$1620 detail hidden in Commonwealth-backed home loan

Homeowners could soon be surprised to see their repayments skyrocket on a new offering backed by the Commonwealth Bank.

A new variable home loan rate offered by a Commonwealth Bank-backed lender may not be all it first seems.

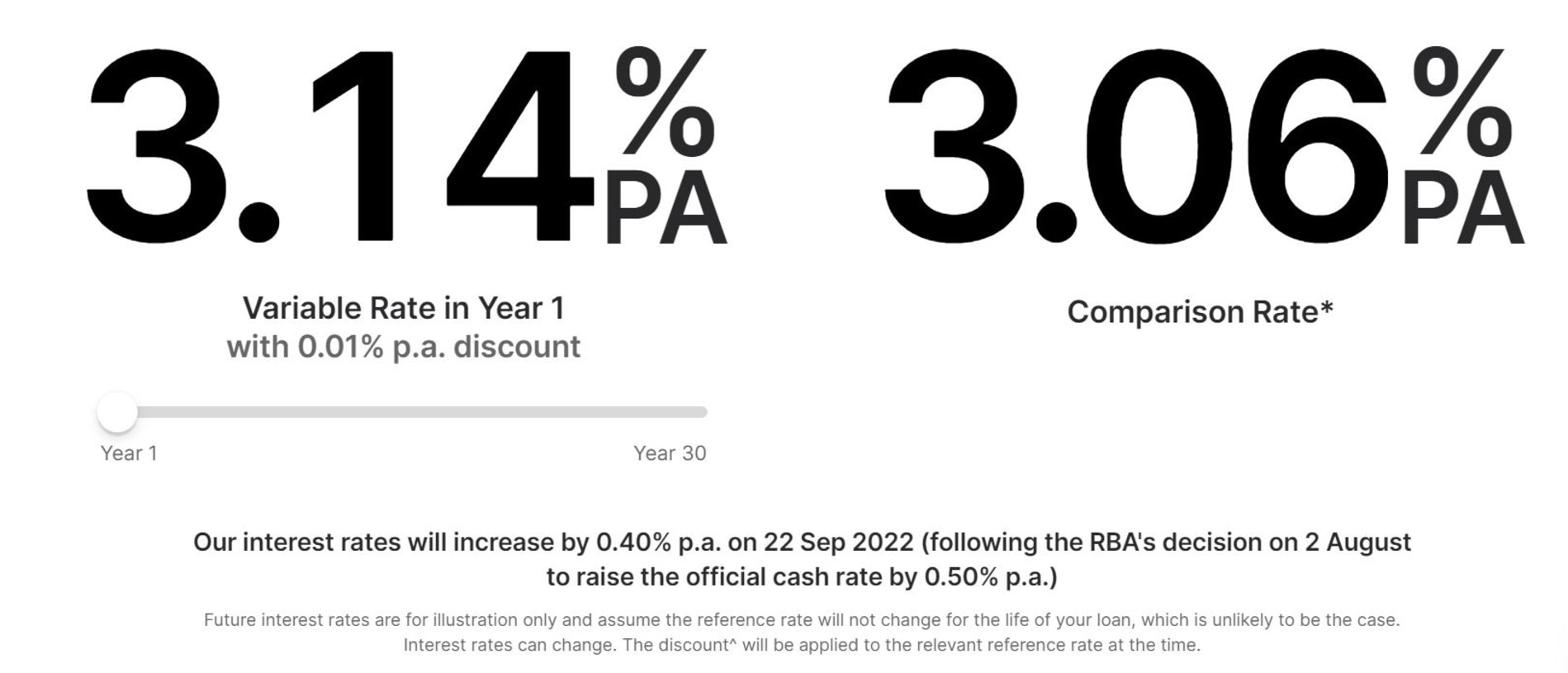

Digital lender Unloan is offering live-in homeowners looking to refinance their loans “low fees and a fast online application process” on a 3.14 per cent per annum home loan.

The major selling point is that the loan reduces by 0.01 per cent each year – culminating in up to a 0.30 per cent “discount” after 30 years.

What the offer doesn’t make clear is the effect of ongoing hikes to Australia’s official interest rate, which on Tuesday saw another increase by the Reserve Bank of Australia for a fifth straight month.

All of Unloan’s loans will be hit with a 0.40 per cent increase on the 22nd of this month, giving customers less than three weeks to enjoy the lower rate.

At that point, the advertised deal will rise from 3.14 per cent to 3.54 per cent.

On an average home loan of $609,050 with a standard 30-year term, customers would be paying $135 more on their monthly repayments and $1,620 more a year.

The fine print of the deal notes “future interest rates are for illustration only and assume the reference rate will not change for the life of your loan, which is unlikely to be the case”.

“The ‘discount’ will be applied to the relevant reference rate at the time.”

Australia’s interest rate is tipped by most experts to continue to climb into next year, meaning most likely so will the amount customers will owe their lenders.

Unloan’s rate after the end of this month of 3.54 per cent is still one of the most competitive on the market currently, but is far more comparable with what is already out there, such as OneTwo Home Loans and Tic:Toc, which both currently offer a rate of 3.59 per cent.

Commonwealth Bank was contacted for comment.