CBA sack 113 staff members and are sending jobs to India, union claims

CBA has been accused of delivering a “kick in the guts” to employees and making cuts to save money, despite recording a $2.5b profit recently.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

The Commonwealth Bank has been accused of putting “profits before people” with 113 staff set to be sacked and the roles sent offshore to India, according to the Finance Sector Union.

Employees in jobs including technology and customer service specialists, based in Sydney and Melbourne, are being told just before Christmas their jobs will be sent offshore, the union said.

CBA’s Indian subsidiary is currently hiring for around 100 roles, with specialist positions in risk management, payments, technology solutions, program design and data, all advertised on the its website to start work at its new facility in Bangalore.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

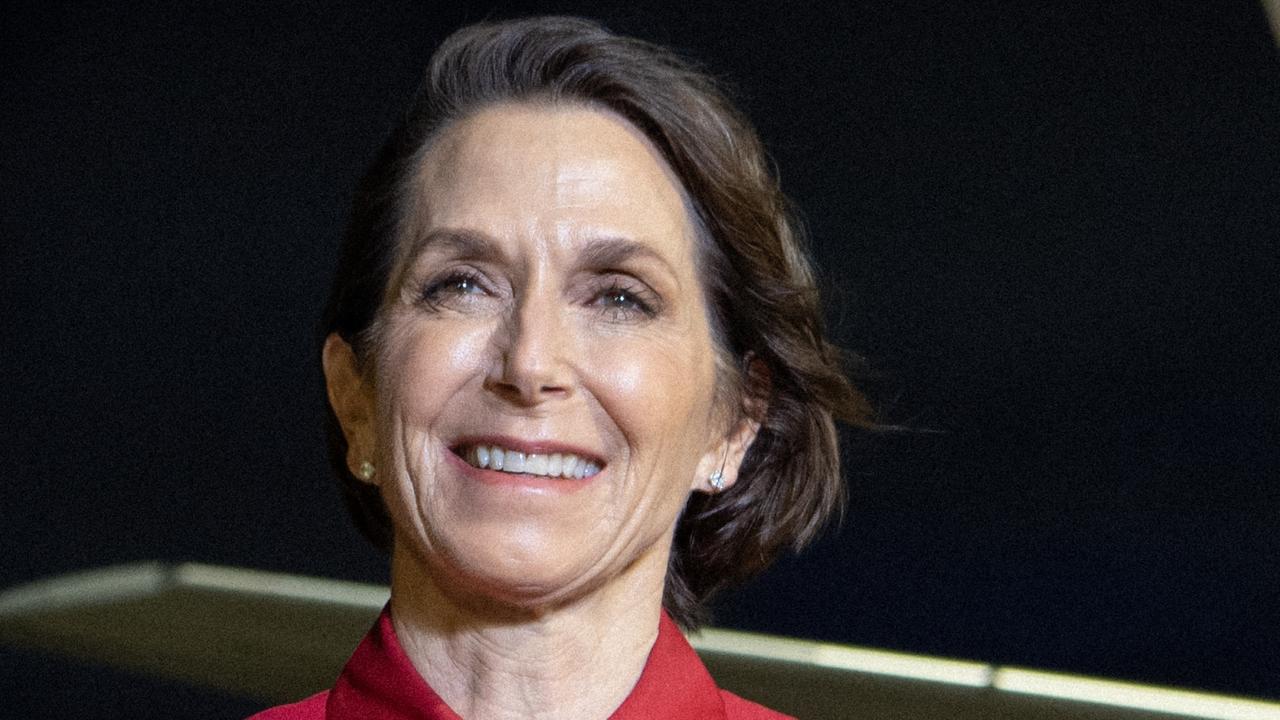

Finance Sector Union (FSU) national secretary Julia Angrisano said the latest round of offshoring was a “kick in the guts” for bank staff who work behind the scenes to keep the CBA’s massive profits rolling in.

“This is the thanks those essential workers in group operations, technology, data analytics and risk control get. They are being kicked into unemployment by the bank that puts profits before people,” she said.

“The workers who are losing their jobs perform the important back office processing of bank cheques, term deposits, dishonours and deceased estates

“Sacking workers and outsourcing their jobs is one of the ways CBA made a $9.6 billion profit in the last financial year and a $2.5 billion profit in the September quarter.”

The major bank sent 100 jobs to India in August 2021 and another 270 jobs in September this year, according to the FSU.

“There is no doubt in the minds of our members at CBA that the new jobs in Bangalore will not attract the same level of salaries that are paid for the same jobs in Australia,” Ms Angrisano said. “And that’s the only reason CBA India exists, to cuts costs.

“These redundancies will see the loss of decades of institutional knowledge from CBA as some of these workers have been with the bank for more than 20 years.”

The union claimed that customers should be questioning what is happening with their data when work is sent overseas.

Ms Angrisano added the “spin around” the latest series “of sackings is staggering”.

“CBA is telling these workers their jobs are being cut so the CBA can ‘shape its workforce to meet evolving customer needs and expectations’,” she said.

“CBA says it wants to ‘access talent in India with global experience,’ and ‘access productivity benefits from co-locating related teams.’

“These sacked workers know when they are being lied to. They know that the only thing CBA executive managers think about is profits and their own fat bonuses.”

A spokesperson for the Commonwealth Bank said it established CBA India to build its capability to help deliver its strategy of building tomorrow’s bank today for our customers. “For this, we need world-class capability, and this means recruiting and investing in the best talent, both locally and globally,” they told news.com.au.

“Some of the skills we need are difficult to find at scale in Australia. This is a challenge the whole industry is facing. Globally, banks have long had operations in India, resulting in a large-scale pool of talent in India with world-leading expertise.

“We are committed to supporting and investing in our people wherever they are located. As we continue to reshape our workforce to deliver our strategy, our aim is to support anyone affected by changes through reskilling and redeployment initiatives.”

Recruitment for people in Australia-based roles outstrips recruitment for roles in other international locations, with over 8500 people recruited in Australia in the 2022 financial year, the CBA spokesperson added.

The latest round of job losses come as this year has seen a brutal reduction in the major bank’s branches around Australia.

Westpac was closing down another 23 branches across Australia in October in a decision slammed by a union as an “appalling decimation” of the network, which would also see a number of towns lose their last bank and 92 jobs lost.

The move will mean Westpac has overseen the closure of 95 branches over the past four months, according to the FSU.

NAB, CBA, St George’s and Bank of Melbourne have also shuttered 37 branches across the nation, with the union describing the closures as reaching “crisis point”, with the big four closing more than 550 bank branches across Australia since January 2020.

Originally published as CBA sack 113 staff members and are sending jobs to India, union claims