Bank bashing hurts economy: Westpac’s McFarlane

Relentless bank-bashing will erode the industry’s $14bn contribution to government coffers, incoming Westpac chair John McFarlane warns.

Relentless bank-bashing and punitive sector-specific policies like the bank levy will hit returns and erode the industry’s $14bn contribution to government coffers, incoming Westpac chairman and former ANZ chief executive John McFarlane has warned.

In a feisty defence of an industry cowed into silence by the 2018 financial services royal commission, and with Westpac facing a potential $1bn Austrac penalty for 23 million breaches of anti-money laundering laws, Mr McFarlane marked his return to corporate life in Australia by presenting the Singapore model as an alternative.

“In Singapore and other countries, the philosophy is: ‘How can we create the best environment possible for financial institutions to be so successful that we get more tax-take?’ ” he told The Australian in an interview.

“I do think the danger here is that you will cause under-investment and that, in the long run, it will be very bad for the country.”

The irony is that the $6.3bn bank levy was introduced in 2017, after Mr McFarlane — then the London-based chair of Barclays Bank and TheCityUK, the country’s leading financial services body — played host to then-Treasurer Scott Morrison.

On learning about the UK bank levy, the delegation resolved to implement a similar scheme back home.

The appointment of 72-year-old Mr McFarlane, who will become a director next month and succeed Lindsay Maxsted as chairman on April 2, was welcomed by investors desperate for a circuit-breaker after the Austrac money-laundering scandal caused a boardroom implosion.

CEO Brian Hartzer, who was recruited and mentored by Mr McFarlane at ANZ, stepped down, with chief financial officer Peter King replacing him on an interim basis.

Mr Maxsted brought forward his retirement, and non-executive director Ewen Crouch did not seek re-election.

ASIC backed up with an investigation into potential breaches of the Corporations Act, while APRA flagged “an extensive and potentially lengthy investigation” into possible gaps in Westpac’s risk governance.

The prudential regulator also imposed a $500m increase in the bank’s capital requirements last December to reflect its heightened operational risk profile.

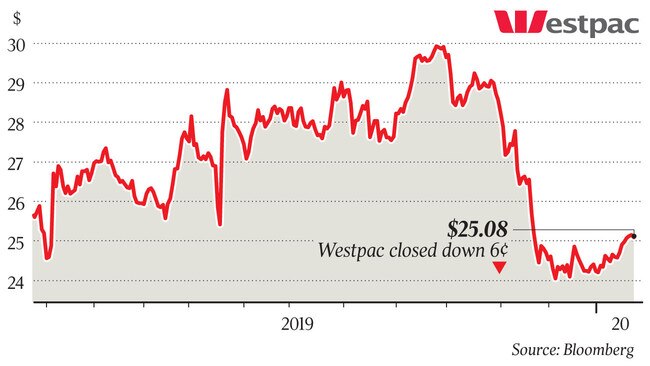

Westpac shares eased 6c to $25.08 as investors processed the likely implications of Mr McFarlane’s appointment.

Evans & Partners banking analyst Matthew Wilson said that accountability was critical in his time as ANZ CEO, when the bank was broken down into 16 different reporting units.

On top of that, Mr Wilson noted, Mr McFarlane took his entire salary in ANZ stock, apart from a notional cash amount that paid the bank’s social club membership fee, and insisted that businesses should establish a track record of sound performance before they were allocated additional capital. Likely moves at Westpac included an IT transformation, cutting the dividend and raising capital to reset the organisation.

“We expect (him) to play the long game,” Mr Wilson said.

“Remove the digital lipstick and tear down the movie set.

“It will require patience plus new NEDs (non-executive directors), a new CEO, a new CFO and a rejuvenated executive team.”

Contrary to expectations, Mr McFarlane said his Westpac chairmanship would be a longer-term assignment.

He expected to “push into a second term”, which could mean about four years in the job or even longer, given the importance of his own successor making a CEO selection.

With the chairman’s position now filled, Westpac can accelerate its search for a permanent CEO, with Mr King and consumer boss David Lindberg regarded as the only serious internal contenders.

Mr McFarlane said Westpac was not confronting big strategic issues, although productivity and efficiency presented challenges.

“And looking at the Austrac-type issue, I think there would be a very strong bias towards execution (of the bank’s strategy) in the selection of a CEO,” he said.

“You will either get a wonderful leader and a good manager, or a wonderful manager and a good leader, so I think we are probably in the second category.

“We have had lots of good leadership here — good people orientation — so we need to deal with the missing part.”

Mr Maxsted agreed, saying the board had agreed last Monday on the qualities and attributes they wanted in the bank’s next CEO, and the clear emphasis was on the ability to execute soundly.

Another priority of the incoming chairman was to meet the heads of industry regulators.

This would include Austrac chief Nicole Rose, depending on any financial settlement of the issues in the regulator’s Federal Court statement of claim.

The chairman-elect said Westpac in no way resembled the scale of turnaround challenges he faced in a four-year term as Barclays chairman, or at the British insurer Aviva, which he chaired from 2012-15.

“No, never!” he said.

“Most situations I have dealt with are troubled companies or seriously underperforming ones.

“Westpac has sustained damage on the regulatory front but it’s actually trading at a premium to book value — it’s the first opportunity I’ve had in 27 years to build something.

“That’s really cool!”

Banks in Britain, he said, were facing zero or very low interest rates in a post-financial crisis environment, and were trading at discounts to book value.

In Australia, Commonwealth Bank was worth two times book and Westpac 1.3 times — valuations that “anyone in Europe would give their right arm for”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout