AMP out of Westpac wealth auction, all eyes on CFS

Since final offers went in on August 22, it has been radio silence from Westpac on the sale of its wealth management unit.

Since final offers went in on August 22, it has been radio silence from Westpac on the sale of its wealth management unit.

Consumer confidence has improved for the first time since November, breaking a long stretch of pessimism, with mixed results for retail, building and real estate sentiment.

A major change is coming to your interest rate if you bank with one of the big four. Here’s what you need to know.

Westpac chief economist Bill Evans wants the Reserve Bank to avoid the policy mistakes of the 1970s and ’80s by beefing up its rhetoric.

The Big Four dominate the attention of Aussie bank investors, but bigger isn’t necessarily better, with some smaller options offering intriguing possibilities.

The financial regulator has removed an additional liquidity requirement put on Westpac in 2020.

Investors bail amid interest rate fears, pushing the ASX 200 down 2 per cent. BHP and others lose ground after paying dividends. Consumer-focused stocks including Endeavour and A2 Milk find support.

Bidders for Westpac wealth management should find out any day which party is the successful suitor.

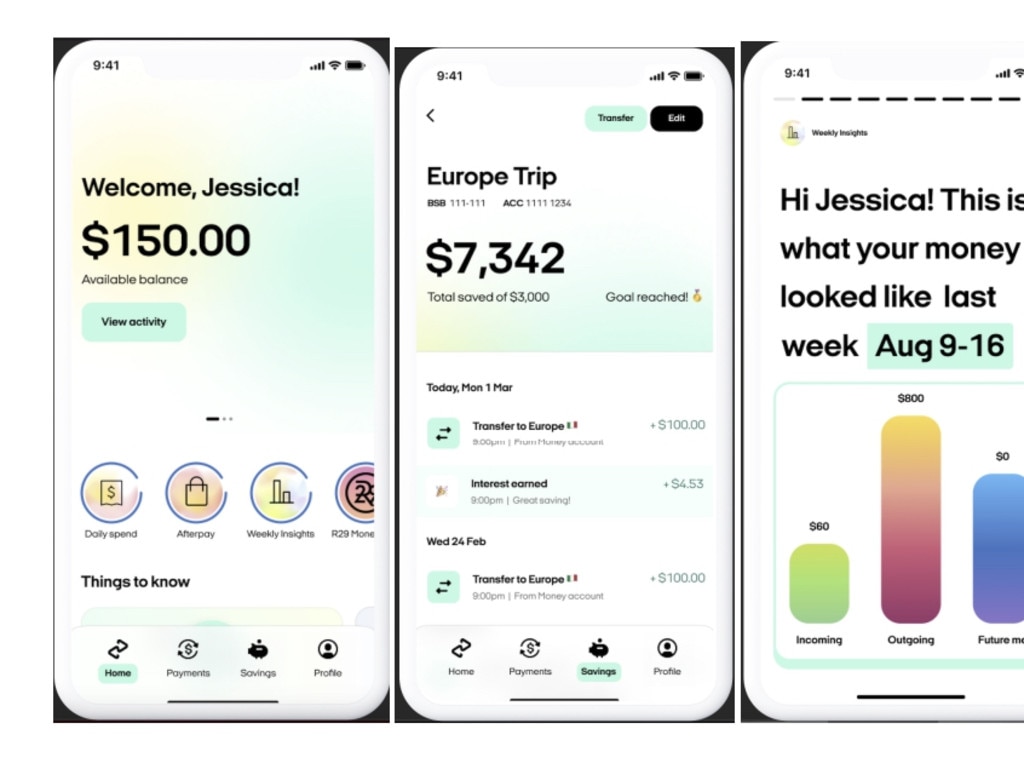

The move paves the way for Jack Dorsey’s Cash App – used by some 47 million Americans – to launch in Australia.

The sale process for Westpac’s wealth management arm could be finalised any day.

The bank has been locked in lengthy talks with unions over pay increases, and says it will hand out the one-off amount if employees vote in favour of its proposal.

Another Australian bank has announced a big change to its interest rates following Westpac’s move on Thursday.

Westpac has confronted a cost blowout on at least one key technology project this year, as it makes slow progress on upgrading its ageing systems.

The bank has joined its peers in reporting improved loan quality, as attention turns to how borrowers will fare in the months ahead given aggressive rate hikes.

Police have interviewed key Westpac employees as they investigate whether to press charges against alleged bank fraudster Bill Papas.

ASX edges higher on tech as banks fall. Coronado profit surges, Megaport revenue jumps, REA firms on profit beat, NAB cash profit hits $1.8bn and consumer confidence falls.

Influential Westpac economist Bill Evans argues the RBA should aim to get inflation back down to 3 per cent next year but might need a significantly higher ‘terminal’ cash rate to achieve that.

The big four banks have all passed on the Reserve Bank’s latest interest rate hike to home loan borrowers but not all savings account customers are happy.

A third big bank has reacted to the RBA’s announcement of a further 0.50 percentage point rate hike, saving customers some hip-pocket pain.

Apollo Global Management is thought to be the latest private equity firm to have turned up in the auction for Westpac’s wealth management unit.

Original URL: https://www.theaustralian.com.au/topics/westpac/page/21