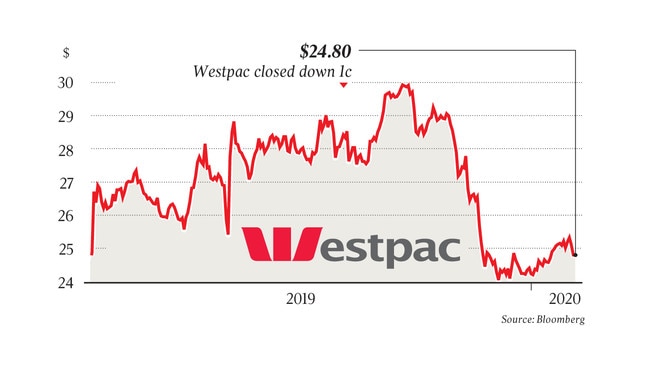

Westpac shares downgraded by Morgan Stanley

Growth and profitability at Westpac’s retail bank is under pressure, according to Morgan Stanley.

Growth and profitability at Westpac’s retail bank is under pressure, with the home loan book shrinking and deposit growth less than its rivals, according to Morgan Stanley.

In a note that downgrades Westpac from equal-weight to underweight, analyst Richard Wiles said the performance of the retail franchise appeared to be deteriorating: “Our latest survey shows Westpac customers are finding it harder to get owner-occupier loans, more likely to repay debt, and more likely to switch banks if mortgages are repriced to protect margins.”

Westpac’s revenue fell 2.5 per cent in the 2019 financial year, excluding notable items, with Morgan Stanley forecasting a further 3.5 per cent decline in 2020 — the worst of the major banks. Home loans were likely to shrink by 2 per cent, other income by 2 per cent, and margins were forecast to erode by eight basis points.

While Westpac was guiding to expense growth of 1 per cent, Mr Wiles said the bank’s response to Austrac’s allegations of 23 million breaches of money laundering laws suggested compliance costs could exceed expectations.

The Austrac case had also created some uncertainty in relation to capital, leadership and strategic direction.

More broadly, Morgan Stanley said major-bank margins were likely to shrink by six basis points this year — and by a similar amount in 2021.

“The key downside risk is further term-deposit repricing, or a less than expected spread-squeeze in high-rate deposits. Commonwealth Bank’s deposit mix makes it more vulnerable to deposit spread-squeeze in a lower-rate environment,” the report said.

Last August, CBA said the net impact of the June and July rate cuts would be a four basis-point reduction in margins. The guidance, however, was out of date because of the October rate cut, with the market expecting an update at next week’s interim result.

Morgan Stanley upgraded ANZ from equal-weight to overweight because investors had factored in a realistic program of cost reductions, a revised institutional bank strategy that was working, and there was investor support at the stock’s current price.

Concerns had also eased about the Reserve Bank of New Zealand’s capital reforms after the central bank’s decision to extend the transition period.

“Against a backdrop of falling interest rates and growing liquidity, it has taken four years for ANZ to stabilise the institutional bank,” Mr Wiles said.

“The operating environment now looks more promising, providing more comfort on the outlook for growth and returns.”