Closing Bell: Supermarkets lift ASX; hydrogen stock Greenhy2 soars 283pc on storage deal

The ASX ended the week on a high note as Woolies and Coles soared. Miners took a hit, however, after Trump’s exec order.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX up as it notches one of best weeks of the year

Woolies, Coles win big, miners hit hard on Trump’s exec order

Greenhy2 soars 300pc after signing storage tech deal with H2Core

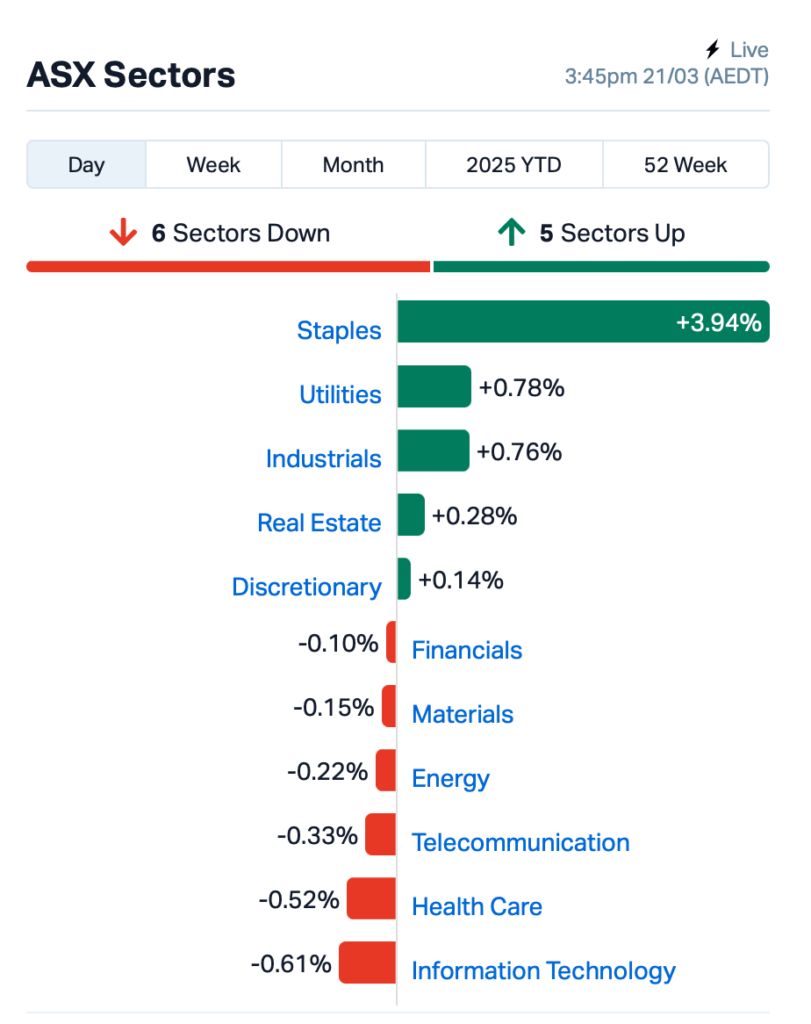

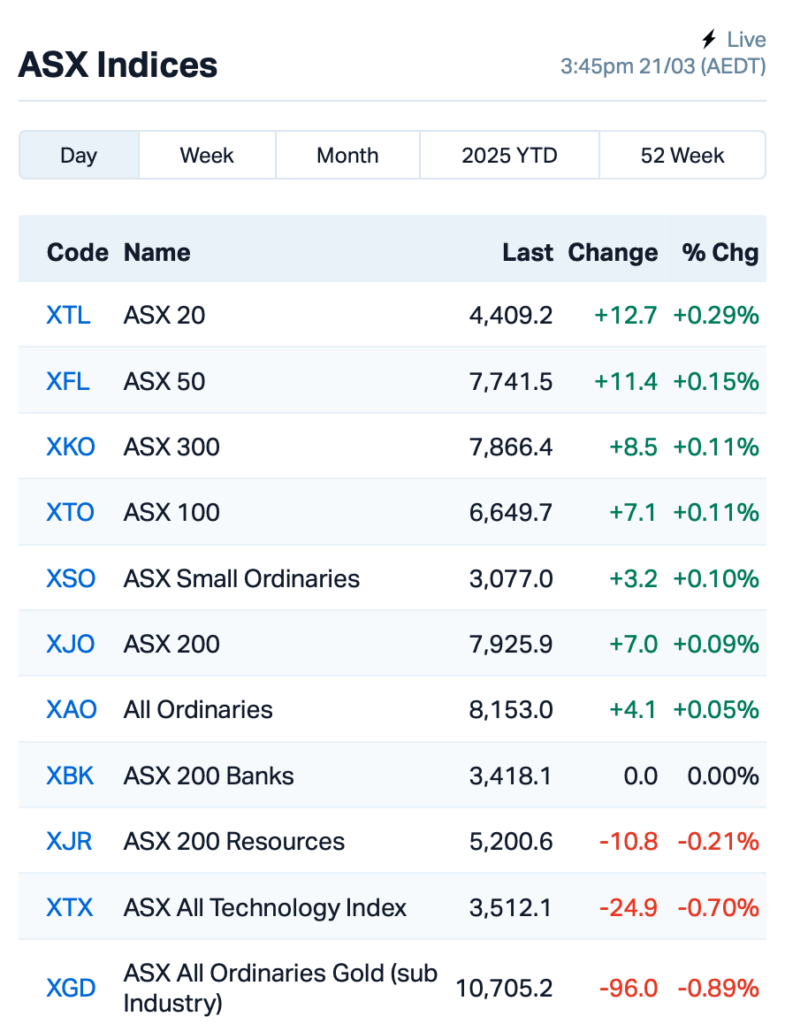

The ASX 200 had a rollercoaster day, but it ended Friday's session 0.10% higher. The benchmark index also had one of its best weeks of the year, up by about 1.75%.

The big movers today were supermarket stocks, which climbed after the competition watchdog released its long-awaited report.

The ACCC report cleared Woolworths (ASX:WOW) and Coles Group (ASX:COL) of any price gouging, saying they were some of the most profitable supermarket chains in the world.

But minerals and coal stocks had a tough day after President Trump said that he’s using emergency powers to ramp up US production of critical minerals, including coal.

The executive order is all about making the US less reliant on China for these vital resources, which are key for tech and defence industries.

This news could have serious ramifications for Aussie stocks, especially if it leads to less demand for iron ore and other minerals from China.

"We're also signing agreements in various locations to unlock rare earths and minerals, and lots of other things all over the world, but in particular Ukraine,” Trump said.

The news hit miners hard today, with Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC) both down by more than 2% today, while Pilbara Minerals (ASX:PLS) also took a hit.

In large caps news, uranium stock Paladin Energy (ASX:PDN) tumbled 4% dive after it temporarily closed its Langer Heinrich Mine in Namibia due to heavy rains.

Gold miner Emerald Resources (ASX:EMR) dropped 5% after its quarterly output missed expectations.

Lender Latitude Group (ASX:LFS) slipped 2.5% after its shares went ex-dividend, though it did post a massive 139% jump in profits for 2024.

And, retailer Premier Investments (ASX:PMV) rose 4% despite a 12.8% drop in interim profit, as it managed record sales in its Peter Alexander stores.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| H2G | Greenhy2 Limited | 0.023 | 283% | 32,444,025 | $3,589,105 |

| GMN | Gold Mountain Ltd | 0.0025 | 150% | 46,483,038 | $4,579,223 |

| OPL | Opyl Limited | 0.033 | 50% | 2,097,837 | $4,245,303 |

| GES | Genesis Resources | 0.007 | 40% | 130,000 | $3,914,206 |

| OVT | Ovanti Limited | 0.0055 | 38% | 17,937,880 | $10,806,191 |

| SNX | Sierra Nevada Gold | 0.022 | 38% | 370,870 | $2,613,069 |

| ASR | Asra Minerals Ltd | 0.004 | 33% | 10,330,669 | $7,119,380 |

| EVR | Ev Resources Ltd | 0.006 | 33% | 4,850,849 | $8,936,265 |

| CMP | Compumedics Limited | 0.32 | 25% | 412,892 | $49,015,563 |

| BNL | Blue Star Helium Ltd | 0.0075 | 25% | 1,263,450 | $16,169,312 |

| VEN | Vintage Energy | 0.005 | 25% | 200,000 | $7,155,687 |

| HE8 | Helios Energy Ltd | 0.011 | 22% | 1,900,597 | $23,436,445 |

| TGH | Terragen | 0.03 | 20% | 66,748 | $12,625,429 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 4,860,506 | $6,620,957 |

| C7A | Clara Resources | 0.006 | 20% | 106,370 | $2,444,998 |

| WBE | Whitebark Energy | 0.006 | 20% | 66,912 | $1,541,046 |

| ION | Iondrive Limited | 0.02 | 18% | 601,038 | $20,108,218 |

| RR1 | Reach Resources Ltd | 0.01 | 18% | 4,962,672 | $7,432,666 |

| PLY | Playside Studios | 0.235 | 18% | 1,056,106 | $81,844,427 |

| HHR | Hartshead Resources | 0.007 | 17% | 51,229 | $16,852,093 |

| OMA | Omegaoilgaslimited | 0.44 | 16% | 658,735 | $125,125,828 |

| AUA | Audeara | 0.03 | 15% | 260,757 | $4,678,294 |

| LDR | Lode Resources | 0.1325 | 15% | 2,847,812 | $18,605,177 |

Greenhy2 (ASX:H2G) has locked in a new deal with European tech supplier H2Core to bring advanced storage solutions to the table, including supercapacitor batteries and hydrogen tech. These new supercapacitor batteries use graphene and promise five times longer life and lower operating costs than traditional lithium-ion batteries, plus H2G said they’re safer with no fire risk. H2G’s also making a move to replace lithium-ion with these supercapacitors for startup and balancing in hydrogen systems, cutting costs and boosting performance.

Asra Minerals (ASX:ASR) has uncovered a bunch of high-priority gold targets at its Leonora gold project in WA. After a detailed exploration program, Asra identified 11 targets at Leonora South and 15 at Leonora North, with new gold anomalies to be drilled in the second half of 2025. The company’s set to kick off drilling soon, focusing on these promising areas to uncover more gold resources.

Compumedics (ASX:CMP) has landed a new MEG order worth $5.7m from Hangzhou Normal University, bringing its total MEG sales to around AUD 20M across China. The company’s Orion LifeSpan MEG system is now the go-to tech for brain research in China, with installations happening at four major universities. Compumedics expects solid growth, projecting over $60m in sales for FY25 and over $70m for FY26. The new tech features advanced superconductor sensors and zero helium refills, setting a new standard in the field.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.001 | -50% | 6,000 | $4,900,774 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 9,761 | $3,467,332 |

| CR9 | Corellares | 0.002 | -33% | 1,000,932 | $1,403,230 |

| ERA | Energy Resources | 0.002 | -33% | 504,416 | $1,216,188,722 |

| AOK | Australian Oil. | 0.002 | -25% | 5,500 | $2,003,566 |

| TOU | Tlou Energy Ltd | 0.030 | -25% | 453,432 | $51,943,373 |

| AUK | Aumake Limited | 0.004 | -20% | 1,208,781 | $15,053,461 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 734,958 | $13,632,593 |

| 1AI | Algorae Pharma | 0.005 | -17% | 137,334 | $10,124,368 |

| CCO | The Calmer Co Int | 0.005 | -17% | 7,605 | $15,300,416 |

| ENT | Enterprise Metals | 0.003 | -17% | 522,000 | $3,534,952 |

| EPM | Eclipse Metals | 0.005 | -17% | 7,315,298 | $17,158,914 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 70,717 | $4,238,418 |

| LNR | Lanthanein Resources | 0.003 | -17% | 326,719 | $7,330,908 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 19,269,784 | $31,932,702 |

| IMI | Infinitymining | 0.012 | -14% | 180,813 | $5,922,221 |

| KGD | Kula Gold Limited | 0.006 | -14% | 23,247,286 | $6,448,776 |

| PHL | Propell Holdings Ltd | 0.012 | -14% | 152,056 | $3,896,734 |

| PIL | Peppermint Inv Ltd | 0.003 | -14% | 620,000 | $7,740,177 |

| THR | Thor Energy PLC | 0.012 | -14% | 113,729 | $9,923,058 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 250,500 | $23,015,477 |

| TMS | Tennant Minerals Ltd | 0.013 | -13% | 3,457,037 | $14,338,356 |

| PL3 | Patagonia Lithium | 0.067 | -13% | 40,000 | $5,998,358 |

| CLA | Celsius Resource Ltd | 0.007 | -13% | 203,982 | $23,052,576 |

IN CASE YOU MISSED IT

Decidr Ai Industries (ASX:DAI)has partnered with Amazon Web Services (AWS), a subsidiary of the global tech giant, to scale its AI solutions globally, making them more accessible through the AWS Marketplace. DAI has also been accepted into the AWS APJ FasTrack Academy to accelerate integration, co-sell readiness, and enterprise expansion.

Mt Malcolm Mines (ASX:M2M)has identified over 2400 wet metric tonnes of economic gold-bearing material at its Golden Crown prospect, with stockpile grades averaging 3g/t gold. The company is now awaiting results from mineralised tailings sampling and plans further drilling to expand high-grade zones and refine resource estimates.

At Stockhead, we tell it like it is. While Compumedics, Decidr.ai and Mt Malcom Mines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Supermarkets lift ASX; hydrogen stock Greenhy2 soars 283pc on storage deal