JCU Economics lecturer analyses northern Australia’s troubled insurance market

An economics expert has examined the issues plaguing northern Australia’s unbalanced insurance market. See what she identified as a ‘glaring’ issue.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

An economics expert has flagged a key issue driving up northern Australia’s insurance costs after analysing the unbalanced insurance market and the reinsurance pool for cyclone and related flood damage.

Campaigning for a fairer insurance market in northern Australia, the Townsville Bulletin joined with the Townsville Chamber of Commerce and 19 other northern chambers to highlight the challenges confronting northerners like C Bar owner Allan Pike, whose business’ insurance bill doubled in recent years.

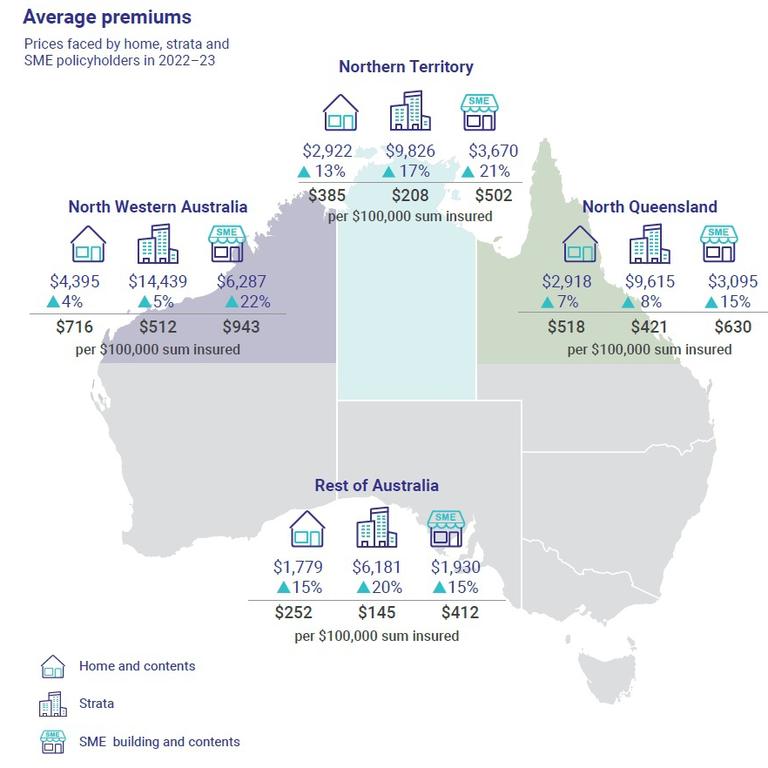

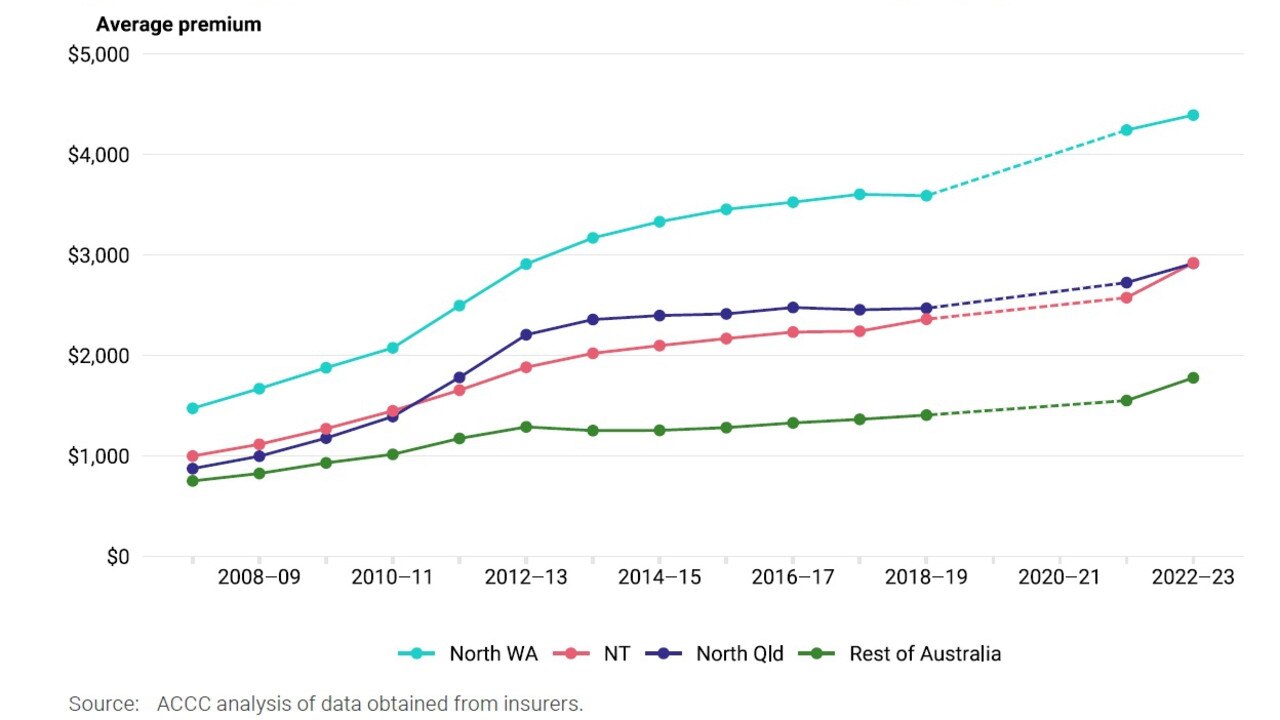

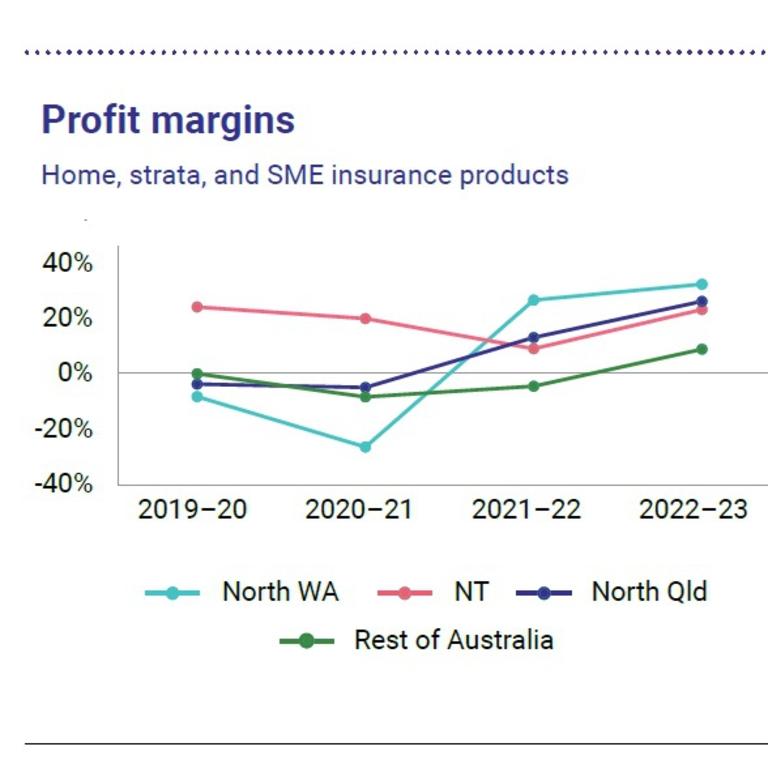

James Cook University Economics Lecturer Diana Castorina pointed to the ACCC’s Second Report, issued in December 2023, which showed Queensland, Northern Territory and Western Australia paid more for insurance than the rest of Australia.

“The market for insurance faces a glaring issue in that the probability of a severe event occurring in any given year than previously modelled is more likely to occur,” Ms Castorina said.

“With an increase in certainty, consumers will be more willing to pay and enter the market (pushes prices up), however on the supply side, the more certainty that the event is to occur, the higher the premium will be.”

In North Queensland, the average premium prices were $2918 for homes, $9615 for strata, and $3095 for small business insurance, surpassing the rest of Australia’s $1779 for homes, $6181 for strata, and $1930 for small businesses.

In the most recent March quarter, she said CPI Insurance prices rose 16.4 per cent annually – the strongest annual rise in 23 years.

“In general we have seen insurance premium prices increase across the board in a number of categories,” Ms Castorina said.

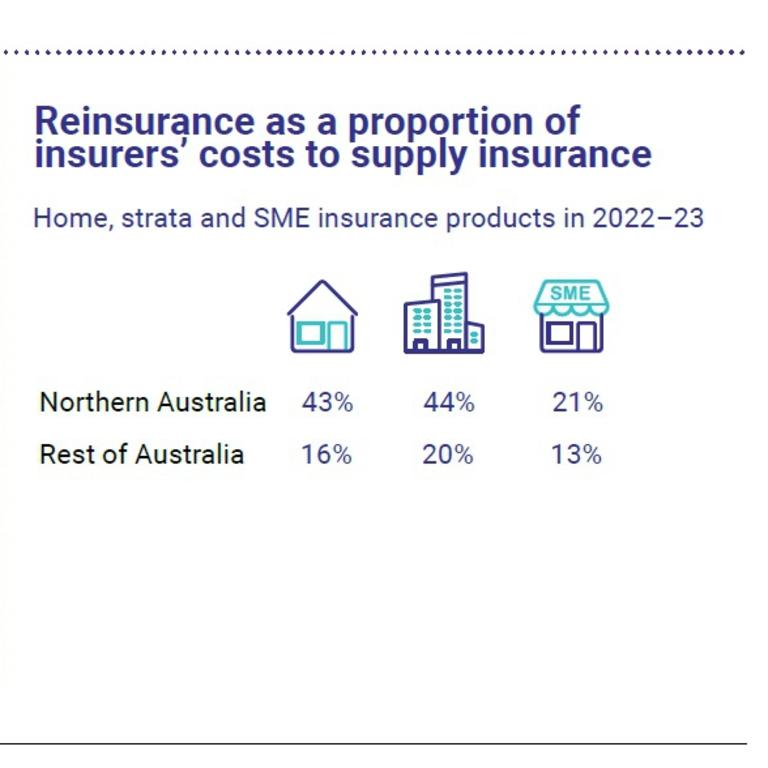

“The ABS has cited higher reinsurance, natural disaster and claims costs as drivers for higher premiums for house, home contents and motor vehicle insurance.”

Referring to a December 2022 survey by the Climate Council, she said one in five people reported having no insurance, with six per cent cancelling their insurance due to the increasing premiums.

To improve insurance affordability in northern Australia, the federal government implemented the reinsurance pool for cyclone and related flood damage (CRP) in July 2022.

Ms Castorina said the pool’s success was partly dependent on participation, with the deadline for large insurers passing at the end of 2023, and smaller insurers by December 31, 2024.

“With any policy, there is a lag between its design, implementation and final impact. Once the pool is widened, risks are diversified, which will subsequently reduce the price of premiums paid,” she said.

The ACCC was tasked with monitoring the impact of the pool, and to assess whether savings were being passed through to policyholders.

“There are penalties if they are not. Collection of data and transparency is key in this process,” she said.

“If we look at reinsurance pools overseas (like in the UK, Spain, France, Switzerland), they have been most successful when coverage reaches 85 per cent.”

Ms Castorina said other measures could be introduced concurrently with the CRP, including greater investment towards resilience and mitigation projects.

“Government funding towards incentives such as subsidies that encourage building resilient infrastructure, will potentially in time reduce premiums paid on insurance (as this feeds into risk modelling),” she said.

More Coverage

Originally published as JCU Economics lecturer analyses northern Australia’s troubled insurance market