Commonwealth Bank’s investment in BNPL provider Klarna loses billions as valuation plummets

One of Australia’s major banks put millions into a buy now, pay later operator but it’s since fired 10 per cent of staff and its valuation dropped by $30b.

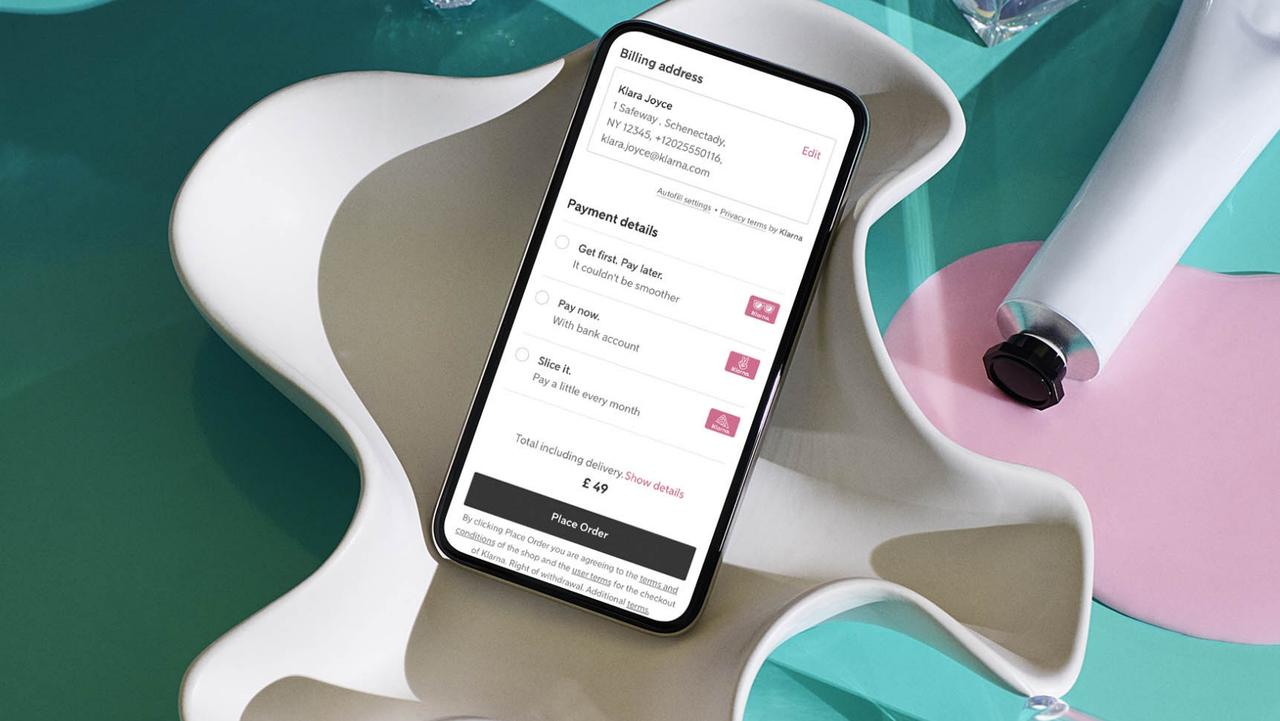

A buy now, pay later provider that Australia’s biggest bank poured millions into has been hit by a dramatic plunge in value, signalling more warnings over the beleaguered sector.

The Swedish-owned company Klarna had downsized its latest fundraising from $US1 billion ($A1.44 billion) to $US500 million ($A722 million), but its valuation of $US15 billion ($A21.6 billion) has plummeted compared to just a year ago, reported The Wall Street Journal (WSJ).

Just last month, the WSJ had reported that Klarna’s valuation had sat at around $US30 billion ($A43.3 billion) when seeking new investment but that has now halved, a sign of the current punishing environment for tech companies but also the carnage sweeping the BNPL sector.

It’s also an eye-watering drop in value compared to June 2021 where Klarna, which was billed as Europe’s most valuable start-up last year, raised money from Japanese venture capital fund SoftBank at a valuation of $US46 billion ($A66.4 billion).

Klarna sacked 10 per cent of its workforce last month in an effort to cut costs, with its chief executive Sebastian Siemiatkowski advertising 570 staff members who had been let go on LinkedIn.

Commonwealth Bank owns a 5 per cent stake in Klarna after a $US300 million ($A433 million) investment in 2019 and 2020.

If Klarna is now worth $US15 billion ($A21.6 billion) as has been reported, CBA’s stake is still worth $US750 million ($A1.08 billion) but that’s a whopping 67 per cent drop from the $US2.3 billion ($A3.3 billion) it was worth 12 months ago.

But CBA chief Matt Comyn has continued to back Klarna, adding it was differentiated by its ability to deliver leads to merchants, having been in operation for 17 years.

Klarna reported a quarterly loss of $SEK2.5 billion ($A357 million) that was three times higher than for the first three months of 2021.

Grant Halverson, the founder and chief executive of payments consultancy McLean Roche, said a reduction in funding shows “reluctant investors”.

“The $US15 billion valuation drops Klarna out of the top 20 unicorns and slots it in 23rd place – now not Europe’s number one fintech – some fall from grace,” he said. “Klarna laid off 10 per cent staff as a cost-cutting measure. It will need to do much more than this.”

The company's borrowing costs have risen to their highest level as increasing interest rates hit, he added.

“Klarna is already totally unprofitable, losses ... in 2021 (jumped) to $US831 million, while first quarter 2022 losses jumped $US250 million ($A360 million) – it’s all going the wrong way,” he said.

“A large investor in Klarna is SoftBank’s, its Vision Fund recently posted a record investment loss of 3.5 trillion yen ($US27 billion) for its latest fiscal year. The Japanese giant is fighting for its own survival – this will impact its ability to invest.”

Financial analyst Marc Rubinstein of Net Interest has also estimated that based on average loan balances, Klarna’s bad debts ballooned from 4.6 per cent in 2018 to almost 9 per cent at the end of last year.

Mr Siemiatkowski has previously said that higher bad debts are the cost of expanding into new markets and attracting new customers

The other key issue markets will focus on is a looming recession, with BNPL bad debts totally unacceptable and companies having very little time to correct this, Mr Halverson added.

A Klarna spokesperson said the company would not comment on fundraising or valuation speculation, but it has been profitable for 14 years out of the 17 years it has been in operation.

Experts have previously predicted potential “carnage” for the buy now, pay later sector as providers burn through cash, bad debts balloon and customers retreat from using the service – a model which they say isn’t sustainable.

Earlier this month, the founder of a buy now, pay later provider called Sezzle lost most of his $800 million fortune after the company’s shares bombed, continuing a nightmare run for the sector.

Last June, American founder Charlie Youakim was riding a boom in Sezzle’s shares which were worth $9.20, but they crashed by 96 per cent, plunging to just 40c.

Australian BNPL providers have also been slammed by sliding share prices. Overall, the sector lost a whopping $A1.05 billion in 2021, which has left investors concerned and has seen share prices dive this year.

Zip’s shares dived in the past 12 months and are currently trading at 51c, compared to $A14.53 back in May last year.

The BNPL provider previously had a market capitalisation of about $A6 billion – which was more than retailer JB Hi-Fi – but this has since plummeted to around $A600 million, a staggering 87 per cent decline in the share price compared to 2021.

Afterpay posted an incredible mid-year loss just months after being acquired for $A39 billion.

The Aussie company’s first results since being taken over by US company Block showed it

recorded a net loss of $A345.5 million over the six months to December 31, 2021.

Andrew Brown of investment company East72, has long been against the BNPL industry and thinks it could soon be reaching a crunch point.

“The bad debt experience is horrendous,” he told The Sydney Morning Herald.

“The simple fact of life is this: BNPL business as a stand-alone means that you are going to attract a large number of people who are incapable of paying their money back, particularly if you don’t have robust credit checks.”

Venture capitalist Bill Gurley has also warned that employees of tech companies used to “Disney-esque set of experiences/expectations in high-tech companies” were in for a reality check.

“For employees that have only known this world, the idea of lay-offs or cost reduction (or being asked to come into the office) is straight up heresy …” he said.

“Unfortunately, you can’t’ ‘wish away’ the fact that if your company isn’t cash flow positive and capital is now expensive, you are living on borrowed time. ‘Culture’ won’t matter if your company isn’t around.”