Young people react to The Project’s superannuation experiment

An experiment conducted on The Project has been a huge eye opener for young Aussies, with one question particularly causing angst.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Since financial adviser Ellie Fordham appeared as part of The Project’s millennial superannuation experiment she has been bombarded by people “stuck” about what to do to make sure they are headed for a comfortable retirement.

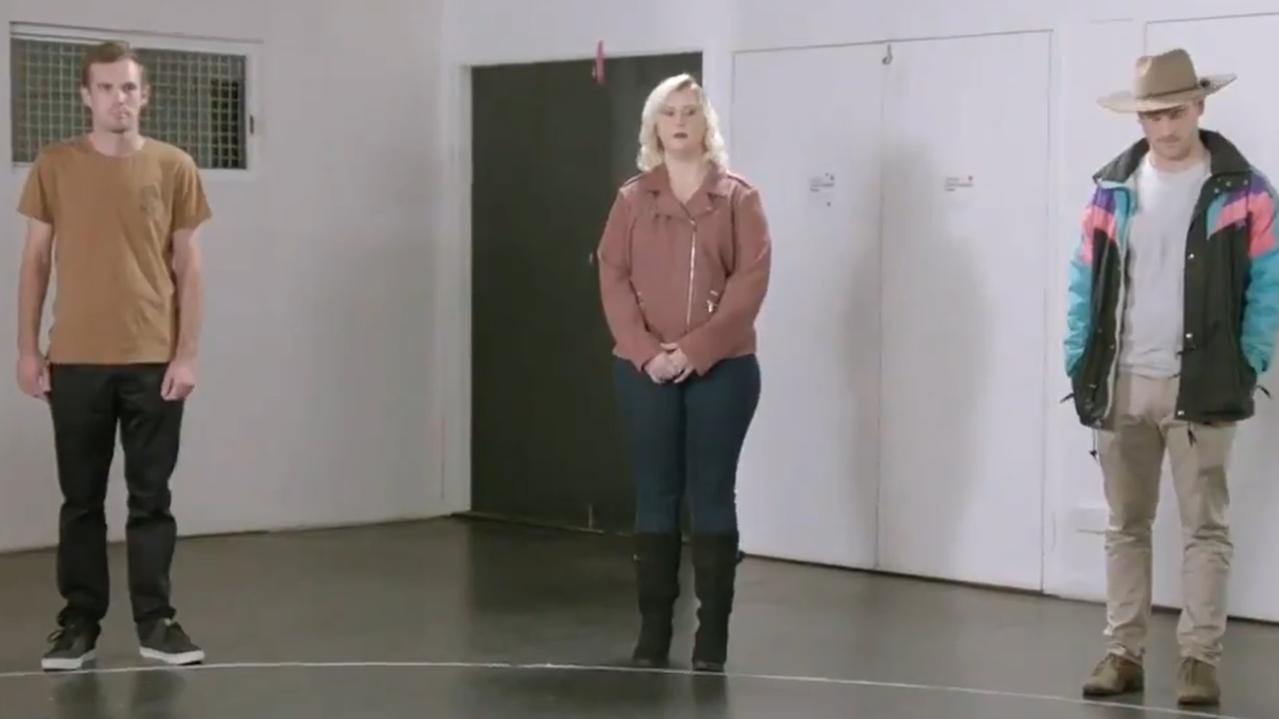

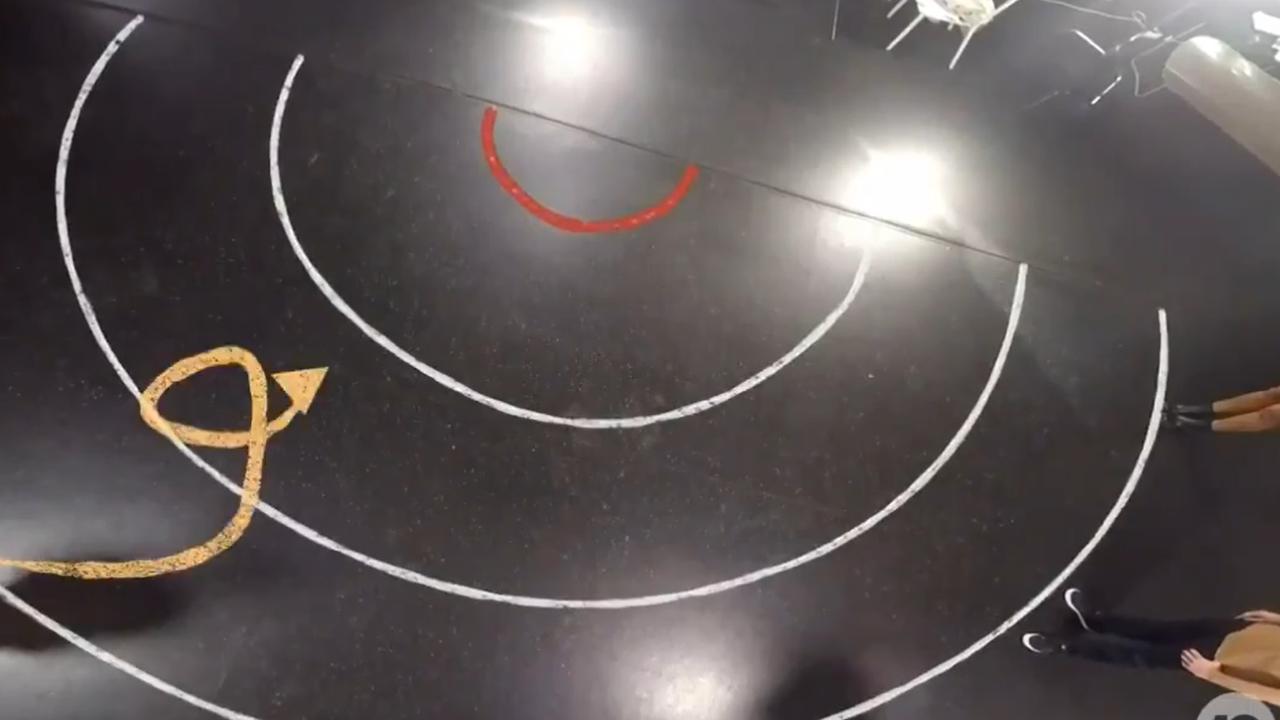

For the experiment, the millennials stood in front of a series of circles that led to a red line, and they had to step forward if a question regarding their financial affairs applied to them.

The closer they got to the red line the higher chances they had of experiencing financial stress in retirement, with questions including if they were renting, earning less than $62,500, had withdrawn super money early or were likely to take more than six months out of the workforce.

After airing on Monday night, Ms Fordham said the segment had helped to highlight how millennials choices today had a huge impact on their future.

RELATED: How to boost your super by $660k

One fact which really surprised the participants of the program was when Ms Fordham revealed singles will need close to $1 million in retirement assets, have no debt and a house that’s fully paid off to avoid using the aged pension.

She said the eight millennials who participated in the experiment experienced a “lot of shock about the factors that can impact them”.

“I think the biggest outtake is most of them really wanted to retire without reliance on the aged pension and when they were starting to think about that $1 million benchmark and about how to live comfortably in retirement it was pretty confronting for them,” she said.

“Then when you start to talk about the impacts of being out of the workforce for periods of time and not having contributions coming in or working for yourself and not making contributions they were pretty shocked.”

One of the most surprising things to come out of the experiment were participant’s change of heart when it came to the aged pension, with many conceding it would need to be part of their retirement plan in the future, she added.

While the Association of Superannuation Funds of Australia recommends a single can retire on $28,000 a year, Ms Fordham warned that millennials need to think about what their lifestyle costs.

“We know that looking at statistics around people’s living expenses, the cost of living for millennials is a lot higher than $28,000, so it’s about understanding how much you need or want to live on in retirement,” she said.

“So that $1 million figure we came to is based on needing around about $45,000 a year in retirement so that means you have to have your own home or some level of housing that is quite affordable and you have to have your debt paid off.”

RELATED: Easy way to boost super by $56k

Many people had reached out to Ms Fordham after the program’s wake up call but were “stuck” about what to do next.

The big message she wanted to get across is that it’s never too late to start making changes.

“I think the first thing to think about is what you are contributing to your super and one of the questions that didn’t make it to air was I asked participants if they know how much is going into their super?” she revealed.

“You need to check and make sure your employer contributions are going into your super fund and chat to your employer about if there are any schemes available where you can contribute a bit more and an employer can increase their super contributions too. It’s pretty common in a lot of big firms, but it doesn’t happen everywhere.”

Voluntary contributions are crucial, according to the Dozzi financial advisor, a firm based in Brisbane.

“Some contribution is better than nothing. You can start by making a small $20 a fortnight contribution that comes out of your salary and can elect to do that pre-tax through salary sacrifice contributions, so it gives people a tax deduction and the impact on take home pay isn’t as significant as they think,” she urged.

Awareness is key, she added, with people needing to learn what type of investment their superannuation is in and researching the best strategy for them depending on how much risk they are willing to take on.

“The benefit for millennials is they have time on their side. I see clients who only have five to 10 years until retirement and they have to work a lot harder to make up the gap,” she said. “Millennials have 20 to 30 years before they can access their superannuation and have the ability to make small changes now. If they want to take on a little bit more risk, they have the ability to wait for that investment cycle to ride out if there is any downturns in the market. The biggest asset they have is time.”

People can contribute a maximum of $27,500 a year to their super, including their employer’s contributions, she explained.

She said for those on an average Aussie salary of $62,5000 they would need to put in $400 a week to their super to fulfil the cap, although she acknowledged that might not be realistic for most millennials who might be saving for a home or paying off a mortgage.

The good news she said is that someone on the average salary is already receiving $119 a week from their employer in super contributions.

But she said superannuation is only part of retirement goal for Australians, with home ownership and personal savings also a huge factor.

“A lot of people are saving for retirement in different ways and not just through superannuation,” she explained,

“Logan, who was part of the experiment, he ideally wanted to retire by 40. He had a bit of an investment strategy where he was purchasing property and I believe he had some direct share investments and he was using that as a way of creating wealth as he can’t access his superannuation when he’s 40 and can only access it when he’s 60.

“It’s a common way for people who have specific goals or to retire earlier and that is investing differently.”

One of Ms Fordham’s biggest concerns was the more than three million Aussies who choose to take at least $10,000 out of their super as part of an early withdrawal scheme during the pandemic, which added up a total of $36.4 billion removed from funds.

She said she had heard many stories of people using this money to buy personal items with no regard to the impact on their future.

“I’ve heard of people who have bought cars, I’ve heard of people paying off credit cards which isn’t maybe quite as bad, but a lot of people are impacted for years by taking $10,000 out,” she said.

“I think it was about $40,000 less in super at retirement for someone who was aged 30, so it’s hard when people don’t realise that at the time.”

Originally published as Young people react to The Project’s superannuation experiment