Closing Bell: ASX up 1.2pc with power play from tech stocks, surprise dip in jobs

ASX rises +1pc, Nanosonics jumps after FDA approval, and Aussie job numbers dip, sparking rate cut hopes.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

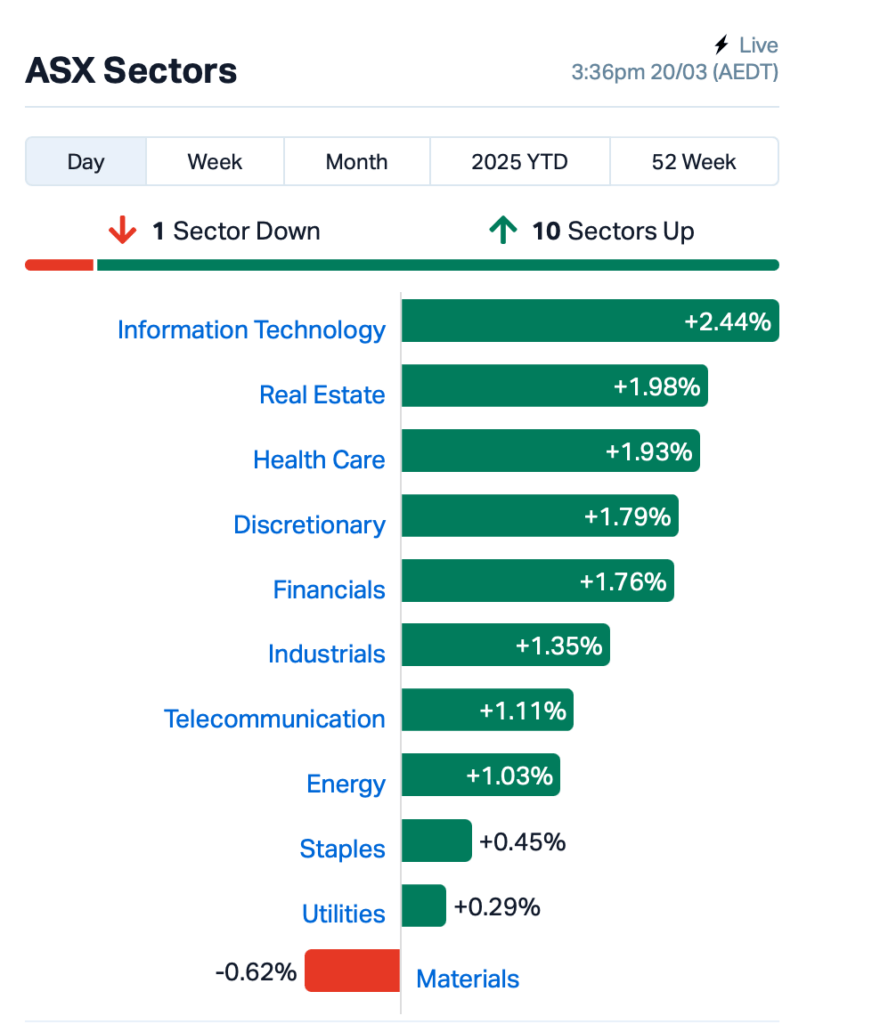

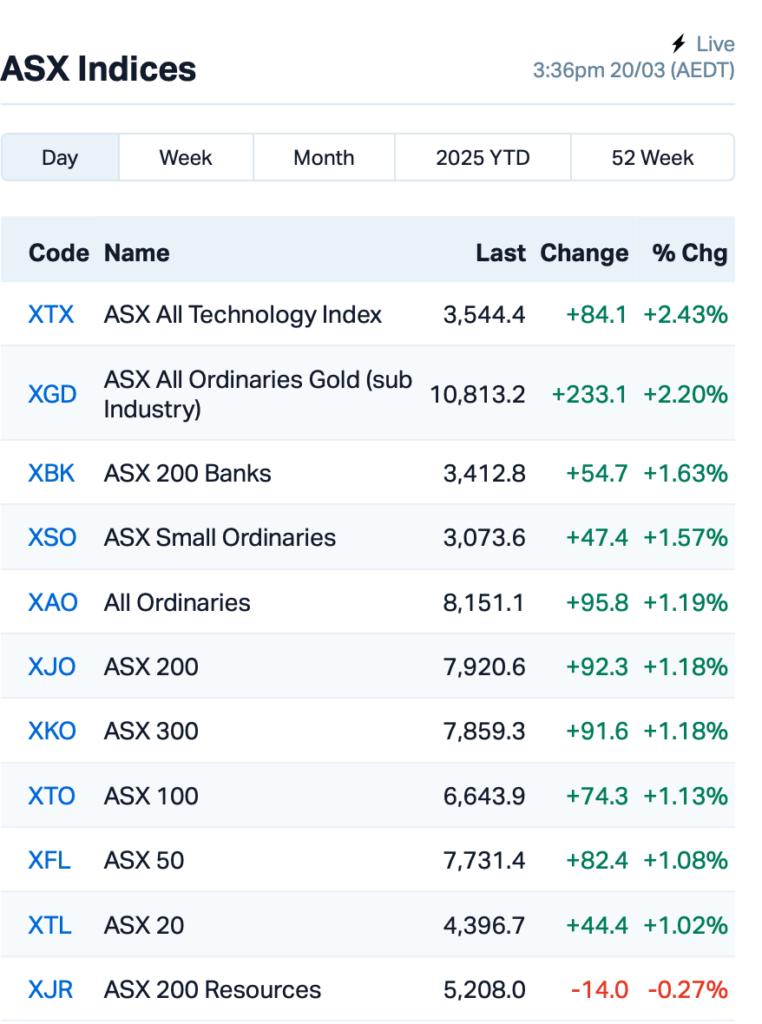

ASX rebounds 1pc with tech and real estate leading the way

Nanosonics jumps after FDA gives approval

Aussie job numbers dip, fuelling rate cut hopes

The ASX had a cracker of a session on Thursday, up by 1.2% as it registered the best one-day performance in over a month.

The session kicked off with solid gains after the US Fed decided to hold rates steady overnight, just like analysts predicted it would.

But what really fired up the market was Fed chairman Jerome Powell’s comment that he wasn’t too worried about tariffs driving up US inflation, adding that any rise in inflation would be “transitory.”

President Trump, meanwhile, differed and said the Fed should drop interest rates now.

“The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy,” Trump said on Truth Social.

“Do the right thing. April 2nd is Liberation Day in America!!!”

Back home, local traders were buzzing after Aussie job numbers took a surprise dip, sparking hopes about a possible RBA rate cut in May.

February saw a bigger-than-expected loss of 52,800 jobs, according to the ABS, while the unemployment rate held steady at 4.1%.

“...We still think that the RBA will only deliver a very shallow loosening cycle, and have pencilled in just two more 25bp rate cuts,” said Marcel Thieliant at Capital Economics.

This is where things stood leading up to today's close, where tech stocks led:

In the large caps space, Nanosonics (ASX:NAN) was on fire, soaring 14% after the US FDA gave the green light to its device that helps clean endoscopes and reduce hospital infection risks.

Cleanaway (ASX:CWY) made moves too, advancing 3% after announcing its $377 million acquisition of unlisted Contract Resources, promising $12 million in annual cost synergies.

NRW Holdings (ASX:NWH) also rose 3.5% after one of its subsidiaries scored a $100 million contract with Rio Tinto (ASX:RIO).

On the commodities front, copper hit a five-month high again, almost cracking US$10,000 a tonne and as much as US$11,286/t in the US futures market. The price spike came after whispers that the US could slap tariffs on copper imports soon.

As for Asian markets, they’re also looking pretty upbeat today, boosted by the Fed’s signal that it’s still looking to cut rates later this year.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap SFG Seafarms Group Ltd 0.002 100% 700,491 $4,836,599 EDE Eden Inv Ltd 0.002 50% 1,200,380 $4,109,881 EEL Enrg Elements Ltd 0.002 50% 650,000 $3,253,779 LNR Lanthanein Resources 0.003 50% 4,260,236 $4,887,272 VPR Voltgroupltd 0.002 50% 10,863,629 $10,716,208 D3E D3 Energy Limited 0.074 42% 430,057 $4,132,700 CRR Critical Resources 0.004 33% 14,569,917 $7,392,664 STM Sunstone Metals Ltd 0.007 30% 2,233,552 $25,750,018 PHL Propell Holdings Ltd 0.014 27% 529,996 $3,061,719 AKM Aspire Mining Ltd 0.270 26% 371,372 $109,141,952 ASP Aspermont Limited 0.005 25% 950,000 $9,880,046 AUK Aumake Limited 0.005 25% 500,000 $12,042,769 CZN Corazon Ltd 0.003 25% 3,000,000 $2,369,145 ERA Energy Resources 0.003 25% 2,142,339 $810,792,482 5EA 5Eadvanced 0.820 24% 13,749 $9,732,802 KCC Kincora Copper 0.027 23% 183,207 $5,302,346 1AD Adalta Limited 0.011 22% 3,064,630 $5,789,005 TOU Tlou Energy Ltd 0.022 22% 146,456 $23,374,518 BRX Belararoxlimited 0.110 22% 453,399 $12,956,770 CYB Aucyber Limited 0.089 20% 912,290 $12,103,689 ALR Altairminerals 0.003 20% 50,000 $10,741,860 ENT Enterprise Metals 0.003 20% 500,000 $2,945,793 KGD Kula Gold Limited 0.006 20% 930,712 $4,606,268

Critical Resources (ASX:CRR) has announced that after a thorough geophysical review and airborne magnetic survey, it’s clear that its Halls Peak project in NSW holds serious potential for gold-antimony mineralisation, alongside its existing base metal systems. The new findings highlight previously overlooked structural corridors and deep-rooted fault systems, suggesting the area could host multiple types of mineralisation, including Hillgrove-style gold-antimony. This opens up new targets for exploration.

Aspire Mining (ASX:AKM) has wrapped up an Independent Technical Report (ITR) for its Ovoot Coking Coal Project, done by SRK Consulting. The report gives a thumbs up to the project’s development and operational plans, confirming that the cost assumptions, technical viability, and financial outlook are all looking strong. The full scope of the project, including mine development, coal processing, and transport, has also been thoroughly reviewed.

China-focused AuMake International (ASX:AUK) has teamed up with Henan Wanbang, one of China’s biggest private distributors, to expand its reach in the Chinese market. This deal gives Aumake direct access to Henan’s massive network of over 7,000 businesses, helping get premium Aussie products into the hands of Chinese consumers.

Clinical stage biotech player AdAlta (ASX:1AD) has secured $2 million in seed funding for its “East to West” cellular immunotherapy strategy. Venture capital fund SYNthesis BioVentures is footing the bill for AdAlta’s subsidiary AdCella as managing director and CEO Tim Oldham describes the funding as a “watershed event” for AdAlta.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -50% | 1,650,000 | $9,158,446 |

| RFA | Rare Foods Australia | 0.010 | -38% | 1,450,649 | $4,351,732 |

| WSR | Westar Resources | 0.006 | -33% | 14,466,629 | $3,588,523 |

| VML | Vital Metals Limited | 0.002 | -33% | 25,000 | $17,685,201 |

| TMK | TMK Energy Limited | 0.003 | -29% | 15,624,953 | $32,772,828 |

| TYX | Tyranna Res Ltd | 0.005 | -29% | 506,022 | $23,015,477 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 50,000 | $4,063,446 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 10,648,376 | $57,867,624 |

| LCL | LCL Resources Ltd | 0.006 | -25% | 7,173,992 | $9,558,502 |

| BSA | BSA Limited | 0.064 | -25% | 1,793,075 | $6,381,427 |

| PAB | Patrys Limited | 0.002 | -20% | 110,000 | $5,143,618 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1,661,500 | $22,646,967 |

| BUX | Buxton Resources Ltd | 0.032 | -18% | 184,392 | $8,669,016 |

| BLZ | Blaze Minerals Ltd | 0.003 | -17% | 235,300 | $4,700,843 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 417,916 | $18,138,447 |

| MRD | Mount Ridley Mines | 0.003 | -17% | 1,083,688 | $2,335,467 |

| ION | Iondrive Limited | 0.017 | -15% | 2,479,531 | $23,656,727 |

| 1AE | Auroraenergymetals | 0.040 | -15% | 12,740 | $8,415,996 |

| SCP | Scalare Partners | 0.180 | -14% | 1,318 | $7,325,388 |

| AX8 | Accelerate Resources | 0.006 | -14% | 1,519,171 | $5,227,278 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 5,500 | $5,665,530 |

| WNR | Wingara Ag Ltd | 0.006 | -14% | 613,694 | $1,228,798 |

| NXS | Next Science Limited | 0.100 | -13% | 271 | $33,598,427 |

| ADN | Andromeda Metals Ltd | 0.007 | -13% | 23,734,848 | $27,429,822 |

IN CASE YOU MISSED IT

Elevate Uranium (ASX:EL8) reported its U-pgrade demonstration plant remains on track for completion by the middle of this year. As design and construction rolls on, the plant is expected to beneficiate ore from the company’s Koppies uranium project in Namibia.

Northern Territory developer Tungsten Mining (ASX:TGN) inches closer to early-stage production at its Hatches Creek project after submitting two key applications for mining approval. The company is also currently chipping away at a resource estimate to support the production plans.

Peregrine Gold (ASX:PGD) has made a star pick up for its roster after adding Matt Rolfe – formerly of Northern Star Resources (ASX:NST) – as exploration manager to drive its Mallina gold project. Rolfe, who served as senior geologist for Northern Star, will be working on “Hemi style” gold targets at Mallina.

At Stockhead, we tell it like it is. While Elevate Uranium, Tungsten Mining, AdAlta and Peregrine Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX up 1.2pc with power play from tech stocks, surprise dip in jobs