ANZ cuts 60 jobs in markets arm

ANZ will slash at least 60 jobs from its troubled markets division in Australia and global offices amid ACCC cartel case.

ANZ will slash at least 60 jobs from its troubled markets division in Australia and global offices amid ACCC cartel case.

Australia’s best financial advisers are rushing to the exits of our biggest financial institutions in the wake of the bank inquiry.

Westpac is the only big bank to dodge the next round of bank inquiry hearings, as Suncorp and Youi face their first grilling.

NAB has fired back at suggestions it engaged in misleading conduct, as banks respond to latest hearings.

The closure of financial planner Dover, whose owner collapsed during the bank inquiry, has left 30,000 customers in limbo.

Slater and Gordon has joined the queue of class actions filed against AMP after scandals revealed at the bank inquiry.

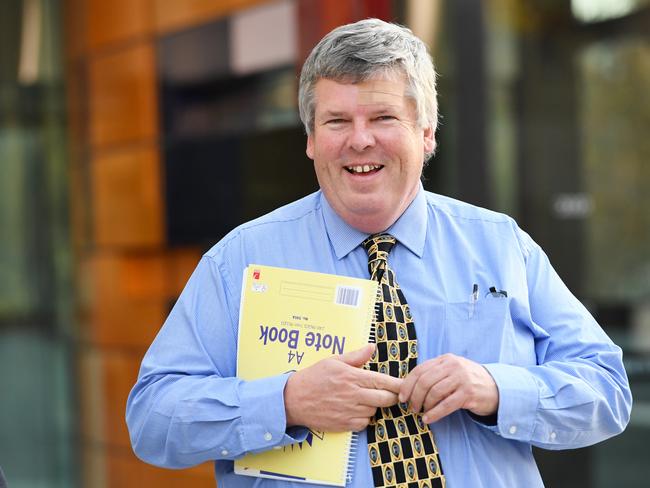

Six of Australia’s highest-powered investment bankers have been charged over alleged cartel conduct, in an explosive criminal case.

The banking royal commission shows worrying signs of being a public show trial for people to vent antipathy towards banks.

ASIC has banned a former AMP financial adviser for five years after he finding he failed to act in the best interest of clients.

ASIC’s offer to “work with” banks over unfair contract breaches has drawn fire from commissioner Hayne.

Wrapping up proceedings, Michael Hodge QC says misleading statements sent by CBA may attract penalties.

NAB concedes it had no lawful entitlement to seize the proceeds of a sold home to repay the owner’s business debts.

CBA’s chief risk officer concedes the bank’s risk management is not up to scratch, and it did not properly log misconduct.

Bankwest pressure to sell a pub despite a clean payment history wasn’t surprising, CBA’s chief risk officer has told the inquiry.

Inquiry hearings into agricultural lending may widen to probe banks’ dealings with indigenous communities.

Shine Lawyers has refused to detail funding arrangements for its class action suit against AMP amid law firm bidding war.

ASIC’s approval of the banking code of conduct depends on evidence at the royal commission, it has told Kenneth Hayne.

A former pub baron has told the bank inquiry how receivers appointed by CBA ripped out $180,000 worth of chandeliers.

In a highly anticipated appearance, CBA’s David Cohen detailed the disasters in Bankwest’s loan book.

Wheeling out a blind pensioner was a new low for the royal commission’s theatrics.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/26