Resources Top 5: Dateline flies high as focus on US strengthens

With its eyes fixed on the US and its strategy to develop a domestic minerals supply chain, Dateline Resources is strengthening US ties and engagement.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Dateline Resources has gained recognition from President Trump for its Colosseum project

Taruga Minerals has exercised an option to acquire the Thowagee polymetallic tenement

Approval has been received by Codrus Minerals for drilling at the Bull Run gold project in Oregon

Your standout small cap resources stocks for Friday, May 2, 2025

Dateline Resources (ASX:DTR)

With its eyes fixed on the US and its proactive approach to developing a domestic minerals supply chain, Dateline Resources is strengthening US ties and engagement with potential investors.

With the company’s Colosseum project in California gaining recognition for its rare earths and gold resources from President Trump and endorsement from the US Bureau of Land Management (BLM), Dateline has this week been a strong performer on the ASX.

From 0.7c at the close on Monday, shares have risen to a new 12-month high of 3c, including a lift of 233% on Thursday’s close with more than 390m changing hands. DTR closed at 2.7c.

The President highlighted Colosseum in his Truth Social weekly update, stating: “The Colosseum Mine, America’s second rare earths mine, has been approved after years of stalled permitting.”

BLM added to the momentum for DTR, stating: “The resumption of mining at Colosseum Mine, America’s second rare earth elements mine, supports efforts to bolster America’s capacity to produce the critical materials needed to manufacture the technologies to power our future … Interior continues to support industries that boost the nation’s economy and protect national security.”

In a move aimed at capitalising on the recognition along with growing interest from US investors, Dateline Resources is pursuing an upgrade of its OTC listing to the OTCQB Venture Market.

DTR’s shares trade in the US under the OTC code DTREF and the process to uplist to OTCQB is underway. The OTCQB listing will operate in parallel with Dateline’s primary ASX listing.

“We have seen growing interest out of the US, particularly after recent milestones at our Colosseum project,” Dateline managing director Stephen Baghdadi said.

“An OTCQB listing is a logical step to better engage with our US audience, allowing American investors to trade our stock more conveniently and be part of Dateline’s journey.

“This cross-listing expands our global reach without adding regulatory burden, which is an ideal outcome for our shareholders.”

The decision follows a surge in interest from North American investors after the US Department of the Interior last month confirmed Dateline’s mining rights at Colosseum.

In a statement, the DOI noted that resumption of mining at Colosseum will “bolster America’s capacity to produce the critical materials needed… and reduce dependence on foreign adversaries like China”.

Colosseum hosts a JORC-compliant mineral resource of 27.1Mt at 1.26 g/t gold for 1.1 Moz, with 67% in the measured and indicated categories.

A 2024 scoping study outlined an 8+ year mine life producing ~75,000 oz/year, with a pre-tax NPV of ~US$235 million and IRR of 31% at a US$2,200/oz gold price.

With growing interest in a domestic critical minerals supply chain, including REEs, the company has integrated exploration for REEs at Colosseum into its program, targeting carbonatite-hosted systems analogous to the nearby Mountain Pass mine, the only REE operations in the US.

Colosseum is an historical gold mine in the Mojave National Preserve of San Bernardino County, roughly 10km north of Mountain Pass.

“The DOI decision was a game-changer for Colosseum’s perception in the US – it signalled official support for the project,” said Baghdadi.

“We’ve had a wave of new US shareholders come on board, and engagement on our US social and investor channels is at an all-time high. Aligning our US trading platform via OTCQB is timely, as it caters to this growth in US investor interest.”

With US regulatory hurdles cleared and a broader investor base coming on-board, Dateline is accelerating activities on all fronts.

The company is focused on completing a bankable feasibility study (BFS) for Colosseum, which will incorporate the latest drilling results and updated economic parameters.

Dateline expects to finalise its OTCQB listing in early Q3 2025.

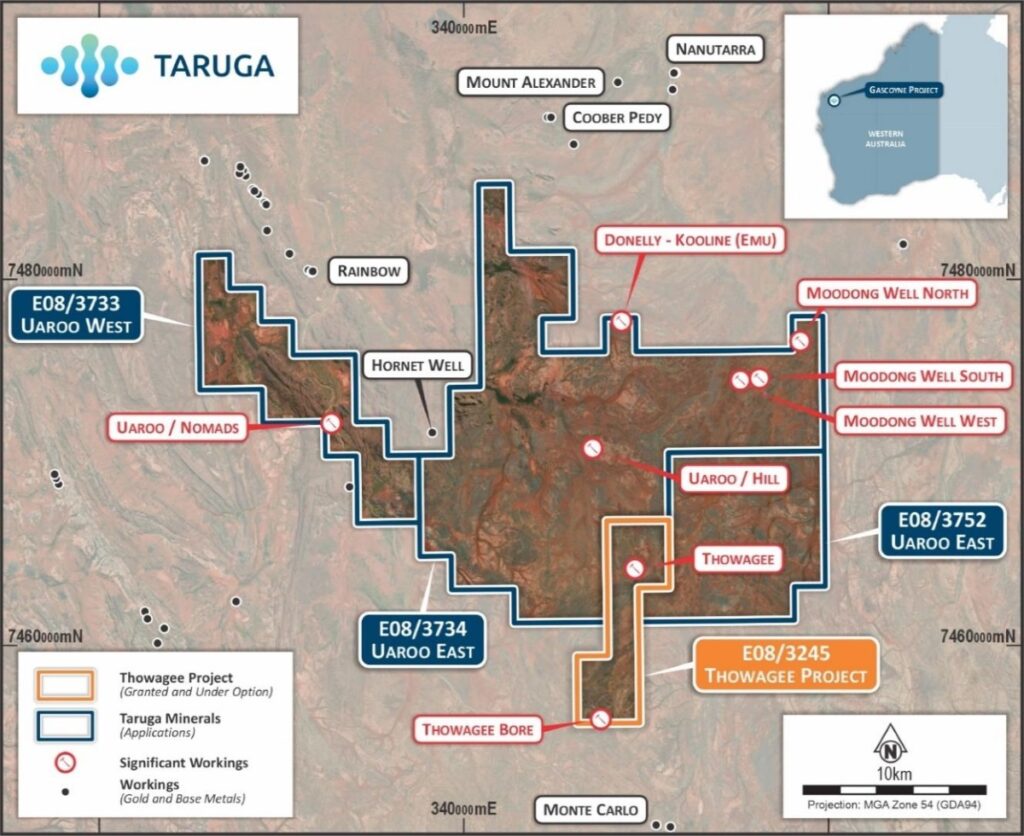

Taruga Minerals (ASX:TAR)

After strengthening its WA footprint by exercising an option to acquire 100% of the Thowagee polymetallic prospective tenement, Taruga Minerals has enjoyed a couple of good days on the ASX with an 11% increase on Thursday to 1c followed by a 20% lift on Friday to a daily high of 1.2c before easing back to 1c.

Thowagee complements its existing application portfolio which spans 416.5km2 of contiguous ground with lead, zinc, copper, silver and gold potential.

It includes two historical mining sites – Thowagee Mine and Thowagee Bore – with high-grade polymetallic mineralisation in outcropping veins and gossans.

TAR intends to revive the mine, which has gone underexplored since 1956, when 15.2t of lead and 5878g of silver were extracted in a concentrate produced on site, along with hints of gold, copper and zinc.

Field exploration at the project kicked off last month, with work focusing on exploiting the potential riches below high-grade base and precious metals mineralisation in outcrops.

Initial reconnaissance and rock chip sampling has been positive, confirming general mineralisation trends and the high-grade polymetallic nature of mineralisation.

Results including heavy mineralised altered country rock samples next to the historical quartz veins showed potential to add to the mineralised system.

Two polymetallic mineralised trends have been mapped, with historical workings extending over 800m along a north-northeast strike and over 350m along a north-northwest strike.

New rock chip results include 26.3% lead, 14.5% zinc and 0.9g/t gold – as well as a silver grade of 130g/t.

Adjacent to the Thowagee Mine, TAR will focus on identifying and sampling gossans, their location and significance.

Other activities include the use of geophysical datasets and in field mapping to trace out the extent of host shear zones and mineralisation potential.

Available data sets include radiometrics, VTEM, magnetics, mapped outcrop geology and interpreted bedrock maps.

Field observations and verified historical data, including from neighbouring workings/mines, will be incorporated and interrogated as part of a broader review of the applicable geological models for potential mineralising events.

Codrus Minerals (ASX:CDR)

Codrus Minerals is preparing to start drilling at the previously producing Bull Run gold project in Oregon after receiving approval for up to 30 holes for 14,000m across 10 sites.

Shares have been up to 30.43% higher to 3c and have risen from 1.6c at the close on April 8.

Gold has been gleaned from Bull Run since 1929 with the most notable period being from 1933 to 1937 when 5000oz was produced from the Record underground mine.

Drilling at the Record mine in 1983 returned a top result of 20.5m grading 3.53g/t gold from a down-hole depth of 7.9m. This hole ended in mineralisation, indicating potential for more gold at depth.

Gold has been included as a metal of importance in President Donald Trump’s executive order to increase production of critical minerals. It comes as the precious metal continues to trade above the US$3200/oz level.

With approvals in place, Codrus can proceed with drilling at Bull Run where it has been engaging with local drill contractors and completing drill targeting and planning.

Should the inaugural drilling be successful, it will start work to define a maiden gold resource.

“This project has been a high priority since identified by Blackstone Minerals some years ago and they remain a very supportive shareholder with leverage to this highly prospective project,” CDR executive chairman Greg Bandy said.

Boab Metals (ASX:BML)

(Up on no news)

A quarterly report this week from Boab Metals (ASX:BML) outlined progress made at the flagship Sorby Hills lead-silver-zinc project in the Kimberley region of WA and shares are 41.67% higher at 17c.

During the quarter, the company finalised due diligence on the potential acquisition of the DeGrussa Processing Plant and has since executed a binding sale and purchase agreement with Sandfire Resources (ASX:SFR) to acquire the plant.

This is expected to significantly enhance Sorby Hills project execution by derisking equipment procurement and reducing upfront capital costs.

The acquisition price of A$10m comprises a $1.5m deposit of which A$500,000 is payable in cash and A$1m in cash or shares at a price of A$0.12/sh; $6m payable in cash upon completion; and $2.5m payable in cash on or before the date that is 12 months from the sale of the first concentrate from the project.

Discussions continue with potential financiers to complement the binding US$30m prepayment from Trafigura.

BML is targeting a final investment decision for Sorby Hills in H2 2025.

“Assessing the DeGrussa opportunity and negotiating the sale and purchase agreement with Sandfire was the core focus of our efforts at Sorby Hills during the quarter and we are delighted to have achieved a successful outcome,” managing director and CEO Simon Noon said.

“The acquisition represents a key derisking event from both a capital expenditure and equipment procurement prospective and builds upon the significant project execution momentum that we have built over the past six months.

“We look forward to completing a competitive tender over the coming quarter to formally price the relocation, reconstruction and refurbishment contract ahead of a targeted H2 2025 FID.”

Sorby Hills is 50km from the regional centre of Kununurra in the East Kimberley and has access to existing sealed roads to transport the concentrate 150km from the mine site to the facilities at Wyndham Port.

The project comprises a mineral resource of 47.3Mt containing 1.5Mt Pb at 3.1% and 53Moz silver at 35g/t.

The current Sorby Hills mine plan comprises 18.3Mt at 3.4% Pb and 39g/t Ag of which ~83% is classified as an ore reserve.

Locksley Resources (ASX:LKY)

(Up on no news)

Another company doing well after releasing a quarterly report this week is Locksley Resources, which has been 67% higher to a daily top of 3c.

Encouraged by the US government strategy to bolster the domestic critical minerals supply chain, Locksley has been focusing on the Mojave antimony and rare earths project in California.

During the March quarter rock chip assays returned up to 46% antimony and 1022g/t silver.

There were 18 samples that returned greater than 1.4% Sb and eight samples with better than 17% Sb.

The mineralised strike has been mapped over 400m and additional polymetallic results indicate lead, zinc and copper zones.

Permitting was also progressed for the Desert antimony mine within the Mojave project.

Initially flagged for an Environmental Assessment (EA) under NEPA, the process may now be streamlined under the US Executive Order aimed at accelerating domestic critical minerals development.

Key provisions include:

- Fast-track approvals for critical minerals

- Access to federal funding under the Defence Production Act

- Support from the newly formed National Energy Dominance Council (NEDC)

Locksley is actively engaging with the Bureau of Land Management to determine how these changes may shorten the expected 12-month permitting window and reduce associated costs.

The company plans to submit a Plan of Operations for drilling to BLM; engage with NEDC for permitting acceleration; and evaluate Defence Production Act funding opportunities.

At the Tottenham copper-gold project in central NSW, a DHEM survey has identified a potential third mineralised zone southeast of the existing Mount Royal–Orange Plains resource.

These EM conductors are coincident with a separate magnetic anomaly and offer significant

expansion potential with the JORC 2012-compliant inferred resource sitting at 9.86Mt at 0.72% Cu, 0.22g/t Au and 2g/t Ag.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Taruga Minerals is a Stockhead advertiser, they did not sponsor this article.

Originally published as Resources Top 5: Dateline flies high as focus on US strengthens