People’s First Bank CEO Steve Laidlaw discusses the future of cash and online banking

While a small section of the community clings to cash, the rest of us have moved on and banks need to adapt to this changing behaviour.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The cash-based economy has gone the way of the dodo and will not be resurrected, according to the head of one of Australia’s largest mutual banks.

“People say cash is king, cash is not king,” People’s First Bank chief executive Steve Laidlaw said.

“Cash hasn’t been king for a while. Pre-Covid about 70 per cent of retail purchases were done by cash but today it is around 13 per cent.

“I never thought I’d walk into a shop and see card only. My dad was a butcher for 40 years and he hated anything but cash, but the world has fundamentally changed.”

Mr Laidlaw made the comments as part of a wide-ranging discussion about the bank he leads, the ongoing merger with Toowoomba’s Heritage Bank and how consumer attitudes are fundamentally shifting.

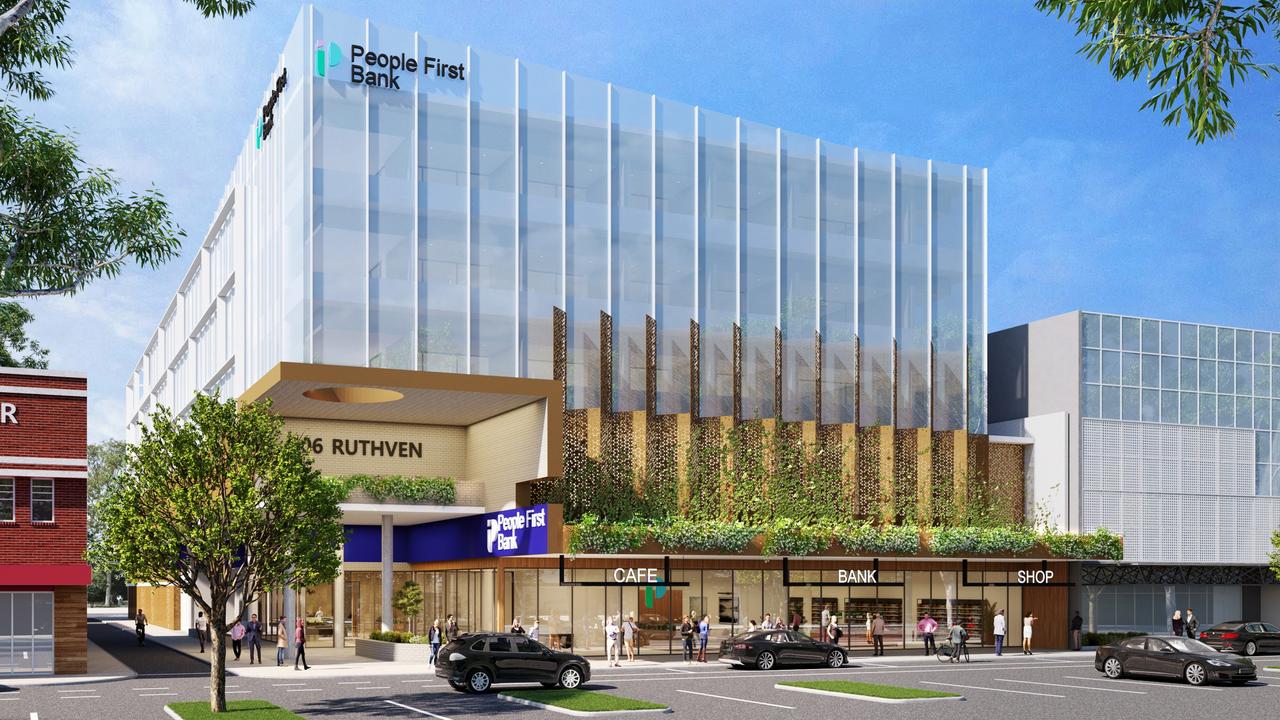

Since Adelaide’s People’s Choice Credit Union and Heritage Bank merged in 2022, the new organisation has embarked on a restructure that includes building a new, modern headquarters in the Toowoomba CBD.

It has brought about the closure of several branches as it migrates its operations to a digital space.

Through all of this Mr Laidlaw said the bank was responding to what its customers wanted.

“Cash is a very expensive way to do business,” he said.

“There are people who prefer to use cash for a number of reasons but, ultimately, the majority of people are very comfortable using cards.”

While the new building will include traditional bank services, Mr Laidlaw said the company was investing about $250m in new technology to serve online customers.

“The change in the way people bank is just so fundamental,” he said

“About 99 per cent of people do their banking online and you’ve got to respond to what’s happening in the environment.

“I could put my head in the sand and just pretend nothing’s happening but I won’t have a business for very long.

“If you want to sign up for an account it is a three day process if you go into a bank, while the app we are building now will allow you to do that within two minutes.”

By Friday the bank will have closed 18 of its 88 branches across Australia, of those 56 were Heritage-branded and 32 were People’s First Credit Union.

The majority of these branches were in Brisbane, the Sunshine Coast and Gold Coast.

Mr Laidlaw said that while he understood the pain associated with branch closures, the site slated for removal service a very small percentage of his customers.

“I can run a very large footprint of physical branches that will restrict my ability to invest in these other things that people are demanding,” he said.

“It is a difficult balancing act, it’s a very emotive issue, it’s a political issue but it is one we are trying to bring balance to.

“It is not driven by greed, it is driven by where the overwhelming majority of our customers prefer to do their banking.”

As a mutual bank, People’s First Bank does not pay dividends to shareholders, but it still relies on its profits to build capital and lend more money to more home buyers.

“We have our 150 year anniversary this year and I want to make sure we are around for another 150 years,” Mr Laidlaw said.