Internet giants Apple, Amazon, Facebook and Google cash in on Covid crisis

The results from Apple, Amazon, Facebook and the Google owner Alphabet underlined their vast earning power in the face of a collapse in economic output.

The US’s big four internet giants saw their combined market value top $US5 trillion ($7 trillion) for the first time on Friday after they mostly delivered “blowout” profits for the latest quarter.

The results from Apple, Amazon, Facebook and the Google owner Alphabet underlined their vast earning power in the face of a collapse in economic output.

Shares in Amazon opened 4.5 per cent higher, Apple gained 6 per cent and Facebook rose 7 per cent. Alphabet fell back nearly 5 per cent after quarterly sales fell for the first time in its 16 years as a public company.

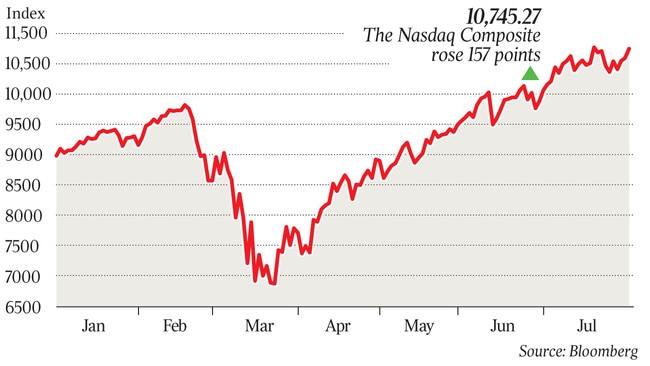

The surge in the stock prices of Amazon, Facebook and Amazon sent the tech-heavy Nasdaq index up 1.5 per cent to 10,745.27 and close to a record high and set the S&P 500 on course for its fourth straight monthly gain.

Jubilant investors pushed the collective market value of the big four through the $US5 trillion barrier. But for critics, the bumper profits will strengthen arguments that they should be more tightly regulated to prevent them from extracting ever greater profits from their roles as digital gatekeepers.

The day before delivering their stellar earnings, the chief executives of the four spent five hours battling policymakers in Washington, who accused them of abusing their dominant positions to squash rivals. The grilling coincided with grim figures showing that the US economy shrank by 9.5 per cent in the second quarter.

In stark contrast, Amazon, Apple, Facebook and Google increased profits by delivering essential goods and services and entertainment to housebound consumers.

Amazon’s revenues rose 40 per cent in the period to $US88.9bn and its profits doubled to $US5.2bn, even after investing $US4bn in its distribution network and warehouse to make them COVID secure.

Analysts at Jefferies, the Wall Street broker, said the turnover figure was “just crazy”, noting that Amazon generated more revenue in the second quarter than in the fourth, which includes the lucrative Thanksgiving and Christmas holidays.

Apple defied gloomy Wall Street forecasts with strong iPhone sales, helping it post record third-quarter results. The company reported revenue of $US59.69bn and profit of $US2.58 a share in the three months to June 2 despite COVID forcing it to shut many of its stores worldwide.

Tim Cook, Apple chief executive, admitted the results stood in “stark relief during a time of real economic adversity for businesses large and small, and certainly for families”.

Analysts at Baird, the broker, raised their annual revenue target for Apple to $US275bn, predicting strong sales of Mac computers and iPads as students return to schools and universities in September. It said Apple was “well within reach” of its target to have 600 million subscriptions to services such as music, cloud storage and TV streaming by the end of September. The company is expected to receive a further boost when it launches 5G-enabled iPhones later this year.

Mark Zuckerberg, founder and chief executive at Facebook, used his call with Wall Street analysts to make a case for maintaining the regulatory status quo.

He said more restrictions would “reduce opportunities for small businesses so much that it would probably be felt at a macroeconomic level”.

Alphabet’s revenues fell 2 per cent to $US38.2bn as advertisers reined in spending, yet it still delivered $US7bn in profits.

The Sunday Times