There are mistrusted banks… and there’s AMP and Westpac

AMP, Bank of China and Westpac are the nation’s least-trusted banks to do the right thing by customers, a survey has shown.

AMP, Bank of China and Westpac are the nation’s least-trusted banks to do the right thing by customers, a survey has shown.

Alleged money laundering breaches will land Westpac in the clutches of significant regulatory powers known as the BEAR.

Westpac investors hoping for a super-quick resolution to the Austrac scandal will be disappointed.

The bank expects to take a $140m hit to first half earnings due to bushfires and hailstorms, and costs from the Austrac scandal.

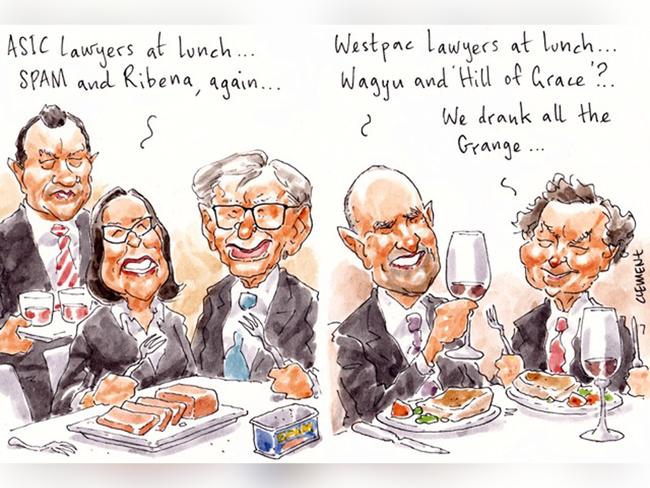

It’s likely lunch will be at the desk in chambers this week as the Westpac ‘wagyu and shiraz’ appeal begins.

Australian consumer confidence has bounced to a three-month high but is still ‘firmly in pessimistic territory’.

Westpac will pay back $NZ3.7m to New Zealand customers after admitting it failed to meet credit card rules.

Westpac’s board was warned it was taking risks ‘outside of its appetite’ two years before Austrac swooped.

Key Westpac outsourcing partner accused of allowing serious security breaches and unauthorised access to the bank’s data.

Growth and profitability at Westpac’s retail bank is under pressure, according to Morgan Stanley.

It’s the second class action lawsuit launched against Westpac over the child exploitation scandal.

The life ban imposed on former Wells Fargo boss John Stumpf puts bank executive accountability in an entirely new context.

Westpac chairman-elect John McFarlane was adamant he was done with corporate life when he returned to Australia last October.

Relentless bank-bashing will erode the industry’s $14bn contribution to government coffers, incoming Westpac chair John McFarlane warns.

On paper, John McFarlane ticks all the boxes, but his track record raises questions.

John McFarlane will brings gravitas, experience and style to the position of Westpac chair, and is a safe pair of hands.

‘Battle hardened’ incoming chair John McFarlane says Westpac has obvious governance issues and change will be a priority.

Shares clocked their worst session for the year after a surprise lift in employment numbers, as economists pushed back their rate cut calls.

Former ASIC deputy chairman Peter Kell has joined the global risk management consultancy Promontory Financial Group.

January’s dive in consumer confidence due to bushfires could have been worse had it not been for recent rain.

Original URL: https://www.theaustralian.com.au/topics/westpac/page/51