Debt fear hangs from State Bank financial disaster

A catastrophe dating back to the heady days of the Adelaide Crows’ formation has Paul Starick worried about a repeat. Find out why.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

Way back in the summer of 1991, two events changed South Australia forever.

One was an SA team entering the AFL for the first time – 50,000 people turned up to watch the Adelaide Crows’ first trial match against Essendon on February 1, 1991.

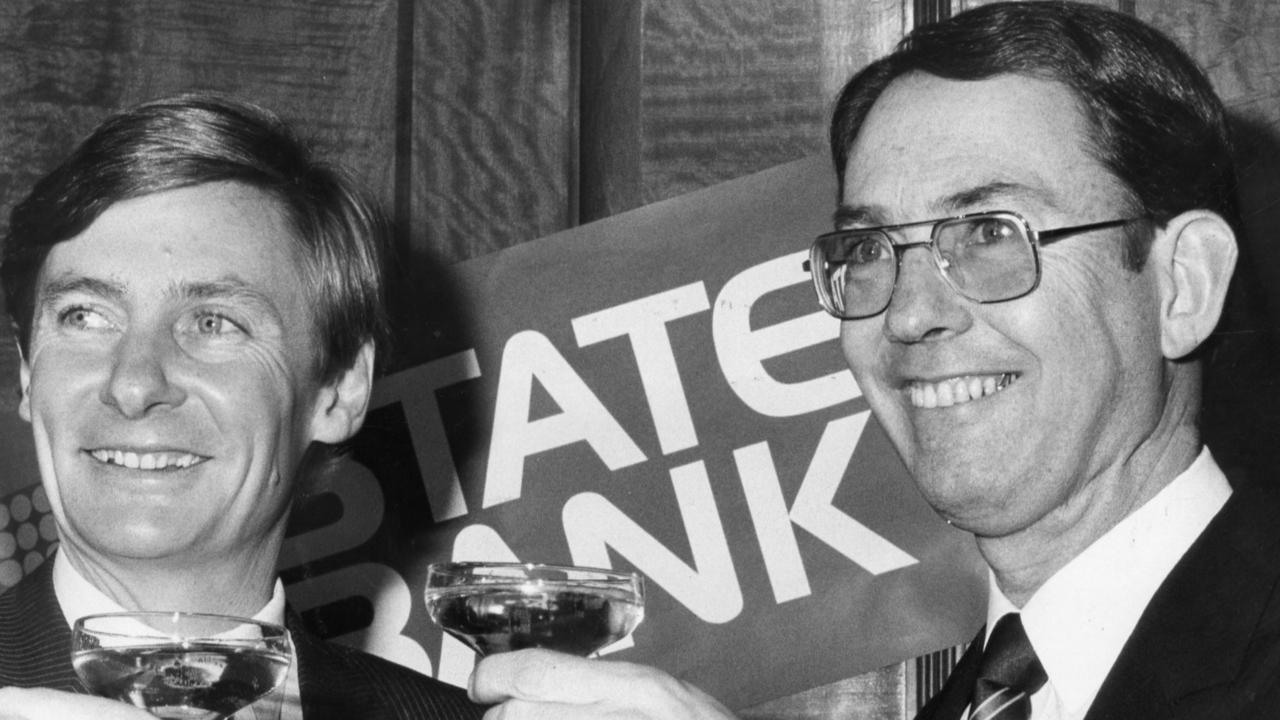

Days later, on February 10, the State Bank collapse was revealed – $3.15bn in government-guaranteed funds was lost.

This cataclysm plunged SA behind the rest of nation. By mid-1991, the jobless rate topped 10 per cent, rising to 11.2 per cent by December.

As a 19-year-old in the final year of university at the height of a nationwide recession, I was extremely grateful to snare a job at Messenger Newspapers.

Many of my age cohort were not so fortunate. The interstate brain drain escalated dramatically, as young people fled the economic desert that was SA in search of work.

The aftershocks of the State Bank debt catastrophe linger to this day. SA Productivity Commission research in 2022 found, since 1991, a $29bn gap between SA’s economic output and the national average.

The debilitating millstone of large debt has been devastatingly discovered by countless homeowners during the Reserve Bank’s recent historic hiking of interest rates, after a prolonged period of record lows.

Arguably, this has cushioned and distracted the public from the immense debt burden being racked up by state and federal governments in recent years.

Perhaps this is because only middle-aged people, like me, and older generations, can remember the grinding, relentless pain of double-digit interest rates and unemployment in the early 1990s.

Veteran Liberal treasurer Rob Lucas all-but maxed out the state credit card in his final budget in 2021, sending debt soaring to $33.623bn in his forward estimates.

This was despite Mr Lucas using his debut budget in 1998 as a lethal weapon to attack the huge state debt burden lingering from the State Bank.

Modern-day treasurers like Stephen Mullighan, who will deliver his fourth state budget on June 5, insist that debt is within comfortable levels.

His 2024 budget forecast the state’s debt burden to soar to an eye-watering $44.2bn in 2027-28.

Perhaps people were too distracted by their own debts to be alarmed by that budget forecasting interest payments on state government debt would surge to $2.1bn annually – or more than $5m a day.

Mr Mullighan projected six consecutive budget surpluses and was keen to emphasise that debt was within comfortable levels, as measured by crucial ratings agencies, with a net debt to revenue ratio of 131.8 per cent.

One key ratings agency, S & P Global Ratings, said a likely increase in tax revenue meant the state could handle higher infrastructure spending. Most notably, this was on the $15.4bn South Rd tunnel project and the $3.2bn new Women’s and Children’s Hospital.

But the alarm needs to be sounded about storm clouds rising from huge debt levels across the country, lest we sleepwalk into another State Bank disaster. The chief culprit is the basket case of Victoria, where Tuesday’s state budget outlined a trajectory of a staggering $200bn debt by 2030, with almost 10 per cent of spending needed simply to service payments.

Mr Mullighan has already warned of hits to his June 5 budget from the Whyalla steelworks rescue package, among other measures.

The consequences of big debt repayments for governments are the same as for households – there’s little money left over, even for emergencies.

As Mr Mullighan eloquently said in June, 2019, when he was critiquing Mr Lucas’s Liberal budget: “This interest rate bill each year will not only increase as time goes on. It will reduce the capacity to fund essential services, particularly in health and education.”

Exactly right. Interest rates might have stopped rising but the pain of debt repayment continues. Let’s hope the state never returns to the wasteland of the 1990s – apart from the Crows flying high.

More Coverage

Originally published as Debt fear hangs from State Bank financial disaster