Chalmers to unveil big surplus surprise

Despite forecasting a second consecutive surplus, Tuesday’s budget will show the nation’s finances falling further into the red from next financial year.

Despite forecasting a second consecutive surplus, Tuesday’s budget will show the nation’s finances falling further into the red from next financial year.

A former Labor strategist has warned the federal government that without a bold policy vision in the budget voters could ditch the major parties.

Australian shares were flat on Monday before important inflation data is released midweek.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

A small detail in the federal budget suggests long-struggling Australian homeowners might finally get some relief.

Australians struggling with the cost of living in the wake of the RBA’s 11th rate hike have been given a grim warning.

Aussie homeowners are in for pain as the final major bank hikes interest rates yet again.

The average Aussie could risk losing more than $2000 in twelve months by making one simple mistake with their finances.

An eye-watering figure has been named as Australia’s biggest expense as the Treasurer sprints to the budget finish line.

Three of the four big banks have now changed their interest rates for mortgage holders and some saving accounts.

Banks have started to raise mortgage rates again following the Reserve Bank’s decision to increase the official rate to its highest level in 11 years.

Australians have been dealt a chilling financial hit as interest rates have been hiked once again and now the major banks are responding.

RBA governor Philip Lowe has defended yesterday’s interest rate hike, after it sent shockwaves through the country.

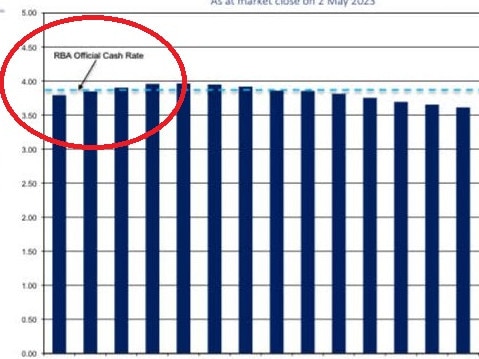

The ASX futures market has predicted when interest rates will stop rising in Australia. And it’s more bad news for mortgage holders.

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/86