Consumers keep wallets shut in April

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

Jim Chalmers’ Treasury department has delivered a glimmer of hope for inflation crunched households ahead of the federal budget on Tuesday.

Jim Chalmers’ Treasury department has delivered a glimmer of hope for inflation crunched households ahead of the federal budget on Tuesday.

Consumer and financials were crunched on Thursday as investors grew increasingly concerned with the impact of elevated inflation on households.

The Greens’ call for the government to override Tuesday’s shock RBA decision has fallen on deaf ears.

Leading finance expert Mark Bouris has slammed the RBA’s latest interest rate hike, amid calls for the decision to be overturned.

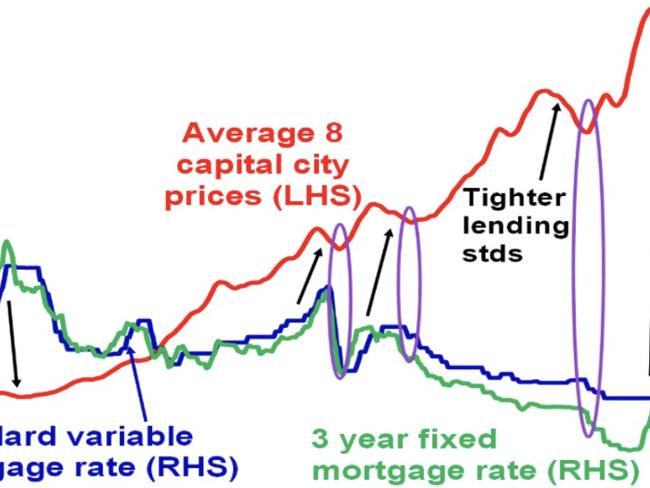

Rates rises have almost double mortages for some Australians but something strange is happening to Aussie house prices.

Treasurer Jim Chalmers has been urged to overturn the RBA’s shock decision on rates, amid fears the latest hike could result in a recession.

Homeowners have been on a knife edge and now the Reserve Bank has made its latest shock decision on interest rate hikes.

Homeowners will face a double-barrel assault from rising cost-of-living pressures and high interest rates, as the RBA delivered another hike.

The body representing Australians in poverty is concerned that the poorest will miss out in the budget.

Aussies are anxiously waiting to see whether the RBA will keep rates on hold for the second month in a row, with experts branding it a “close call”.

Few Aussies expect the Reserve Bank will lower interest rates this year as a new poll has revealed many are avoiding new loans unless necessary.

After months of rate rises, one bank has made the choice to decrease a portion of its home loans.

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/87