buildings, premium reductions, and a narrow 48-hour claim window.

In February 2022, TEL’s chief executive officer Claudia Brumme-Smith praised Prime Minister Scott Morrison and assistant treasurer Michael Sukkar.

Changes signed-off in early 2022 to mixed use strata-title limits, and amendments to ensure more small and medium businesses are covered, “will improve insurance access and affordability for North Queensland residents and business owners”, Ms Brumme-Smith said.

“Insurance affordability and availability is critical to enabling business investment and regional growth, today’s announcement ensures that more homeowners, properties and businesses will now be able to benefit from the $10bn reinsurance pool,” Ms Brumme-Smith said.

She went on to thank Herbert MP Phil Thompson, “who has rallied with us to see these changes come into place and we look forward to the scheme commencing in July 2023”.

Cairns MP Warren Entsch worked on the scheme, but he has since pushed for major changes just months after it was introduced.

In November last year, Mr Entsch said the government needed to “make the bloody thing work”.

Mr Thompson has since said the new government was “not working fast enough” on the scheme.

In a submission to the government in November 2022, Ms Brumme-Smith said the issues of premium reduction and a narrow 48-hour claim window persisted.

Ms Brumme-Smith refuted that the organisation had changed it’s mind about the scheme.

“When it was announced there was not a lot of detail … the devil was in the detail,” she said.

“We’ve advocated for it, but then the details came, and we saw it was not fit for purpose once we got the disclosure.”

Tropical Cyclone Jasper had highlighted issues within the scheme, which she said a North Queensland contingent would raise in Canberra in the New Year.

In the aftermath of the cyclone, Emergency Services Minister Murray Watt said the government had already looked at changing the scheme before Jasper hit.

“We’ve all been sceptical [about whether] the reinsurance pool would be as effective as was claimed, and unfortunately, we seem to be seeing that now,” he said.

More Coverage

Originally published as Townsville Enterprise says change needed to reinsurance pool after first cyclone tests scheme