C Bar’s owner calls for changes to fix northern Australia’s unfair insurance

A North Queensland business being ‘gouged’ by hikes in insurance costs has called for changes and urged people to shop around. See how much his bill went up.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

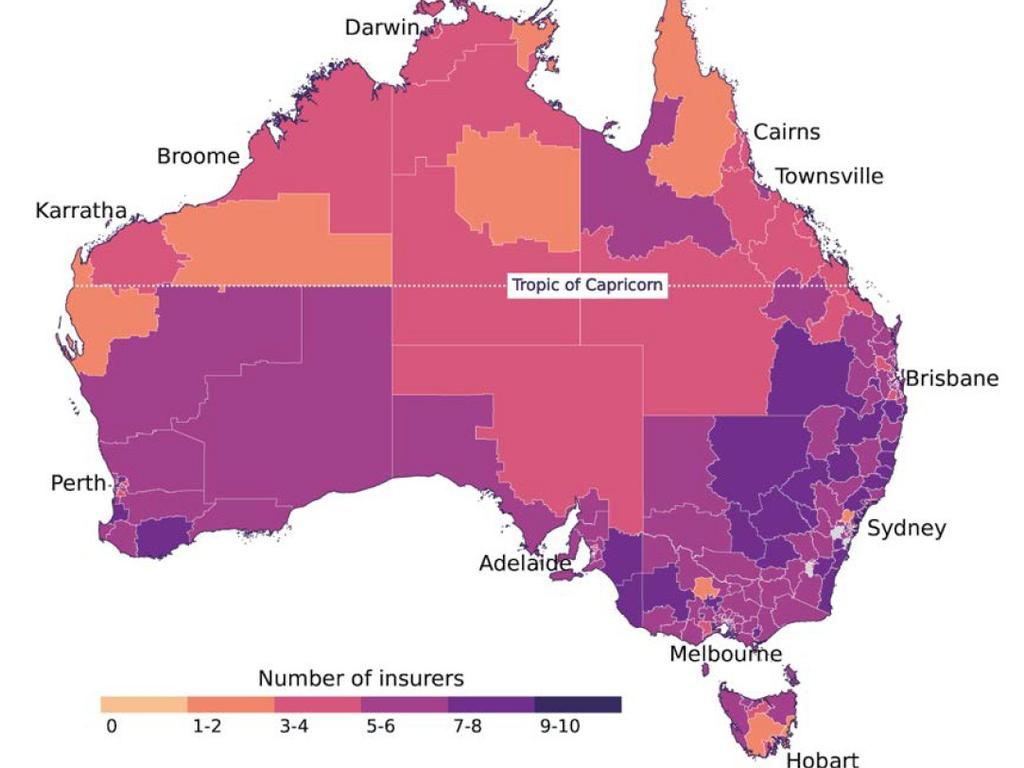

Small businesses like Townsville’s C Bar are bearing the brunt of an unbalanced insurance market servicing northern Australia, forcing them to take desperate measures like raising prices, cutting back staffing hours, or take their chances without insurance altogether.

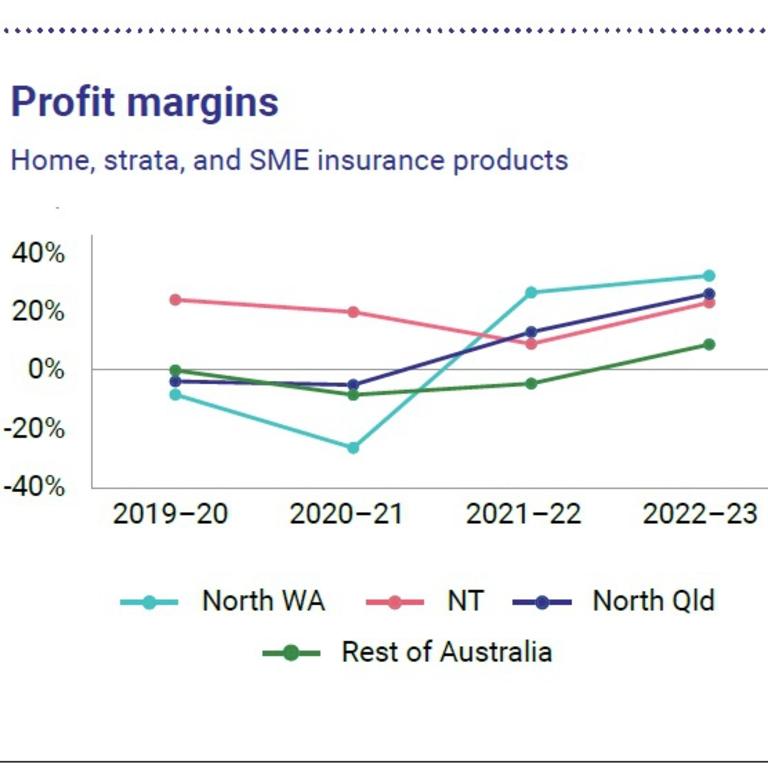

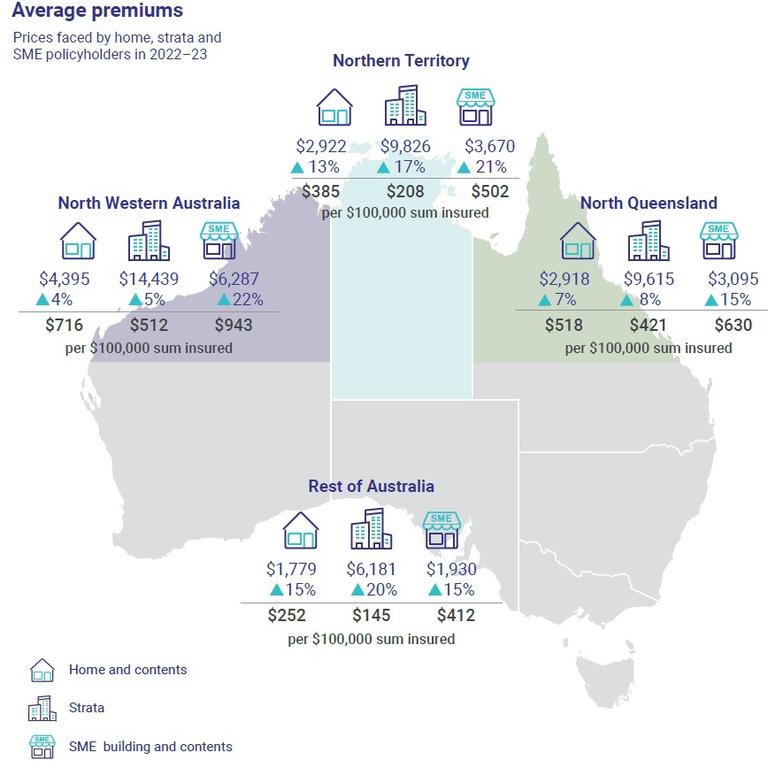

The ACCC’s second insurance monitoring report revealed last December that the average for small business insurance (policies for building and contents insurance) premium for North Queensland was $3095, compared to $1930 in the rest of Australia.

North Western Australia recorded the highest change on previous year with an average premium of $6287, followed by the Northern Territory at $3670.

Looking at what the top 5 per cent of policyholders were paying, North Queensland forked out $5629, while the rest of Australia paid $3673, with North Western Australia again ranking the highest at $9924.

C Bar owner Allan Pike said his business’ insurance premiums had “gone through the roof”, more than doubling over the past five years from $14,000 to $36,000 two years ago.

“I think that North Queensland gets a raw deal, particularly with insurance companies, and you’re seeing that over a given time,” Mr Pike said.

“The insurance companies are super quick to take all your money but they don’t want to help you out and you see that with the people up north that got flooded … they’ve been taking their money for years and years.

“(In the) North Queensland market, we get taken advantage of there’s no question about it.”

With the assistance from a good broker, he was able to shop around to secure a better deal for his portfolio from new American entrants into the insurance market, bringing the C Bar’s bill down to $29,000 last year.

“If you get the right person and they do all the research for you, you can get some savings out of it,” he said.

He was aware of local businesses struggling with rising costs taking the risk of not insuring for certain things, like plant breakdowns.

“They’re cutting corners to continue to operate the business and that’s not sustainable … it’s not a good business model,” he said.

To help address the problems, Mr Pike called for a larger contribution from the state government into the reinsurance pool for cyclones and related flood damage, along with increased regulation of the insurance industry, particularly in northern Australia.

“I’d like to see the insurance companies come under reviews to keep them accountable for their actions … there’s got to be some higher authority,” he said.

“I don’t see it changing straight away, I think the insurance companies are too big.

“Someone’s got to oversee them and make sure that are doing the right thing and make sure they’re not gouging everybody and make sure that they’re helping people out.”

Insurance Council of Australia responds to rising costs

The Insurance Council of Australia has blamed the escalating cost of natural disasters for driving the increase in insurance premium prices, saying more needed to be done to reduce risk.

A spokesman for the Insurance Council of Australia (ICA) said premium prices were rising, irrespective of where you lived in the country.

This was due to the escalating costs of natural disasters, the growing value of our assets making them more costly to replace, inflation driving up building and vehicle repair costs, and the increasing cost of capital for insurers.

“The ICA has long been advocating for measures that reduce risk and will moderate pressures on premiums over the long-term,” the spokesman said.

“This includes investment in mitigation infrastructure, changes to land use planning and building codes, home buyback programs, as well as the removal of unfair taxes and levies.

“The Commonwealth Government has made a commitment to review the Cyclone Reinsurance Pool, and the Insurance Council and insurers look forward to participating in that process whenever it happens.”

Since the start of the year, the ICA and insurers have participated in the insurance roundtable led by the Assistant Treasurer following Ex-Tropical Cyclone Jasper, and participated in hearings to support the Joint Select Committee on northern Australia on Cyclone Reinsurance Pool.

The ICA is committed to working with government and industry partners to help improve the insurance outcomes for customers.

“Since the Black Summer Bushfires of 2019-20 insurers have paid out $16 billion in claims from 13 declared insurance catastrophes or significant events, events that are still having an impact on the price of premiums for every Australian insurance customer,” he said.

He flagged ICA’s intention to campaign for the removal of stamp duty on insurance in Queensland’s upcoming state election campaign, after the states made more money from it than insurers made in profits.

More Coverage

Originally published as C Bar’s owner calls for changes to fix northern Australia’s unfair insurance