Age shall not weary them: Dunlops fight for justice

Alexander Dunlop may have been a footnote in history if not for CEO’s actions.

Until last week’s surprise intervention by acting National Australia Bank chief executive Phil Chronican, the tragic story of Alexander Dunlop might have been a footnote to any updated biography of his war-hero father, Edward “Weary” Dunlop.

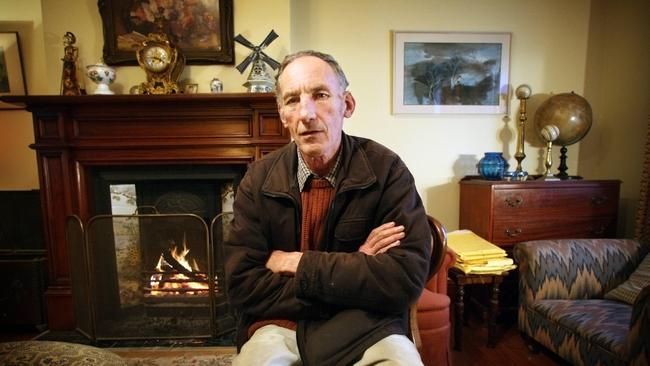

Alexander, a surgeon who spent most of adult life battling chronic schizophrenia and alcoholism, died penniless in a high-care Melbourne nursing home in 2014.

A decade before, he was induced by the “trickery and fraud” of a Toorak mortgage broker to sign mortgage and loan agreements in relation to a rural Victorian property inherited from his father.

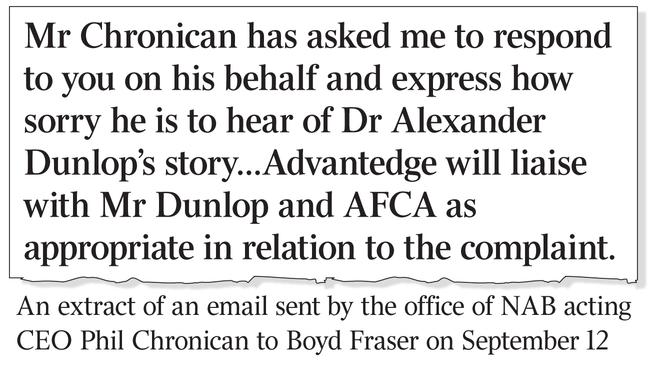

On Thursday last week, NAB chairman-in-waiting Chronican instructed his office to send an email to Boyd Fraser, who took on the Dunlop cause two years ago and has been instrumental in rallying the family to seek $750,000 in compensation on behalf of Alexander’s estate through the nation’s new external dispute resolution scheme, the Australian Financial Complaints Authority.

Alexander’s younger brother John formally lodged the AFCA complaint, which indirectly involves NAB, last May.

“Mr Chronican has asked me to respond to you on his behalf and express how sorry he is to hear of Dr Alexander Dunlop’s story,” the email says.

“As you know, the AFCA complaint has been lodged by Mr John Dunlop against (the NAB unit) Advantedge Financial Services regarding Perpetual Trustees Victoria. Advantedge will liaise with Mr Dunlop and AFCA as appropriate in relation to the complaint.”

The tale of Alexander’s desperate circumstances when he became entangled with a range of financial services entities was a forerunner to the searing responsible lending cases examined last year by the royal commission.

Some elements of the industry have learned nothing from their previous poor behaviour.

As John Dunlop tells it, his brother “died broke with a dribble coming out of the corner of his mouth every time I visited him”.

Before lodging the AFCA complaint, John chanced his arm last year with a submission to the royal commission, later discovering that Ken Hayne was in the same class as Alexander at Scotch College, an elite private school in Melbourne. Perhaps because of this, or due to the passage of time, the Alexander Dunlop case failed to make the cut.

While the main victim has passed away, John says his older brother’s ordeal has cost the family well over $1 million in losses and legal fees and had a devastating impact not only on himself but the next generation of Dunlops, including Alexander’s son and daughter Edward and Diana.

Instead of a comfortable retirement, the 70 year-old says he lives in a “$200,000 shack” in outback Queensland and has to chase contract engineering work in far-flung locations to support his own family.

“People know about my father’s service to the community, but dad and I both did service in Vietnam,” he tells the Weekend Australian from the Russian Arctic, where he’s working at a large phosphate mine near the city of Murmansk.

“I look back and think to myself: ‘What has the service that we did for our country done for us?’ It’s just terrible.”

John’s efforts to seek redress on behalf of his brother’s estate got a shot in the arm when Fraser, a second cousin to former Prime Minister Malcolm Fraser, enlisted for the cause.

The two men have a common enemy in the Perpetual group, and Fraser says he’s “outraged” at the treatment of the Dunlop family.

When he received Chronican’s email, Fraser could barely conceal his delight. However, the truth is that the path to ultimate success is littered with so many hurdles, and so many vested interests held by powerful institutions, that overcoming them all will be a superhuman feat.

This, after all, was not a garden variety mortgage involving a borrower with a steady income. Alexander was mentally ill, living on a disability support pension, and the financial arrangements were layered and complex.

Some of the background was set out in an inconclusive 2009 Victorian Supreme Court case where Perpetual was seeking to take possession of Alexander’s property at Smiths Gully on the grounds that he had signed a loan agreement and executed a mortgage in favour of Perpetual.

A statement of claim filed against Perpetual on Alexander’s behalf said his signature on the loan agreement and mortgage was obtained by a mortgage broker’s “trickery and fraud”, and that he had also invested in the purchase of a rental property in the inner-Melbourne suburb of St Kilda.

John says Alexander was completely unable to provide any details, but on further investigation it was found that the St Kilda property was rented out as a brothel, with the weekly proceeds going to the broker.

To sum up, Alexander was preyed upon by the broker, the Challenger group originated the loan, and Perpetual acted as trustee for investors because the mortgage was part of a securitisation program.

As the so-called “lender on record”, Perpetual has the legal standing to undertake anything procedural to do with the loan.

As for NAB, the big-four bank acquired Challenger’s mortgage management business in 2009, rebadged it Advantedge and now earns fees from Challenger for managing its loans, including dispute resolution.

Advantedge was therefore named as a party in the AFCA dispute, which explains Chronican’s email to Fraser.

The email’s wording, however, makes it very clear that Chronican was expressing general sympathy to the Dunlop family without any admission of liability or guilt on behalf of NAB.

Fraser’s campaign has extended well beyond NAB over the last few years.

A blizzard of emails under his name, which also refer to a running $1.5 million dispute with Perpetual over the administration of his father’s estate, has drawn the attention — and sometimes the ire — of a number of CEOs.

At 11.21pm on a Friday night in April 2017, then-Perpetual CEO Geoff Lloyd had clearly heard enough from Fraser about the handling of his father’s estate and the Dunlop family.

“Mr Fraser,” began Lloyd, who is now running NAB’s wealth unit MLC ahead of its proposed sale.

“Best you focus on your conduct in relation to your mother and not others from decades ago and in relation to which you continue to falsely state the facts.

“Either way these other matters have no relationship to your mother. We will continue to act in her best interests.”

Undeterred, Fraser chased Lloyd to MLC, drawing then-NAB CEO Andrew Thorburn into their dispute.

Thorburn responded by email, thanking Fraser for his “clear passion and commitment” to the Dunlop family.

“Our decision to appoint Geoff Lloyd as the CEO of MLC reflects his ability to lead MLC through its transition away from NAB, establish a new standalone business and build it for the future,” he said.

“He is a highly regarded executive with a proven track record of delivery, having successfully driven a major turnaround program at Perpetual through a period of significant structural change. The announcement of his appointment was favourably received by the market and our employees.

“I would not wish for you to consider me offering this broader background as showing any disregard for your interests, and I wish you well for your campaigns.”

Fraser’s campaign for redress for the Dunlops has now landed at the doorstep of AFCA, but it must clear the jurisdictional hurdles.

First, while John lodged the complaint, the beneficiaries of Alexander’s estate — his two kids and former wife — must give their consent. If that occurs, victims only have six years to knock on AFCA’s door, although legacy complaints can go back further if they weren’t settled elsewhere.

There’s a suggestion that the executor of Alexander’s estate might have reached a settlement in 2011 or thereabouts.

AFCA declined to comment on the status of the matter or whether it would be allowed to proceed.

In the meantime, Fraser has maintained the rage, exchanging emails with the former Liberal Party leader Brendan Nelson, who is currently head of the Australian War Memorial.

Last October, Nelson said he had followed Fraser’s “dogged determination on this outrage with admiration”.

“There should be a Cross of Valour or similar recognition coming to you on this,” he said.

Fraser’s own battle with Perpetual is reaching its denouement.

Earlier this month, he received notification from Perpetual’s lawyers that he was required to vacate his Toorak home by next Wednesday. John Dunlop says Fraser knows that he, John, is “struggling to hold things together, so he’s been carrying the torch for me”.

“I had to spend every last dollar on my brother’s case and I had to give up,” he says. “AFCA hasn’t ditched it yet but I don’t think anyone wants to get involved.

“All I want now is to make the public aware of what’s happened so it doesn’t happen again.

“I’ll probably have to work now until I’m 80 but it’s not going to change the sort of person I am.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout