Closing Bell: Seventh straight day of gains as ASX lifts more than 1pc

The ASX has notched a more than 1pc gain with strong performances across the board to post a seventh straight day in the green.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX has gained to cinch seventh straight session in the green

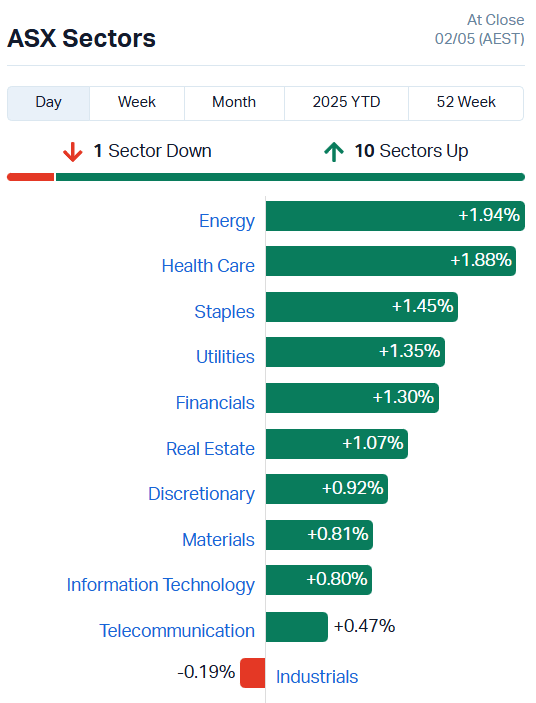

10 of 11 sectors on the up

Bank index lifts 1.6pc as CBA hits record new share price high

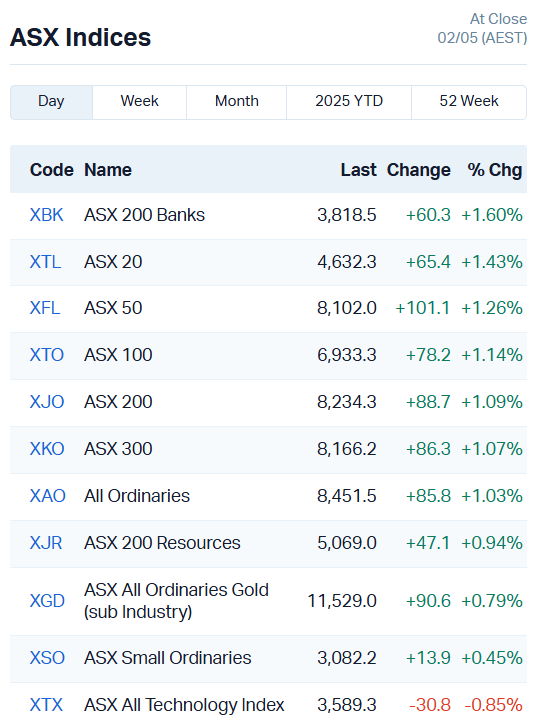

The ASX is on trajectory to return to pre-trade war highs after lifting for a seventh straight session, adding a convincing 1.13% to round out a week of progress.

The bourse is up 3.34% over the last five days, and now virtually unchanged over the last year to date.

There was plenty of joy to go around, with 9 of 11 sectors up more than 0.8%. Only TeleComms (+0.47%) and Industrials (-0.19%) lagged behind.

Boss Energy (ASX:BOE) had another day in the sun, up 5.44%. They weren’t the only uranium stock to make gains today.

88 Energy (ASX:88E) surged 50%, Elevate Uranium (ASX:EL8) 7.84%, Alligator Energy (ASX:AGE) 6.9% and Toro Energy (ASX:TOE) 5%.

Among larger companies, Bannerman Energy (ASX:BMN) gained 4.5%, Deep Yellow (ASX:DYL) 3.5% and Paladin Energy (ASX:PDN) 2.4%.

There was also plenty of upward momentum in oil and gas stocks, which were responding to a tidy 1.8% lift in global oil prices after an extended period of decline.

Woodside (ASX:WDS) lifted 2.1%, Santos (ASX:STO) 2.5% and Whitehaven (ASX:WHC) 2.1%.

The Banks Index also moved higher, lifting by 1.6% as Commonwealth Bank (ASX:CBA)hit a new record of $169.66 a share for a 1.44% gain overall.

Most of the major financial stocks lifted between 1% and 2% today, although Block Inc (ASX:XYZ) languished, plunging a whopping 26.7%.

The company’s earnings report disappointed investors. Revenue was down 3%, gross profit came in under expectations, and Block downgraded its full-year gross profit guidance.

"We are operating in a more dynamic macro environment, so we have reflected a more cautious stance on the macro outlook into our guidance for the rest of the year," the company said.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DTR | Dateline Resources | 0.027 | 200% | 2.27E+08 | $24,890,118 |

| CDR | Codrus Minerals Ltd | 0.03 | 50% | 2224511 | $3,307,750 |

| 88E | 88 Energy Ltd | 0.0015 | 50% | 3717973 | $28,933,812 |

| BML | Boab Metals Ltd | 0.17 | 42% | 4490506 | $28,007,413 |

| HPC | Thehydration | 0.011 | 38% | 2464103 | $3,066,407 |

| RNX | Renegade Exploration | 0.004 | 33% | 3275000 | $3,865,090 |

| TFL | Tasfoods Ltd | 0.004 | 33% | 125000 | $1,311,287 |

| CGR | Cgnresourceslimited | 0.125 | 30% | 195486 | $8,714,706 |

| EXL | Elixinol Wellness | 0.019 | 27% | 1051672 | $3,312,302 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 2021986 | $12,693,855 |

| LNR | Lanthanein Resources | 0.0025 | 25% | 866296 | $4,887,272 |

| MSG | Mcs Services Limited | 0.005 | 25% | 1651521 | $792,399 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 5744830 | $18,739,112 |

| LKY | Locksleyresources | 0.022 | 22% | 6708472 | $2,640,000 |

| ZNO | Zoono Group Ltd | 0.033 | 22% | 2030811 | $9,596,713 |

| JAL | Jameson Resources | 0.03 | 20% | 23416 | $15,268,333 |

| 1AD | Adalta Limited | 0.006 | 20% | 1308333 | $3,216,114 |

| CHM | Chimeric Therapeutic | 0.006 | 20% | 3689628 | $9,086,764 |

| ERL | Empire Resources | 0.006 | 20% | 3273333 | $7,419,566 |

| MEM | Memphasys Ltd | 0.006 | 20% | 17099680 | $9,917,991 |

| TAR | Taruga Minerals | 0.012 | 20% | 1200491 | $7,060,268 |

| TON | Triton Min Ltd | 0.006 | 20% | 230000 | $7,841,944 |

| NC6 | Nanollose Limited | 0.043 | 19% | 380179 | $8,999,363 |

| WGR | Westerngoldresources | 0.074 | 19% | 518329 | $11,755,513 |

| OMX | Orangeminerals | 0.05 | 19% | 1077786 | $5,233,296 |

Making news…

Dateline Resources (ASX:DTR) is gearing up to list on the US OTCQB to give American investors better access to its shares. Dateline already trades on the OTC Pink market under the code DTREF, but this upgrade will boost visibility while keeping its main listing on the ASX.

Its Colosseum project in California has just got a presidential nod after Trump highlighted Colosseum in his official Truth Social weekly update, stating:

“The Colosseum Mine, America’s second rare earths mine, has been approved after years of stalled permitting.”

The US government says the mine will help secure critical minerals and reduce reliance on China.

Colosseum has got 1.1 million ounces of gold, and rare earths now firmly in the exploration mix. A full feasibility study is underway, and with rising US interest, Dateline’s shaping up as a serious player in America’s critical minerals push, the company said.

Codrus Minerals (ASX:CDR) has just locked in a drilling permit for its high-grade Bull Run gold project in Oregon, with plans to punch in up to 14,000 metres across 10 sites.

It’s a historical gold patch, the old Record Mine pumped out gold back in the 1930s, and past drilling has pulled up hits like 20.5 metres at 3.53g/t, including a juicy 6.9 metres at 9.31g/t. Gold has also been named a critical mineral in a Trump executive order, good timing as Codrus gears up to drill and unlock what it reckons could be a major find.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 2673633 | $2,239,454 |

| KEY | KEY Petroleum | 0.041 | -32% | 71 | $1,510,770 |

| EMT | Emetals Limited | 0.003 | -25% | 1000000 | $3,400,000 |

| SIS | Simble Solutions | 0.003 | -25% | 500000 | $3,505,321 |

| WYX | Western Yilgarn NL | 0.028 | -20% | 3515 | $4,814,638 |

| ADN | Andromeda Metals Ltd | 0.02 | -20% | 92722672 | $85,718,192 |

| ALM | Alma Metals Ltd | 0.004 | -20% | 192346 | $7,931,727 |

| AOK | Australian Oil. | 0.002 | -20% | 44000 | $2,504,457 |

| C7A | Clara Resources | 0.004 | -20% | 103630 | $2,558,021 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 599501 | $9,929,183 |

| FTC | Fintech Chain Ltd | 0.004 | -20% | 14099 | $3,253,848 |

| RLL | Rapid Lithium Ltd | 0.002 | -20% | 21090 | $3,112,362 |

| SPQ | Superior Resources | 0.004 | -20% | 387694 | $11,854,914 |

| NOR | Norwood Systems Ltd. | 0.021 | -19% | 899106 | $12,729,908 |

| QFE | Quickfee Limited | 0.055 | -18% | 80618 | $22,903,398 |

| GTE | Great Western Exp. | 0.014 | -18% | 848348 | $9,651,885 |

| REE | Rarex Limited | 0.0225 | -17% | 6310468 | $21,622,838 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 5791964 | $8,033,235 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 1000000 | $4,169,331 |

| PKO | Peako Limited | 0.0025 | -17% | 435305 | $4,463,226 |

| SPX | Spenda Limited | 0.005 | -17% | 4788233 | $27,691,293 |

| WBE | Whitebark Energy | 0.005 | -17% | 315900 | $2,399,441 |

| CKA | Cokal Ltd | 0.0295 | -16% | 1870476 | $37,763,214 |

| DKM | Duketon Mining | 0.135 | -16% | 249182 | $19,585,853 |

| KNI | Kunikolimited | 0.135 | -16% | 145299 | $13,907,883 |

IN CASE YOU MISSED IT

Greenvale Energy (ASX:GRV) has locked-in the acquisition of the Oasis uranium project in Queensland, already mobilising exploration crews to put boots on the ground.

Past exploration outlined a high-grade uranium zone at Oasis over a 300m area stretching 200m in depth. Historical data has also revealed a mineralised intersection of 1m at 0.72% U2O8, offering some strong targets for further investigation.

Trading Halts

HyTerra Limited (ASX:HYT) – results from current drilling program

Gold Road Resources (ASX:GOR) – potential change of control transaction

At Stockhead, we tell it like it is. While Greenvale Energy is a Stockhead advertiser, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Seventh straight day of gains as ASX lifts more than 1pc