Budget 2023: Chalmers forced to restrain big spending instincts as inflation bites

Any additional stimulus would threaten higher interests rates and push Australia into a grinding recession. Chalmers has taken the safer option.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

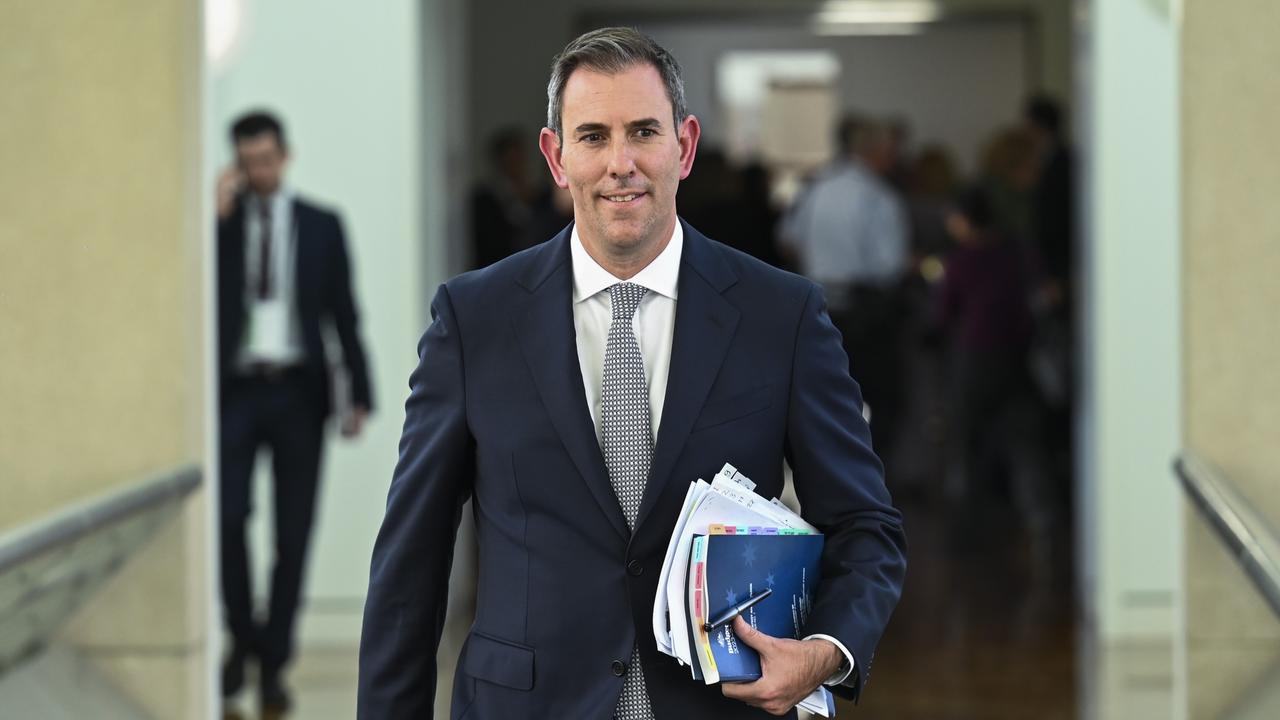

Jim Chalmers has resisted Labor’s natural instincts to spend its revenue windfall on nation building, with inflation proving to be a bigger force on the budget than demands from his own backbenchers.

Those big spending urges have been contained to smaller targets with a budget that hits traditional Labor themes built around a $14.6bn cost of living package to help with energy bills, healthcare and affordable housing.

The reality is Chalmers had very limited room to move in his second budget, so has taken the safer option to bank more than 80 per cent of the revenue surge coming to Canberra. There is also $17.8bn in savings and redirected spending out of this budget, taking a total of $40bn out of the economy since last October.

Intense focus on debt and a central bank that is prepared to pounce on inflation through further interest rate hikes, has meant restraint is in order. Any additional stimulus pushed through from further spending would have threatened higher interests rates, more pain in the suburbs and very likely pushing Australia into a grinding recession.

Chalmers was sticking to the script, describing inflation as Australia’s “primary economic challenge”.

“(This) is why this budget is carefully calibrated to alleviate inflationary pressures, not add to them,” Chalmers said.

Money markets taught the UK government a savage lesson around restraint last year when a high spending mini-budget was tabled, prompting a bond meltdown. Then UK prime minister Liz Truss was forced into retreat from tax cuts for all, but the political cost to her was fatal.

Australia’s first surplus in 15 years to be delivered by a Labor treasurer is a small step but goes a long way to building the fiscal credibility Chalmers is cultivating. The caveat here is as long as everything – including a prediction that inflation is largely back under control by mid-next year – goes to plan.

The surplus underlines the resilience of the Australian economy in the face of the rapid pace of interest rate rises, with corporate taxes

Chalmers is betting that inflation has passed its peak and is now beginning to moderate. But it’s the mix of how inflation playing out that has given him some room to move on cost of living relief, particularly around energy bills.

Goods inflation and commodities are falling, but it is services inflation such as wages and insurance that remains sticky. Indeed, banking bosses such as Westpac chief executive Peter King this week acknowledged that the blunt instrument of cash rate hikes are also hurting low income earners, renters and pensioners.

Indeed, with household power bills coming down, this in effect “games” official inflation figures. Treasury estimates cost-of-living relief will directly reduce inflation by as much as 0.75 percentage points over the coming financial year.

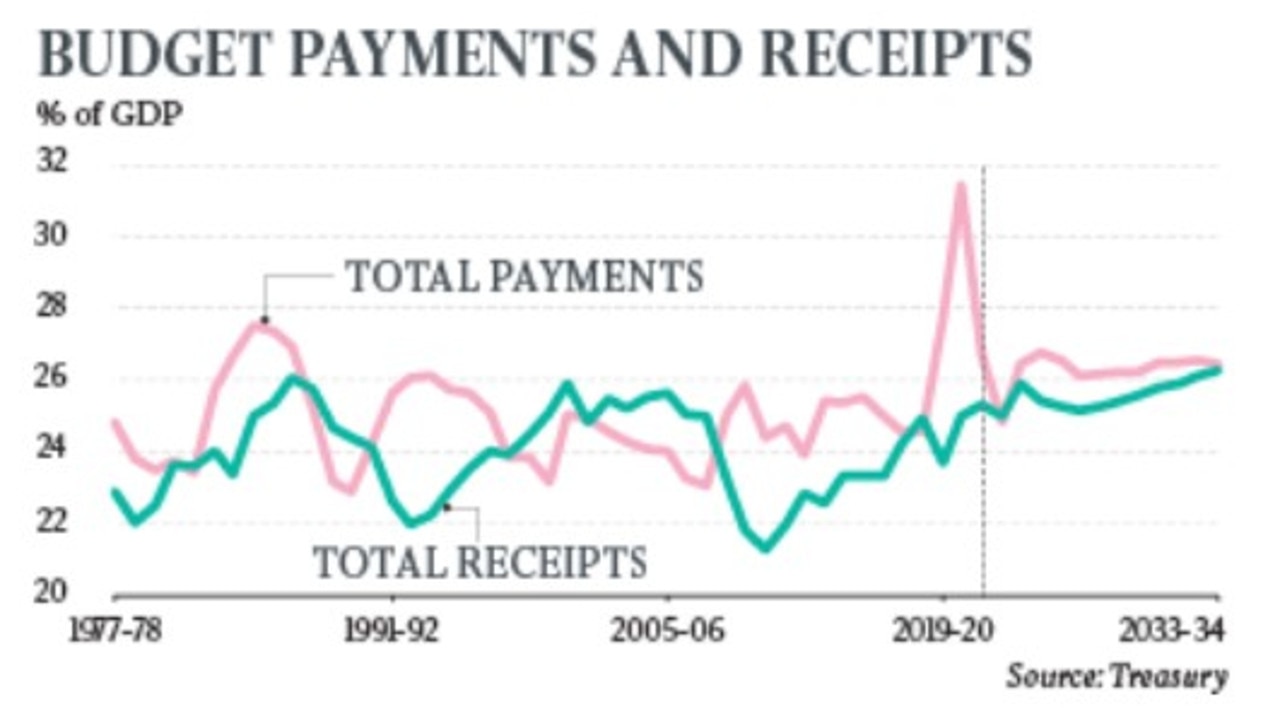

The budget surplus of $4.2bn is a substantial turnaround from last October’s prediction of a deficit $36.9bn as higher corporate tax take, higher income tax receipts and lower welfare payments boost the bottom line.

Company tax collections were running around $7.6bn higher than expected than at the October budget, reflecting consistently higher commodity prices and profits in the mining sector.

However, the same economic tailwinds are short-lived, with Australia set on a path of budget deficits as far as the eye can see. Next year’s deficit is $13.9bn and the real pain comes with deficits passing $35bn in the next two years as interest payments, defence, NDIS payments and economic slowdown take hold.

Inflation is forecast to ease to 3.25 per cent by mid next year, which is slightly below the Reserve Bank’s own 3.5 per cent estimate by the same period. Then, Treasury expects it to fall to a more comfortable 2.75 per cent a year later.

Economic growth is set to slow to 1.5 per cent by next year, comfortably avoiding a recession, before recovering to 2.25 per cent a year later. Increasing population growth and housing spending will underpin the rebound.

The National Australia Bank business conditions index released this week remains elevated and rose 2 points in April, showing strength in demand and labour market. Although confidence which is more of a forward measure has been stuck below average for several months. At the same time, capex intentions have started to pull back.

Treasury expects business investment to ease, although it is holding up despite the slowing economy and higher interest rates. It is now tipping investment at 3 per cent from an estimate of 6 per cent in October.

Wesfarmers chief executive Rob Scott says many of the same cost of living pressures are hitting businesses – big and small – which means governments need to work hard to ease transport and energy pressures.

“Labour availability remains a challenge, particularly in technology, healthcare, construction and supply chain, and we need to ensure IR reforms help enable employers to innovate and evolve, as this is the only sustainable basis for wages growth,” Scott said.

Infrastructure cools

Chalmers has opted to pull right back on infrastructure spending. The assumption here is that NSW and Victoria are flat out spending billions with existing road and rail projects, and Canberra already has Western Sydney Airport underway, that any more spending will only crowd out existing private sector projects.

It also marks the very start of a generational shift in infrastructure spending, with more being earmarked to rewiring the energy grid to hit net-zero targets while keeping the lights on.

Chalmers has given his response to the $US360bn ($530bn)-plus US Inflation Reduction Act that business has long been arguing for. However, like all things on this budget, it comes with a cautious overlay with a new $2bn package aimed at helping Australia’s renewable hydrogen sector to mature.

Andrew Forrest’s Fortescue, which has been out the front on the hydrogen shift, could capture the bulk of the investment spend.

Chalmers has also rebadged several existing green energy programs under the one umbrella to package this as Australia’s $40bn renewable energy fund. This includes the existing $20bn Rewiring the Nation program and ongoing transmission projects. Here, players like Macquarie Group will be looking for a part in green infrastructure management, while power majors Origin and AGL will also look for opportunities. There is little new for getting critical minerals processing off the ground, although Canberra already has a $2bn fund underway.

With more tax incentives to invest in affordable housing and an increase in support for around 7000 more houses should spur more super fund investment in this area while builders Mirvac and Lendlease will get a boost.

Multinational tech companies continue to be targeted as part of global efforts to close anti-avoidance loopholes while Woodside, Santos already know they are up for more with this week’s watered down changes to the Petroleum Resources Rent Tax to deliver $2.4bn over the next few years.

Investment markets will also get a boost from the Australian government finally committing to issuing green sovereign bonds from mid-2024.

A round of bank profit results released over the past two weeks had shown households in the whole remain in sound financial health. There is next to no pick-up in mortgage stress in the face of interest rate rises, while only a small pick-up in credit card and personal loan arrears. Bank bosses say households are starting to adjust to higher rates, but executives are preparing for a soft landing in the economy through to the end of this calendar year.

The nation’s key financial regulators the ACCC, APRA and ASIC get a top-up in funding but more to cover inflation than a new wave of crackdowns.

This budget is a holding pattern for the economic storm to hit, including a possible US recession and a risk that inflation holds higher for long. Then Australia faces the real challenge of tackling the structural deficits over the next decade from a cocktail of new defence spending, NDIS and debt.

Low productivity growth – reset last October at 1.2 per cent – will further sap the nation’s ability to generate greater wealth, while an ageing population will put further pressure on health spending.

The position has improved substantially from the October budget, helped by an improved debt position and revised estimates for NDIS spending, but the deficit by 2033 is still expected to hit 0.5 per cent of GDP. In addition, there’s $110bn of accumulated deficits forecast out until 2027.

Credit agency S&P Global Ratings affirmed Australia’s AAA-rating after the budget was released but highlighted long-term challenges linger and any faster slowing in the economy could pressure the rating.

Commonwealth Bank chief executive Matt Comyn acknowledges the Chalmers budget is a complex balancing act. Although the cost of living relief, “will take the pressure off” the economy slightly.

“Ideally, you’d like your fiscal position to not stimulate the economy, so we can get inflation back towards the target range”.

“I think it’s part of a longer discussion over many years to take on the reform to address the overall budget repair and invest in areas for growth for the broader economy while making sure that those that need support the most can get it”.

Originally published as Budget 2023: Chalmers forced to restrain big spending instincts as inflation bites