Airwallex eyes global growth with $US100m raising

The fastest Australian start-up to hit a billion-dollar valuation is set to expand its global reach after a fresh funding round that has seen it achieve what Canva was not able to do this year.

The fastest Australian start-up to hit a billion-dollar valuation is set to expand its global reach after a fresh funding round that has seen it achieve what Canva was not able to do this year.

The software company is likely to overhaul its new building and could make it a new headquarters as it looks to dramatically step up its operations.

Mike Cannon-Brookes and Canva billionaire Cameron Adams are backing this start-up aiming to get thousands more electric vehicles onto Australian roads.

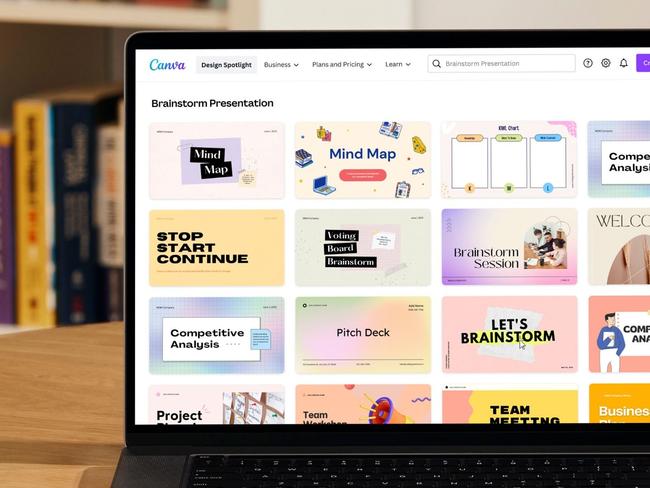

Canva, one of Australia’s rare unicorn tech companies, is also one of the most sought-after employers, dealing with about 300,000 job applications each year.

Virtual Gaming Worlds was only established 12 years ago, but is now the sixth-biggest private company in Australia, ahead of big names like Linfox, Chemist Warehouse and Spotlight. See the list.

Analysts say Adobe is being squeezed in the market by Australian tech darling Canva, and this acquisition is out of ‘need and not opportunity’.

Having a $1bn in the bank is a good start.

The start-up that had its valuation slashed by 40pc has hit back saying not a day goes by without new business landing at its feet.

Canva is zeroing in further on the enterprise market but selling enterprise offerings may not be the pushover that its original consumer package was.

Amazon Web Services launches first major Aussie campaign as cloud adoption grows Down Under.

Paul Bassat’s Square Peg has just slashed Canva’s value. Now he says tech founders must relatively quickly find a way to continue to grow.

The tech industry is not well.

Melanie Perkins and Cliff Obrecht have had an estimated $US5bn wiped from their net worth amid a growing technology bloodbath.

What makes the global startup superstar say yes? Founders such as Canva’s Melanie Perkins who won’t take no for an answer.

Early employees at Canva, Atlassian and Airbnb are backing this syndicate, which began as a private investment fund for a Shark Tank star.

Famed investor Bill Tai has taken a strategic stake in this Australian company that he says shares the same DNA as our hottest tech export.

One fund manager just cut its Canva valuation by a third. Does this reflect a sector bloodbath, or rare opportunity in private equity?

Australia’s fastest growing start-up hit its climate targets two years early, and its billionaire co-founders have a message for others to follow suit.

Australia’s biggest venture capital firm, Blackbird Ventures, has lifted the lid on its three new funds, which it will use to back the next Canva or Culture Amp.

Buying a digital likeness of Mike Cannon-Brookes or Clive Palmer sounds daunting, but it’s easier than you might think.

Original URL: https://www.theaustralian.com.au/topics/cliff-obrecht/page/5