Afterpay shutters financial wellbeing app, ends Westpac partnership

The move paves the way for Jack Dorsey’s Cash App – used by some 47 million Americans – to launch in Australia.

Afterpay is shutting down its Money by Afterpayapp to “pursue other opportunities”, following its multi-billion acquisition by Jack Dorsey’s payments giant Block.

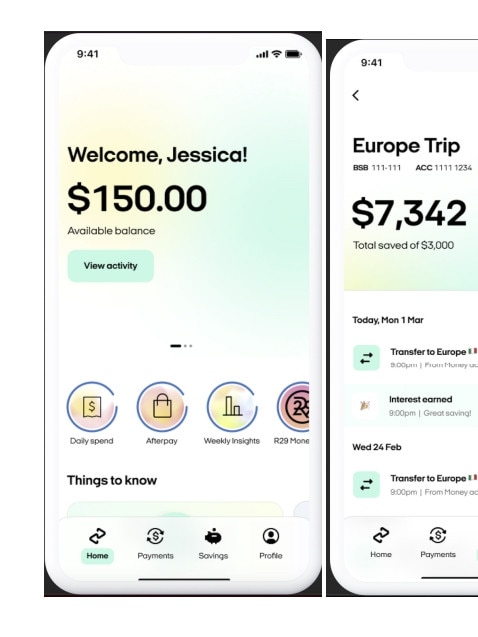

Launched in 2021, the app was the product of a partnership with Westpac and was touted as a holistic money manager for young people – complete with a debit card – encouraging users to pay salaries into linked account.

It was also closely integrated with Afterpay’s buy now, pay later functionality, displaying upcoming Afterpay payments and allowing customers to shop at Afterpay merchants online inside the app.

Afterpay is now ending its partnership with Westpac, however, and the companies’ smartphone app, which relied on Westpac’s banking-as-a-service platform, will stop accepting customers from August 26 and will close as of October 10.

The move paves the way for Block to offer its Cash App in Australia, which would have been a rival to Afterpay’s offering. That app is used by around 47 million customers in North America who use it to send, spend, bank and invest money and cryptocurrency.

“Westpac Group and Afterpay have agreed to end their Banking as a Service collaboration agreement following Afterpay’s acquisition by Block and the subsequent decision to withdraw the money management app ‘Money by Afterpay’ offer in Australia,” Afterpay executive Lee Hatton said in a statement on Friday.

“We are really proud of the work we’ve done with the Westpac team to model a completely different approach in the Australian market that was firmly focused on the needs of our customers,” she added.

“Our decision to move in this new direction is due to our exciting next chapter with Block, particularly as we think about Cash App opportunities here in Australia, and we wish the Westpac team and its growing list of BaaS customers continued success.”

Ms Hatton, in am interview with The Australian last year, had described the two competing apps “complementary”.

“When (the Block acquisition) closes, which will obviously be huge and a fantastic thing for us, we can see the (Square) Cash App being so complementary,” she said. “We’ve always said this app has global aspirations, and the features and functions of each of the apps will be hugely complementary. We’re really excited about when the time comes to get the teams together and get things accelerating.”

Damien MacRae, chief executive of Westpac Baas, said on Friday that Westpac will support Money by Afterpay customers to transfer funds to accounts of their choice, and competitive offers will be available to account holders who wish to stay with Westpac.

Afterpay had been Westpac’s first banking-as-a-service partner.

“We have learnt a great deal through this foundational partnership, and we wish them well for the next iteration of their business. Westpac is well placed to continue to leverage the capability from our partnership with cloud-native platform 10x.”

Analysts had been sceptical of the joint offering. Nathan Zaia, Morningstar’s banking analyst, had warned of the challenges of an outsider muscling in on the competitive banking sector.

“Afterpay has undoubtedly shaken up the payments space, and they could surprise us again and do it in banking, but I think it’s going to be a tall order for them to make a dent in the competitive banking landscape.”

Senior banking and insurance analyst at Velocity Trade, Brett Le Mesurier, had questioned how much Afterpay “could move the dial” on the competitive banking landscape due to the likelihood that Afterpay customers don’t hold substantial savings.

“Things like this typically don’t last,” he said of the arrangement between the two companies,” he said. “For Afterpay it means they have more products to offer their customers but it’s just an introducer arrangement so there’s no reason to expect this is a forever deal.”

Block acquired Afterpay earlier this year in what was the largest merger in Australian corporate history. In Block’s most recent financial results this month Afterpay contributed 10 per cent of Block’s second-quarter gross profit of $US1.47bn ($2.11bn), which was up 29 per cent year-on-year.

Shares in Block – an ASX200 tech stock – rose 0.8 per cent, or 88c, to close at $105.80 on Friday. Its shares have slid 31.9 per cent, or $49.50, in the last six months. Shares in Westpac rose 0.4 per cent, or 9c, to $21.68.