Westpac-Melbourne Institute sentiment index lifts but confidence remains weak

Consumer confidence has improved for the first time since November, breaking a long stretch of pessimism, with mixed results for retail, building and real estate sentiment.

Consumer confidence has improved for the first time this year, breaking a long stretch of growing household pessimism brought about by Omicron, cost-of-living pressures, rising rates and plunging house prices.

The Westpac-Melbourne Institute sentiment index lifted 4 per cent to 84 points in September, based on a survey conducted in the first week of the month.

Westpac chief economist Bill Evans described the improvement in confidence as “a little surprising, especially given continued sharp rises in the cost of living and the RBA’s decision during the survey week to make another (half a percentage point) increase in the official cash rate”.

While the latest consumer sentiment survey showed a welcome reversal of a nine-month decline, the gauge was still 20 per cent down on a year earlier.

“Consumers may be a little less fearful, but confidence remains very weak,” Mr Evans said. “Index reads in the 80-85 range mean pessimists still greatly outnumber optimists.”

This year’s parade of worries, however, has yet to dent retail spending, which remains at record levels as Australians take advantage of easing health restrictions to splurge in shops and cafes.

With consumers still opening their wallets, firms are enjoying a purple patch of strong demand, supported by a capacity to pass on higher costs to customers.

NAB’s business survey, also released on Tuesday, showed business confidence and operating conditions continued to improve in August.

NAB chief economist Alan Oster said “conditions are strong across most industries other than construction, where profitability remains a challenge”.

Businesses said cost pressures – including for labour and materials – remained intense, but had eased in the month. Mr Oster said firms were also more confident about the outlook, with more optimists than pessimists.

“Confidence took a hit around June as interest rates first began to rise but it seems that firms’ initial concerns about the impact have eased and a more positive outlook is prevailing, at least for the time being,” he said.

“We continue to expect that inflation and rising interest rates will eventually begin to weigh on household budgets more materially, slowing the pace of consumption growth and, in turn, helping to ease inflationary pressure. So far, however, it appears this dynamic is yet to take hold.”

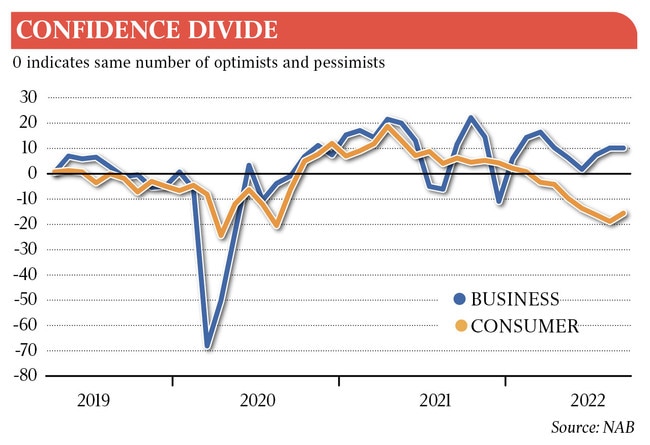

Citi chief economist Josh Williamson said “the small pick-up in consumer sentiment cannot hide the chasm between household perceptions of economic conditions and the much more positive view on the part of businesses”.

“The division reflects rising prices that must be paid by households for goods and services, and businesses, which have been much more able to pass on higher input costs in recent months,” Mr Williamson said.

“That said, household demand is running ahead of sentiment, showing households are effectively accepting higher prices for purchases regardless of what they say in the consumer sentiment survey.”

After starting the year at virtually zero, five straight rate hikes have pushed the cash rate up to 2.35 per cent.

RBA governor Philip Lowe has signalled that monetary policy tightening will now slow, but the Westpac survey showed nearly six in 10 respondents expected a further one-percentage-point increase to rates over the coming 12 months.

Mr Evans said that while the consumer sentiment index level of 84 points was consistent with previous downturns and economic dislocations – such as the GFC and more recently the pandemic – unemployment at near 50-year lows of 3.4 per cent and the tightest labour market in decades had prevented a total collapse in confidence.