Company tax receipts soar but will recede as the economy braces for an expected slowdown

Company tax receipts will peak at a bumper $138.4bn this financial year, before tapering off as the economy navigates weaker demand and slow global growth.

Company tax receipts will peak at a bumper $138.4bn this financial year, before tapering off as commodity prices recede and the domestic economy navigates weaker demand and the slowest global growth in more than two decades.

The federal budget papers on Tuesday showed company tax collections in 2022-23 were being driven higher by payments from resources groups, and large companies outside the financial sector.

“Collections in 2022–23 have continued to exceed expectations. Company tax receipts to March 2023 were $7.6bn higher than expected at the October budget,” they said.

The budget papers showed this financial year’s company tax receipts were up from $123.3bn in 2021-22.

Despite the expected tapering in company tax receipts, Treasury upgraded its forecasts by $29.3bn in 2023–24 and $51.8bn over the five years from 2022–23 to 2026–27. The budget papers expect company tax receipts to amount to $128.7bn next financial year and $119.8bn in 2024-25.

Conglomerate Wesfarmers said Australia cannot take higher-than-expected budget revenues for granted.

“The higher-than-expected budget revenues highlight how taxpayers, workers and businesses are the backbone of our economy and provide Government with the capacity to invest in critical areas,” Wesfarmers managing director Rob Scott said.

“We cannot take this for granted. Given the more challenging and deteriorating economic outlook with growth forecast at just 1.5 per cent next year, it’s essential that businesses have the flexibility to adjust to these headwinds and to navigate higher costs of doing business. This will also encourage future investment and job creation that will sustain our prosperity.”

The budget comes against the backdrop of a more challenging domestic operating climate, exacerbated by 11 Reserve Bank rate hikes since May last year, aimed at fighting rampant inflation.

The tougher environment and higher funding and input costs have already spurred a spate of company collapses this year including building groups Porter Davis, Privium and listed beauty company BWX.

National Australia Bank’s April business survey this week showed a zero confidence reading, suggesting an equal share of companies were optimistic and pessimistic about the operating climate.

Business conditions eased in April, although remained at above-average levels.

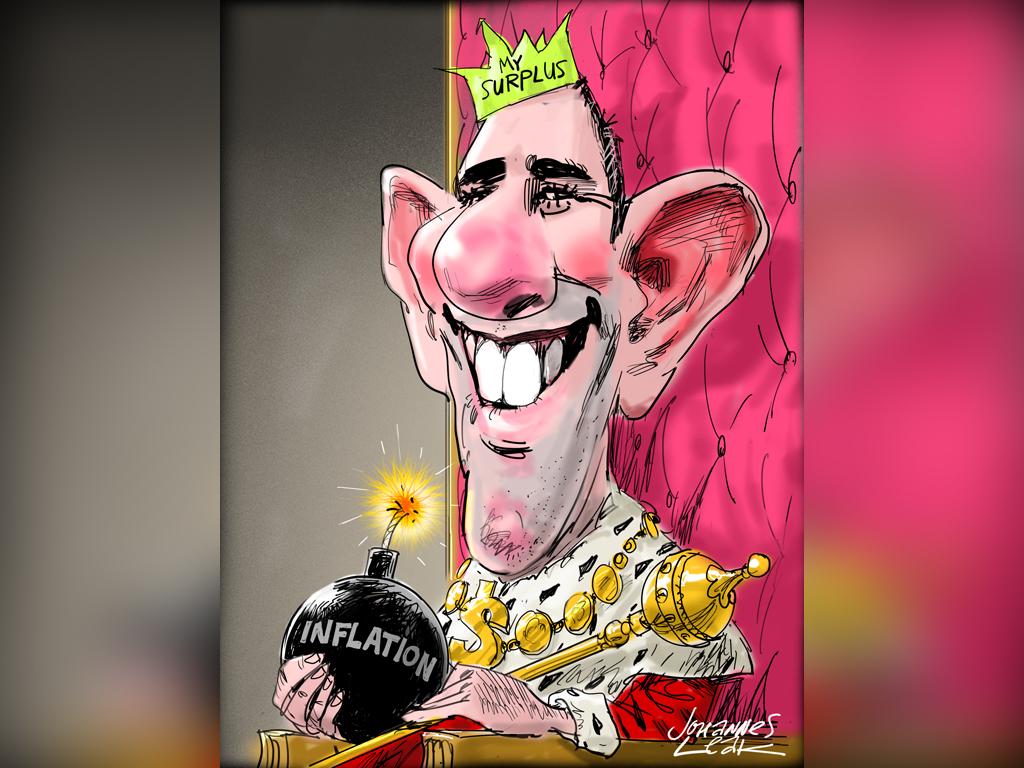

Treasurer Jim Chalmers used his budget speech to highlight the risks ahead for the domestic economy, businesses and exporters, as global growth is expected to markedly slow.

“Outside of the pandemic and the global financial crisis, the next two years are expected to be the weakest for global growth in over two decades,” he said.

“This will affect us here in Australia.”

NAB’s chief economist Alan Oster said the economy remained resilient, and while the bank expected consumption growth to slow it was unclear how quickly or sharply that would occur.

“Across industries, conditions remain very strong across the board, particularly in transport and utilities and mining,” he added. “Construction remains the softest which reflects the ongoing challenge of elevated input prices.”

The budget papers noted that softer global economic activity, excluding markets such as China which is expected to post healthy growth, would weigh on confidence and demand for Australian exports.

“The economy is not immune to the global slowdown and there are clear signs that domestic demand is responding to higher interest rates and other cost-of-living pressures,” they said.

“This slowing was expected in the October budget, but has materialised slightly earlier than anticipated, with consumers and the housing sector most exposed. This is being offset by a stronger than expected rebound in service exports following the reopening of international borders.”

Treasury held its forecasts for real gross domestic product steady from October, expecting the domestic economy to post slower to 1.5 per cent growth in 2023–24, before accelerating to 2.25 per cent growth in 2024–25.

The budget papers said tax policy measures – outlined since the October budget – were expected to decrease company tax receipts by $362.1m in 2023–24 but boost receipts by $911.5m over the five years from 2022–23 to 2026–27.

Treasury forecast business investment would expand 3 per cent this financial year, but said that would ease to 2.5 per cent growth in 2023-24 and 2 per cent the year after.

“The possibility that firms may delay or cancel projects in response to elevated input costs and ongoing domestic and global headwinds remains a downside risk,” they said.

“Non-mining investment is expected to be the main driver of growth in business investment over the coming years, increasing by 4 per cent in 2022–23, 2.5 per cent in 2023–24 and 2 per cent in 2024–25.

“Ongoing upgrades to machinery and equipment and continued expenditure on construction projects is driving growth throughout these years.”

Treasury cautioned that despite high commodity prices, mining investment was forecast to be flat this financial year, before “growing modestly” over the rest of the forecast period.

The RBA is expecting business investment to expand 2.3 per cent this calendar year, before declining to 1.9 per cent in 2024.

Separately the budget papers showed the bank levy – a tax on the big four banks and Macquarie Group – was expected to deliver Treasury $1.54bn this financial year, up from $1.45bn in 2021-22.

The controversial tax was introduced in 2017, as pressure increased for a royal commission into the sector’s conduct. The levy imposed a tax of 0.06 per cent applied to banks with liabilities of more than $100bn, but some products were excluded.

Last month, Mr Chalmers ruled out raising the bank tax in this year’s budget even as some economists called for the rate to be revised higher among other levers to help balance the budget.

His comments came ahead of the big four banks reporting combined first-half profits of $17bn, but warning of a more difficult period ahead due to fierce competition for mortgages and deposits.

The bank levy is forecast to have tax receipts of $1.62bn in 2023-24, and rise to $1.8bn in 2026-27.

While the banks lobbied intensely against the levy in 2017, they are now largely resigned to it.

On the economy’s digital transition and productivity, the budget papers flagged new technology could reduce costs, assist employees to focus on higher-value tasks and improve product quality and consumer choice.

“Amid a global slowdown in productivity growth, data and digitalisation have significant potential to improve Australia’s productivity performance,” the documents said.

“Productivity gains associated with transformative new technologies take time to emerge as the economy adjusts to make the most of new opportunities.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout