Fresh sign of interest rate cut

Stoking the case for rate cuts this year, the unemployment rate moved sharply higher in April.

Stoking the case for rate cuts this year, the unemployment rate moved sharply higher in April.

Debate is swirling that the budget is “smoke and mirrors” and a cash splash risks interest rates being hiked or staying higher for longer.

Workers, already under pressure from inflation, saw their wages slide last quarter but there is some good news for homeowners.

Despite a chorus of economists sharing concerns with the budget, the Treasurer is adamant his plan won’t make the cost of living crisis worse.

Aussies struggling with the cost of living have been issued a dire warning as one economist predicts a major collapse in household incomes.

Frustrated homeowners have been saying the same thing for months – and now, the RBA has finally owned up to a major error.

With inflation still out of control, the International Monetary Fund has sounded a dire warning about the global economy. See what could follow the cost of living crisis.

Fresh forecasts have painted a grim picture where the inflation remains higher for longer but the Treasurer is optimistic Australia will avoid one thing.

Australians have been hit by the cost of living crisis with one major expense set to explode in coming months.

One of Australia’s top banking executives has given new insight into the grim future for countless homeowners.

When talking mortgages, this is the most common argument trotted out by Boomers. But it doesn’t prove anything.

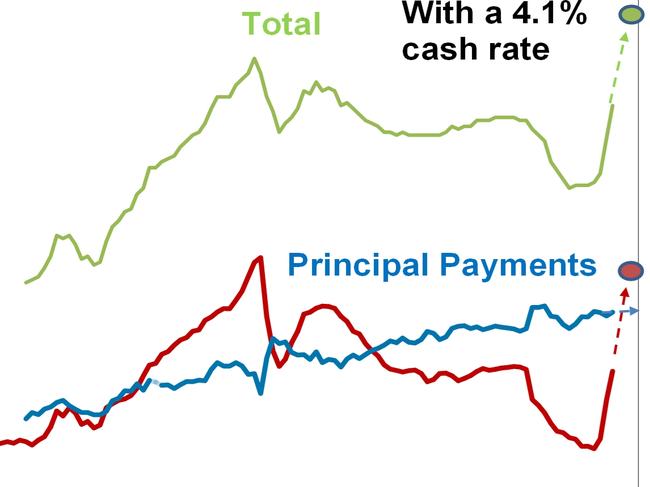

Nearly 900,000 Aussies could be in for bill shock when their cheap pandemic fixed-rate home loan expires by the end of the year.

A shift in how Aussie households are made up is only adding to a major rental crisis gripping the nation, Philip Lowe says.

The Reserve Bank has sounded the alarm on the amount Australian homeowners will soon be making in mortgage repayments.

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/94