Aussies’ credit card debt on the rise again

Aussies are owing almost $18bn in credit card debt, with experts warning it could get worse in the wake of the Reserve Bank’s latest interest rate decision.

Aussies are owing almost $18bn in credit card debt, with experts warning it could get worse in the wake of the Reserve Bank’s latest interest rate decision.

Warning that the RBA would not hesitate to pull the trigger on further rate hikes if needed, Governor Michele Bullock revealed rate hikes had been considered.

Warning that the RBA would not hesitate to pull the trigger on further rate hikes if needed, Governor Michele Bullock revealed rate hikes had been considered.

After a six week reprieve, Australians will learn today whether interest rates will rise again.

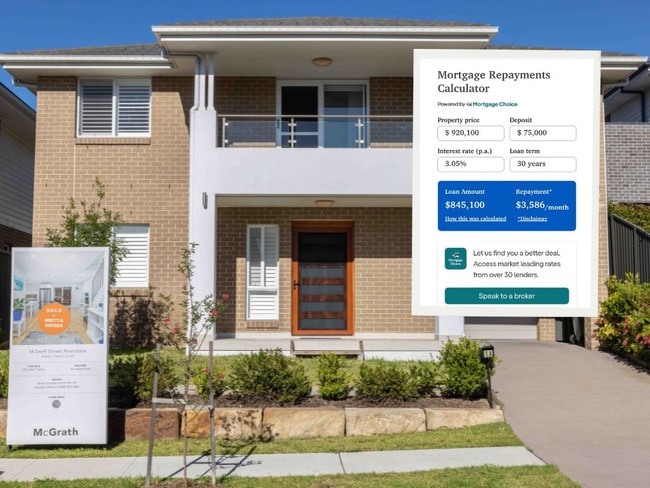

As the RBA pauses rates, savvy homeowners, buyers and investors can save plenty over the course of their loan. See the best deals and use our calculator to work out how much you will pay.

Homeowners can rejoice as they have been given a brief reprieve after the central bank paused interest rates for the first time in nearly a year.

Nearly 900,000 Australians are facing a big shock as their cheap fixed-rate home loan period expires – regardless of what the RBA does today.

The signs are already there that higher interest rates are going to come sooner than expected.

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/93