How a tour through the US is helping Matt Comyn shape CBA

Even with few signs of stress in the Australian economy, the emphasis from Comyn is around “strength” as well as managing lending and liquidity risks. Being Australia’s biggest bank delivers inherent market advantages. Its gravitational pull and inherent share means it can keep new business flowing as long as it’s competitive. Indeed in the past three quarters it opened 463,000 new transaction accounts — many of these being cashed-up migrants returning after years of border closures.

But CBA’s dominant size means it also has a responsibility to the economy to keep lending so the funds can flow even when times are tough. Comyn is preparing his bank for being on the cusp of one of those moments. While he is not as downbeat in his outlook for the Australian economy as rival Westpac, what has been going on in the US where interest rates are much higher can’t be ignored.

Speaking from the US, Comyn tells The Australian the concern from that market is the “de-leveraging effect” for banks that are trying to conserve capital given the rising rates there.

“I think that’s a unique point of difference between the Australian banks and the US. Our balance sheet has never been in a stronger position. It means that not only are we there to support our customers, we can also facilitate and keep credit flowing, which I think in the US is one of the things that is an overhang in terms of what’s on the market’s mind”.

His comments came as earlier on Tuesday CBA posted a March quarter net profit of $2.6bn, largely flat on the average during the September and December quarters.

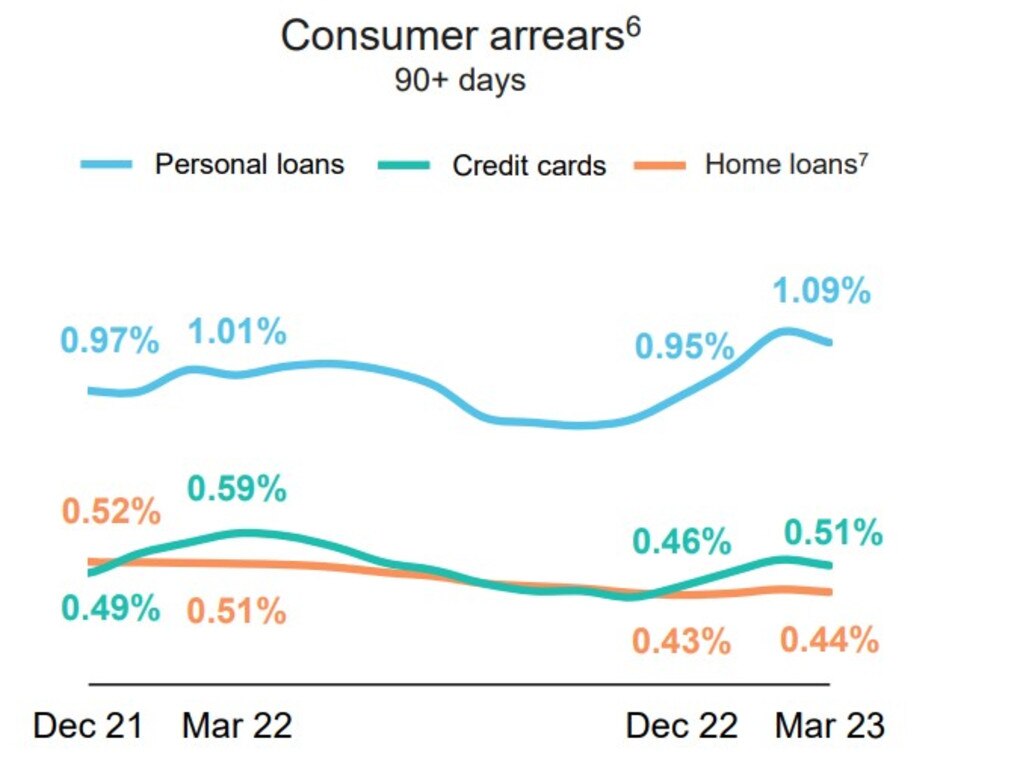

Comyn is expecting some slowing in the outlook for the Australian economy into next year but is confident on Australia’s medium term outlook. Housing construction has been under the most pressure with some builders caught on fixed price contracts, but there are no signs of a sharp deterioration in the economy. Indeed soured mortgages remain at cyclical lows helped by low unemployment rates. However there has been a slight pick-up in missed payments for personal loans, which is often a forward indicator of stress.

West coast tech

While balance sheet and funding were dominating investors on the US east coast, Comyn also saw several tech companies on the west coast where emerging tech including machine learning and artificial intelligence is moving ahead. Although it is still early stages AI represents both a threat in terms of disruption as well as opportunities for banks looking to become more efficient. CBA is already trialling the use of AI in fraud detection and looking for ways to provide better customer analytics. CBA has a $130m investment in Silicon Valley-headquartered AI cloud platform H2O.ai, which was also the list.

The CBA boss plans to attend a major AI workshop hosted by Microsoft this weekend where the conference is looking at AI’s impact on society and technology. It is Microsoft-backed ChatGPT that has got the ball rolling on AI. While early stage it has put the tools in the hands of more people. Comyn is also known to have close links with Microsoft global boss Satya Nadella.

“AI is a theme that is not just on the mind of the tech companies but the number of US corporates,” Comyn says.

Cashback freeze

Adjacent to a shift to a more conservative footing is a decision to walk away from offering thousands of dollars in cashbacks to new mortgage customers.

Given CBA’s outsized influence on the mortgage market the move is expected to see other big banks also water down their own offers. Smaller banks have been offering as much as $5000 in cashback for customers signing on to new loans but chief executives including National Australia Bank’s Ross McEwan have said this is unsustainable with some loans being written below their cost of capital.

The cashback offer had been aimed at capturing more than $90bn up for grabs this year as fixed rate mortgages roll off. CBA itself had been offering $2000 cashback on new loans in recent weeks while players like ANZ has been looking to boost market share with $4000 on offer.

CBA’s March quarter figures show it had been growing its home lending business in line with the broader mortgage market. Lower net interest margins had squeezed top line earnings.

Comyn argues that the value in the loan is better reflected in a competitive top line interest rate for borrowers. “We certainly anticipate the market will remain competitive,” he says.

CBA shares on Tuesday opened 1.1 per cent lower at $96.06.

johnstone@theaustralian.com.au

Commonwealth Bank’s Matt Comyn is in the United States meeting with investors on the east over the past week and keeping an eye on emerging tech trends coming out of the west coast. However the tour is also offering a front-row seat to the regional US banking crisis unfolding in the background, and this has shaped how Comyn is positioning his bank for the looming economic slowdown.