Lunch Wrap: Woolies, Coles cleared of price gouging; miners ratted after Trump’s exec order

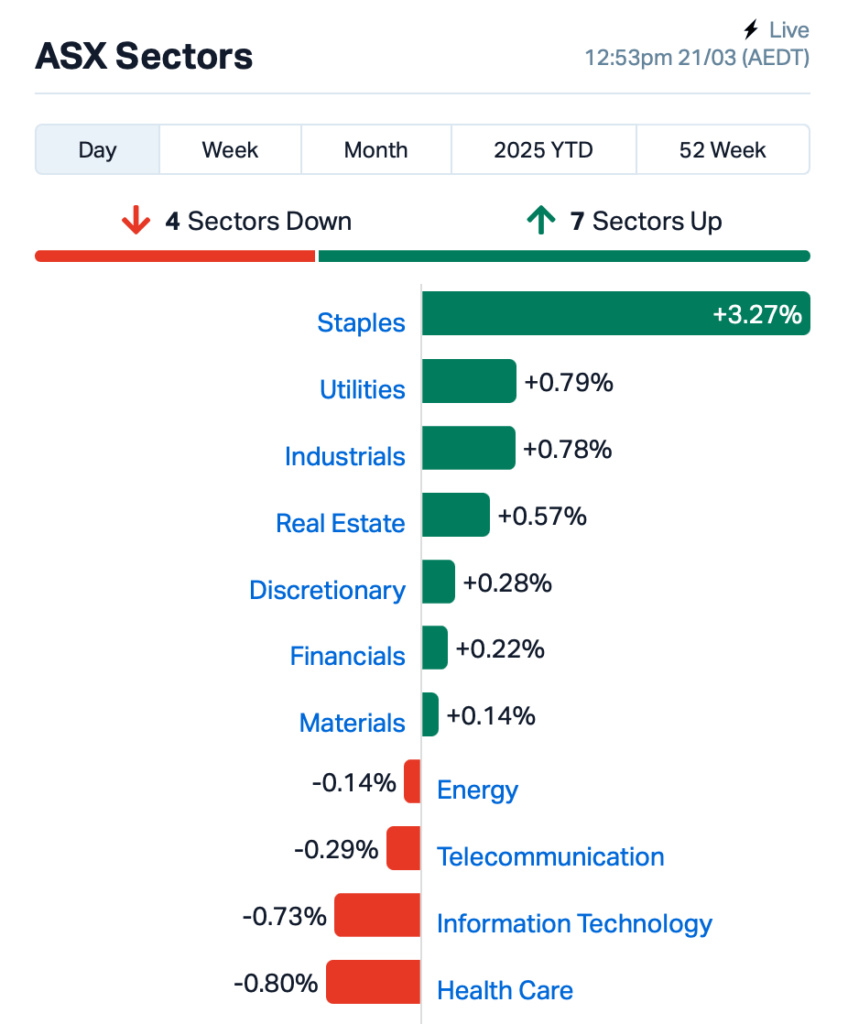

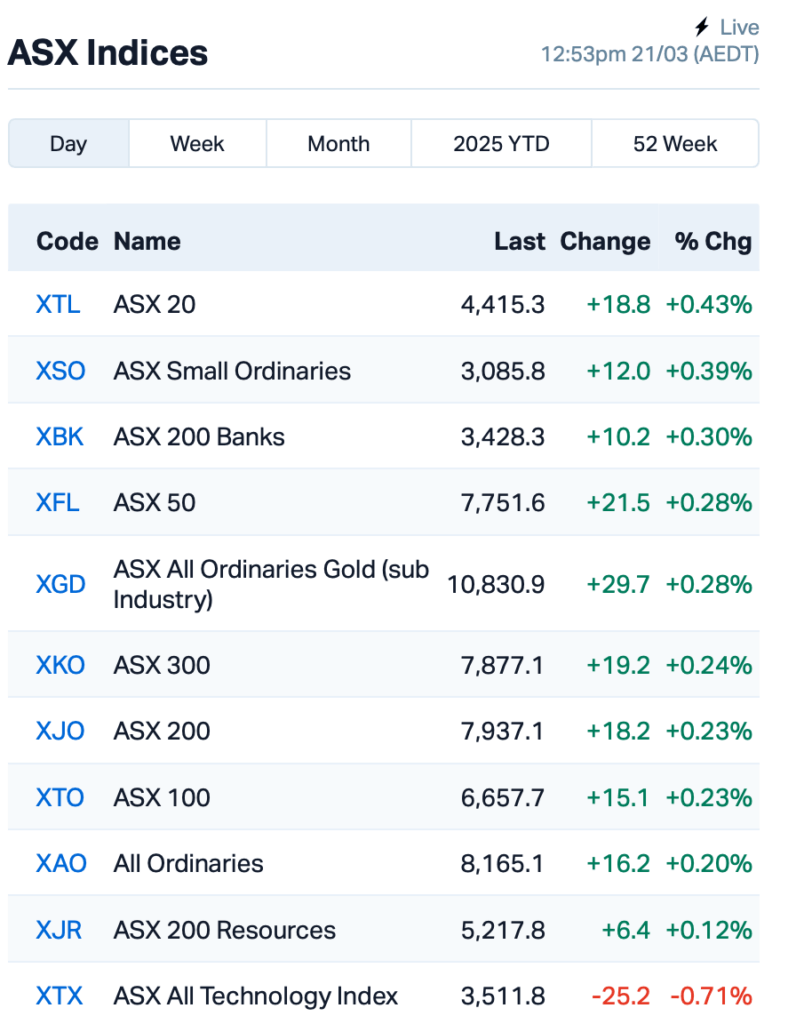

The local market has swung between green and red on Friday. At lunch time AEDT, the ASX 200 index had bounced back by 0.3%.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Woolies, Coles surge after ACCC clears them of price-gouging

Trump invokes emergency powers to boost US critical minerals

Paladin Energy dives after Namibian mine closure due to heavy rains

The ASX swung between the green and red on Friday, and at lunch time AEDT, the S&P/ASX 200 index had bounced back by 0.3%.

On Wall Street overnight, things weren’t looking quite as rosy. After a Fed-fuelled rally on Wednesday, US stocks took a step back.

The Nasdaq dropped 0.3%, the S&P 500 lost 0.2%, and the Dow Jones barely held on to the flat line.

Wednesday’s rally had been sparked by the Fed’s decision to keep interest rates unchanged, which initially boosted investor sentiment.

But a later press conference overnight revealed that US inflation projections were being revised upwards, while economic growth forecasts were being slashed.

The mood shifted as doubts crept back in about the economy’s direction, particularly with Trump pushing hard for tariffs.

Meanwhile, Trump has invoked emergency powers to boost the US’s production of critical minerals, which could include coal.

Last night, he signed an executive order aimed at reducing the country's reliance on imports by ramping up domestic mineral production.

"The United States was once the world's largest producer of lucrative minerals, but overbearing federal regulation has eroded our nation's mineral production," the president said.

On ASX, miners were rattled on the back of this latest order.

Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC) were sent into a tailspin, dropping by 3% each.

Liontown Resources (ASX:LTR) and Pilbara Minerals (ASX:PLS) followed suit, each dropping around 4%.

Paladin Energy (ASX:PDN) fell 3.5% after hitting pause on its Langer Heinrich Mine in Namibia. Paladin said it has been struggling with heavy drenching of rain that made getting to the site a no-go.

Meanwhile, the best large cap movers of the morning were Woolworths (ASX:WOW) and Coles Group (ASX:COL), both of which surged after the competition watchdog dropped a bombshell of a report.

The ACCC’s long-awaited findings cleared the supermarket giants of price-gouging allegations, and dubbed them some of the most profitable supermarket retailers in the world.

And finally, to round up the large-caps news, Premier Investments (ASX:PMV) rose 2% despite a 12.8% drop in H1 profits. According to chairman Solomon Lew, it’s still “a credit to management” in what’s been a tough trading environment for consumer brands.

The profit for the half slid to $148.8 million, but that doesn’t factor in the transaction costs from flogging off Premier’s Apparel brands to Myer, or its stake in Myer itself.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 21 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.003 | 150% | 46,483,038 | $4,579,223 |

| H2G | Greenhy2 Limited | 0.013 | 117% | 13,075,247 | $3,589,105 |

| AXP | AXP Energy Ltd | 0.002 | 100% | 220,000 | $6,574,681 |

| OVT | Ovanti Limited | 0.006 | 38% | 16,770,674 | $10,806,191 |

| EVR | Ev Resources Ltd | 0.006 | 33% | 2,713,583 | $8,936,265 |

| HE8 | Helios Energy Ltd | 0.012 | 33% | 1,478,439 | $23,436,445 |

| RDG | Res Dev Group Ltd | 0.011 | 22% | 263,100 | $26,557,723 |

| GES | Genesis Resources | 0.006 | 20% | 110,000 | $3,914,206 |

| WBE | Whitebark Energy | 0.006 | 20% | 66,912 | $1,541,046 |

| CRS | Caprice Resources | 0.066 | 18% | 17,347,271 | $28,320,678 |

| CMP | Compumedics Limited | 0.300 | 18% | 302,218 | $49,015,563 |

| RR1 | Reach Resources Ltd | 0.010 | 18% | 3,162,923 | $7,432,666 |

| BDG | Black Dragon Gold | 0.055 | 17% | 539,777 | $14,274,655 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 4,737 | $16,169,312 |

| HHR | Hartshead Resources | 0.007 | 17% | 51,229 | $16,852,093 |

| PLY | Playside Studios | 0.230 | 15% | 534,145 | $81,844,427 |

| CPO | Culpeominerals | 0.016 | 14% | 504,555 | $3,079,471 |

| SP8 | Streamplay Studio | 0.008 | 14% | 50,000 | $8,969,552 |

| ODA | Orcoda Limited | 0.081 | 14% | 53,186 | $12,116,652 |

| TMX | Terrain Minerals | 0.005 | 13% | 50,000 | $8,014,226 |

| VRC | Volt Resources Ltd | 0.005 | 13% | 467,777 | $18,117,573 |

| LKY | Locksleyresources | 0.019 | 12% | 30,000 | $2,493,333 |

| PSC | Prospect Res Ltd | 0.145 | 12% | 811,113 | $74,446,188 |

Greenhy2 (ASX:H2G) has locked in a new deal with European tech supplier H2Core to bring advanced storage solutions to the table, including supercapacitor batteries and hydrogen tech. These new supercapacitor batteries use graphene and promise five times longer life and lower operating costs than traditional lithium-ion batteries, plus H2G said they’re safer with no fire risk. H2G’s also making a move to replace lithium-ion with these supercapacitors for startup and balancing in hydrogen systems, cutting costs and boosting performance.

Compumedics (ASX:CMP) has landed a new MEG order worth $5.7m from Hangzhou Normal University, bringing its total MEG sales to around AUD 20M across China. The company’s Orion LifeSpan MEG system is now the go-to tech for brain research in China, with installations happening at four major universities. Compumedics expects solid growth, projecting over $60m in sales for FY25 and over $70m for FY26. The new tech features advanced superconductor sensors and zero helium refills, setting a new standard in the field.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 21 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.001 | -50% | 6,000 | $4,900,774 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 9,761 | $3,467,332 |

| ERA | Energy Resources | 0.002 | -33% | 457,727 | $1,216,188,722 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 3,982,867 | $57,867,624 |

| AOK | Australian Oil. | 0.002 | -25% | 5,500 | $2,003,566 |

| TOU | Tlou Energy Ltd | 0.030 | -25% | 453,432 | $51,943,373 |

| AUK | Aumake Limited | 0.004 | -20% | 908,781 | $15,053,461 |

| BCB | Bowen Coal Limited | 0.004 | -20% | 1,446,212 | $53,878,201 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 5,817,218 | $8,100,749 |

| HLX | Helix Resources | 0.002 | -20% | 112,500 | $8,410,484 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 175,000 | $13,632,593 |

| 1AI | Algorae Pharma | 0.005 | -17% | 137,334 | $10,124,368 |

| AMS | Atomos | 0.005 | -17% | 200,000 | $7,290,111 |

| ENT | Enterprise Metals | 0.003 | -17% | 522,000 | $3,534,952 |

| EPM | Eclipse Metals | 0.005 | -17% | 2,269,753 | $17,158,914 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 70,717 | $4,238,418 |

| LNR | Lanthanein Resources | 0.003 | -17% | 326,719 | $7,330,908 |

| IMI | Infinitymining | 0.012 | -14% | 180,813 | $5,922,221 |

| KGD | Kula Gold Limited | 0.006 | -14% | 22,160,487 | $6,448,776 |

| PHL | Propell Holdings Ltd | 0.012 | -14% | 152,056 | $3,896,734 |

| PIL | Peppermint Inv Ltd | 0.003 | -14% | 620,000 | $7,740,177 |

| THR | Thor Energy PLC | 0.012 | -14% | 113,729 | $9,923,058 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 250,500 | $23,015,477 |

| RVT | Richmond Vanadium | 0.130 | -13% | 18,309 | $33,275,000 |

At Stockhead, we tell it like it is. While Compumedics is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Woolies, Coles cleared of price gouging; miners ratted after Trump’s exec order