Reality cheques for NAB execs

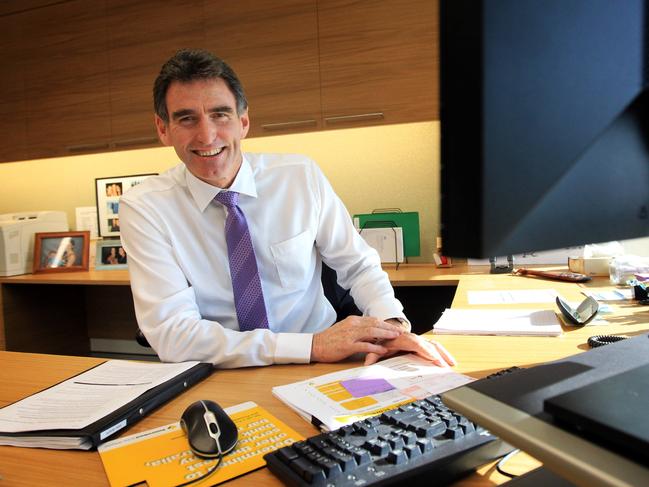

Still smarting from last year’s AGM, NAB’s board has slashed the pay of the bank’s top executives in half.

Still smarting from last year’s AGM, NAB’s board has slashed the pay of the bank’s top executives in half.

Phil Chronican and Mike Baird were among NAB’s top-level execs answering calls on its complaints hotline last month.

National Australia Bank has pulled out all stops to try to avoid a second strike on its remuneration report.

A ‘whole of government’ effort is needed to restore confidence, especially in small businesses, NAB’s chair says.

NAB is believed to have accepted it engaged in misleading or deceptive conduct when it charged superannuation customers fees for services it never provided.

Neither rain nor his $3.1bn Latitude float failure was going to stop Melbourne’s most discussed business executive Ahmed Fahour from heading to the races.

Alexander Dunlop may have been a footnote in history if not for CEO’s actions.

NAB will need to weigh up to $3m in compensation costs if it picks the outgoing RBS CEO as its next boss.

A blitz of property data has one conclusion – prices are still going down and nobody knows when they will stop.

LISTEN: Kirby and Kohler take in the big picture and mull the likelihood of two interest rate cuts on the horizon.

National Australia Bank has vowed to “engage constructively” on Labor’s $640 million proposed bank levy.

Scott Morrison has been in a free-flowing mood these past few days — not least on Kerryn Phelps’s bill on offshore processing.

The top corporate cop has made a number of shocking admissions about its dealings with the banks under unrelenting grilling.

Kirby & Kohler warn of trade war turmoil and ask if aged care stocks have entered the no-go zone.

AustralianSuper’s chief executive, Ian Silk, finally got his turn in the financial services royal commission hot seat yesterday.

NAB chief executive Andrew Thorburn has strongly rejected allegations the bank might have engaged in criminal behaviour.

NAB has no plans to refund customers it has stung with a so-called ‘adviser contribution fee’.

NAB offshoot CYBG has upped its all-scrip offer for Virgin Money, as it eyes building Britain’s ‘leading challenger bank’.

NAB was forced to concede it had no lawful entitlement to seize the proceeds from selling a customer’s home to repay his debts.

Banks have taken another pummelling at the financial services royal commission.

NAB is fostering a learning environment in which its staff can be free to experiment.

NAB concedes it had no lawful entitlement to seize the proceeds of a sold home to repay the owner’s business debts.

NAB has become the first bank at the financial services royal commission to seriously question the evidence given by a customer.

A cashless society has seemed inevitable. But system outages like NAB’s, and cryptocurrencies, are a reason to keep cash handy.

NAB faces a potentially hefty compensation fee after a power outage downed its ATMs, Eftpos and online banking.

Karen McLeod, a one-time planner at NAB’s Godfrey Pembroke division, is now in a very different job as an adviser at Ethicial Investment Advisors.

NAB has foreshadowed an overhaul of executive pay practices that will include incentives linked to the treatment of customers.

NAB will tie the treatment of customers to executive bonuses as it looks to foster cultural change, says chair Ken Henry.

Police made several arrests related to out-of-control house parties in Melbourne as they cracked down on African youth crime.

NAB offshoot CYBG has swung to a pretax loss after it booked legacy conduct costs associated with payment protection insurance.

Original URL: https://www.theaustralian.com.au/topics/national-australia-bank/page/32