Banking royal commission live: CBA may have breached ASIC Act, Hayne told

Wrapping up proceedings, Michael Hodge QC says misleading statements sent by CBA may attract penalties.

That’s it for the last day of the small business hearings at the financial services royal commission.

Today corporate regulator ASIC was in the spotlight, with its offer to “work with’ banks breaking laws banning unfair contracts with small businesses drawing fire from financial services royal commissioner Kenneth Hayne.

This afternoon, counsel assisting summed up the fortnight of hearings and make recommendations. The commission has heard over the past two weeks of:

— NAB seizing house sale proceeds when it had no right to do so;

— A CBA executive putting his “bruised” emotions ahead of giving customers a refund; and

— Westpac allowing a blind disability pensioner to act as a guarantor for her daughter’s small business loan.

It comes amid the explosive news this morning that the ACCC expects criminal cartel charges to be laid against ANZ in relation to trading in the bank’s shares after an institutional share placement in 2015. ANZ will defend the allegations.

4.10pm: Was ASIC’s approach appropriate, effective?

In the final minutes of wrapping up the third round of hearings, senior counsel assisting Michael Hodge QC turns attention to the regulator and peak industry body.

The code of banking practice has been reviewed by Philip Khoury, who said his review would have to be transformational to make the community less sceptical towards banks. Mr Khoury was disappointed with parts of the draft code including the definition of small business and protections for guarantors.

Australian Banking Association chief executive Anna Bligh noted the ABA and ASIC were disagreeing on the definition of small business, as the ABA wants a line drawn at $3m of debt instead of a $5m limit. The ABA warned smaller banks might face a loss of control over most of their loan books due to the customer protections in the code. She said placing limits on enforcement might make banks hesitant to lend.

The new code has not been approved by ASIC as of today and was submitted for approval over five months ago but the parties wanted to wait for the royal commission small business hearings to check if any issues arose.

The commission also heard about unfair contract laws for small businesses. Suncorp executive Steven Kluss said the bank had not yet completed its review of its contracts.

The ACCC had said the body moved into an enforcement mode once the laws were introduced. ASIC had also given evidence.

Was ASIC’s approach to the unfair contract laws appropriate and effective, Mr Hodge asked.

Was the proposed code adequate to address concerns about the obligations imposed on the bank? Would the absence of ASIC approval undermine the effectiveness of the code?

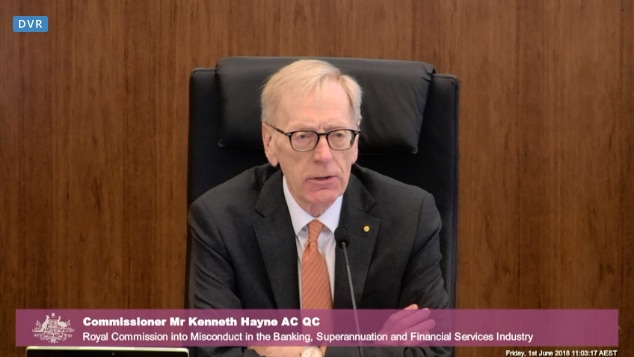

Commissioner Kenneth Hayne AC QC raised the questions of whether ASIC’s approach was appropriate and effective - and encouraged parties making submissions to explain and justify their answers beyond a simple yes or no.

“I know what I’m asking is difficult,” Mr Hayne said. “But the questions are difficult.”

Mr Hayne asked for case study submissions of no more than 20 pages by 4pm on 8 June and general submissions of up to 30 pages by noon on 12 June.

The commission is now adjourned until the next round of hearings in Brisbane later this month.

3.55pm: NAB may have engaged in misleading, deceptive conduct

Senior counsel assisting Michael Hodge QC is wrapping up the third round of hearings at the banking royal commission. He recounts the case of small business owner Ross Dillon, who imports musical instruments.

Mr Dillon said he told his NAB banker he would sell his family home and used the funds to buy a smaller house and inject funds into the business. NAB did not initially tell Mr Dillon the bank might claim some of the money.

NAB executive Ross McNaughton agreed the communication here was “poor”.

After Mr Dillon sold his house he found out the bank would take the whole sale proceeds to pay down his debts even though he was never in monetary default and NAB had not made a call under the guarantee that was the only way it would be entitled to lay claim to the house.

Mr McNaughton admitted NAB did not have a right to take the funds to pay down debt but still insisted the bank had acted with integrity.

It was open to find NAB might have engaged in misleading or deceptive conduct as it did not tell its customer the bank would require all the sale proceeds. The bank also told Mr Dillon it was entitled to take the money but it has now acknowledged it did not have a legal right to do so.

The failure of communication of its expectations may also breach the code of banking practice in that it failed to act in an ethical manner. NAB fell below community standards and it was open to find NAB bankers may not have engaged with NAB policies requiring them to be open and honest.

How much disclosure should a bank give a business director where a bank decision would affect a customer’s personal asset, Mr Hodge wondered?

3.50pm: Westpac may have engaged in misleading conduct, Hayne told

As he wraps up the third round of banking royal commission hearings, senior counsel assisting Michael Hodge QC has moved on to the question of bank power and communication.

For example, Bradley Wallis and his wife bought a property with a house and bed and breakfast on it in regional NSW. They provided a profit and loss projection with their loan application.

The banker stood to gain a bonus if the loan was approved.

The Bank of Melbourne approved a residential loan and after the business failed the bank said the property should have been characterised as commercial not residential.

The bank refused to discharge the proceeds of the sale of their property unless the bank could keep $100,000 as a security shortfall.

The bank told Mr Wallis the bank documents allowed the bank to keep money in relation to discharging securities.

Westpac’s Alastair Welsh agreed that the bank’s clauses it relied on to justify keeping the money were too complex for a customer to understand - and that the bank did not act in accordance with the clauses in keeping the money.

It may be open to find that by keeping the money the bank failed to act fairly and reasonably.

It may be open to find that by saying it was entitled to keep the money, the bank engaged in conduct that was misleading or deceptive, and it may be open to find the bank acted in a way that fell short of community standards and expectations.

Mr Hodge made the general observation that a lower level of regulation for business lending than consumer lending mean there was a need “for banks to be mindful of not focusing on relentlessly acquiring new business”.

3.40pm: CBA communication failings on show

As he wraps up the third round of banking royal commission hearings senior counsel assisting Michael Hodge QC has turned his attention to the four case studies the commission heard of Bankwest customers who had been reviewed as part of Project Magellan, ranging from loans of $1m to over $50m.

The cases offered insights into the covenants included in business loans and how loans are managed as business conditions worsen, Mr Hodge said.

Michael Kelly had two loans for land development projects and his interest rates had been increased a number of times. He pointed to a reduction in the loan to value ratio as encouraging him to exit. He did not miss any loan repayments.

CBA’s Mr Perry said the borrower should understand a bank might not be willing to refinance a loan at the end of the term, adding that Bankwest’s policy at the time was not to end loans early but to exit at the end of the term. Mr Perry could not explain the interest rate changes and agreed the bank gave the customer inconsistent information about charging default interest rates.

The second Bankwest case study was Stephen Weller of the Nambucca Hotel.

He took a loan for 15 years that included non-monetary covenants but no loan to value ratio. When his interest-free period ran out he was offered a two-year loan.

He was never in default of any monetary payments owed.

The bank asked for an updated valuation. He and his wife put their home on the market about this time.

Bankwest told the borrower of a breach of its terms and ultimately his personal guarantee was called on.

The issues raised included the lack of transparency around the hotel valuation, the shortening of the loan term and the entry of a deed of forbearance.

CBA’s Mr Clark said it was no longer bank policy to withhold valuations from customers who had paid for them, but added financial covenants were part of prudent management of a business loan.

The next case study was former Hobart pub baron Michael Doherty who borrowed about $50m for a complex hotel and retail development.

Mr Doherty said the bank had changed its valuation method for his hotel project and he had pushed for the bank to use the valuation method he thought would most fully describe the project. He said he did not receive a copy of the valuation even though it was a factor in the bank’s decision not to extend the facility.

CBA’s Mr Clark said there were also concerns about money owed to creditors and the bank’s relationship with the borrower. Bankwest lost $38m on this account.

The fourth Bankwest case study was country publican Brendan Stanford.

Even though Mr Stanford made all loan repayments due the bank issued letters for non monetary defaults and decided to exit the banking relationship. CBA’s David Cohen said breaches of financial ratios were indicators of trouble to come for a business.

The bank appointed investigative accountants and gave Mr Stanford and his brother a week to pay the $9900 accountant fees for a report it would not show them.

The bank now has to provide an investigative accountant report to the borrower under a new policy.

CBA’s David Cohen said it was unfair of the bank to only give the brothers a week to respond to a report they had not seen and pay the costs within a week.

Mr Cohen conceded the lack of transparent engagement with Mr Stanford fell below communications.

Mr Hodge did not suggest there were any open findings of misconduct in relation to these case studies.

It was open to conclude that CBA in each of the four cases had errors of communication and transparency which were below community expectations.

He asked, how should banks deal with circumstances where they no longer want to fund a particular industry, and if there was any reason why investigative accountant reports should not be provided to customers, and whether banks should take enforcement action when no monetary defaults had occurred and whether there should be an extra degree of protection.

Commissioner Kenneth Hayne wondered if there was a disconnect between bank conduct and bank advertising.

3.20pm: Project Magellan necessary to address risks, Hayne told

Senior counsel assisting Michael Hodge QC has turned to Bankwest’s takeover by CBA as he wraps up the third round of hearings at the banking royal commission. He has already dismissed ulterior motive theories, saying CBA did not move customers off its books to cut the price it paid for the takeover target.

He looked instead at how a bank might deal with a perception of increased risk in lending to a particular industry.

The commission has received 43 public submissions from former Bankwest customers.

The commission issued many notices for CBA to produce documents and received over 13,000.

It would be open to conclude that these issues become apparent to CBA in the 18 months after buying Bankwest:

- Problems in the business loan book and an increase in the concentration of troublesome assets transferred to the bad bank;

- Problems with the diversity of the loan book as Bankwest had a high exposure to commercial property after taking a very aggressive strategy particularly on the east coast;

- Problems with the business functions, as bankers were not actively monitoring the progress of loans as they should have been, and there concerns about how the business was assessing credit. Eg Bankwest did not have a watchlist for worsening loans;

- Problems with the risk management function including provisioning, and concerns about the risk ratings given to some loans

CBA’s David Cohen said the risks came to light after the acquisition so Bankwest reduced its cap on the business loan book and targets to further reduce the exposure over time, Mr Hodge said.

Project Magellan, a review of the business loan book, was concerned with more accurate provisioning to meet prudential obligations.

It was open to conclude that Project Magellan was necessary to address the risks in the Bankwest business loan book as CBA had valid concerns about Bankwest’s approach to credit writing and account management.

The documents had not revealed evidence that Project Magellan was undertaken to make certain types of assessments. It was not open to find Project Magellan was intended to be a process of deliberately defaulting loans against Bankwest customers, Mr Hodge said.

3.10pm: Hayne invited to find Suncorp failed to comply with code

Senior counsel assisting Michael Hodge QC turned to the Low family and their loans from Suncorp.

Rien Low’s father received five loans from Suncorp and FOS said the last of these was irresponsible lending.

A series of offers and counter offers were made between the bank and the Lows, with Suncorp initially trying to accelerate repayment of the loan to up to 12 months.

Mr Low said his family felt pressured by the bank to withdraw his FOS dispute and shared how stressful the experience had been.

Suncorp’s David Carter described a longer repayment plan as an interest free-loan spanning 17 years, and he thought the FOS determination eliminated the loan contract. FOS’s lead ombudsman Mr Field said FOS does not consider a loan contract void in cases of maladministration and said the body erred in advising the parties towards a short repayment time.

It was open to find Suncorp failed to comply with the banking code of practice in failing to investigate the purpose of the loan.

It may be open to find Suncorp failed to act with obligations to act fairly and reasonably.

It was open to find Suncorp engaged in conduct below community standards by defending the FOS complaint, by demanding repayment in an unreasonable timeframe, asserting the loan was void.

The evidence supports a finding FOS did not function as an effective mechanism for redress in this case, Mr Hodge said.

There were also general questions. If a business loan was affected by maladministration should the bank be allowed to ask for a faster repayment? Could FOS improve processes?

3.00pm: Hayne invited to find Westpac may have breached Act

Focus turns to blind disability pensioner Carolyn Flanagan who suffered serious ailments such as cancer and removal of part of her tongue, as senior counsel assisting Michael Hodge QC wraps up the small business hearings.

Ms Flanagan signed a guarantee for a loan to her daughter’s small business.

A Westpac banker pre-filled answers in a form about whether Ms Flanagan had received advice.

Westpac’s Alastair Welsh said it was not uncommon for these forms to be pre filled.

A NSW Legal Aid staffer sought for Ms Flanagan to be able to remain in her home.

Mr Welsh said Westpac should have progressed the hardship application earlier but did not see a problem with her going guarantor on the loan or the application of Westpac’s policies.

She was a shareholder but there was no suggestion a dividend would ever be paid.

It was open to find no reasonable person could have been satisfied that Ms Flanagan had any meaningful interest in the business.

Mr Hodge said it was open to find Westpac may have contravened the unconscionable conduct part of the ASIC Act by relying on a guarantee from Ms Flanagan when the bank was in a superior bargaining position, she was in a disability pension and in poor health, and the bank made inadequate efforts to identify any interest in the loan for her even though this was the basis on which it took the guarantee.

It was open to find the case was conduct below community standards in that Westpac relied on the guarantee, failed to respond to her request for a life interest in the property in a timely way and insisting that its behaviour in taking the guarantee was acceptable.

Commissioner Kenneth Hayne wondered what a third party was to make of the documents if it had to consider them after Ms Flanagan dies - would the executor know the bank had “helpfully filled out the form before it is taken to the solicitor”?

The case raised general issues about guarantees.

There are case and statutory rules around unconscionable conduct.

It might be open to find there was any inadequacy or gap in the established protections.

The legal protections operate after the event - if Legal Aid NSW could not rely on their contacts at Westpac (to help Ms Flanagan stay in their home) what could she have done? How feasible would it be for her to take the bank to court?

If a parent wanted to guarantee a borrowing out of love then why should the informed and consenting parent not be able to do so?

The test of whether a guarantor was receiving a direct interest was sometimes applied in a meaningless way, Mr Hodge said.

Even if a guarantor got legal advice, could a solicitor give substantive enough advice? Would making banks give extra information address the problem?

He invited submissions on whether extra advice for guarantors would help them make an informed decision and what would be required.

2.50pm: Hayne invited to find CBA may have contravened ASIC Act

Senior counsel assisting Michael Hodge QC has turned to the Commonwealth Bank’s overdraft facilities as he wraps up the latest round of royal commission hearings.

CBA’s Clive van Horen gave evidence that the bank offered simple business overdrafts to customers considered to be a low risk of default, sending letters to over 10,000 customers without making a genuine assessment as to whether the customers wanted an overdraft.

He did not suggest it was open to find this conduct was below community standards or in breach of the code of banking practice.

But CBA also overcharged overdraft customers double interest - some 337 regular overdraft customers and 2354 simple business overdraft customers.

Most customers were remediated by an amount of just under $3m. The bank will remediate more customers.

The bank first found a pricing problem in 2013 and implemented a low-level fix without asking if the problem affected more than one customer.

In 2015 five customers complained about overcharging but the bank did not investigate if it affected more accounts.

After a FOS complaint, CBA investigated if it affected more customers. It did.

The remediation program took two and a half years but the bank did not notify the board when the overcharging issue was first discovered.

But the bank CEO met ASIC on 15 May 2018 and the overcharging issue was discussed. So the bank did notify ASIC of a breach of the ASIC Act eight days before Mr van Horen gave evidence.

It was open to the commission to find CBA may have contravened the ASIC Act, and failed to notify ASIC of the issue under the Corporations Act.

Each time CBA sent a statement saying the interest rate was 16pc when it was much higher, CBA made a false or misleading representation. Mr van Horen conceded at least 25,000 statements were sent.

It might be open to find that the sending of each statement was a contravention of the ASIC Act which can attract a pecuniary penalty.

2.40pm: No need to increase obligations on banks

Senior counsel assisting Michael Hodge QC has turned to general questions over responsible lending such as scrutiny of cash flow assessments.

Banks were lending on the basis of the income of the business, or as a second way out the security of borrower or guarantor.

Cashflow projections came from an accountant, a franchisor or the vendor.

Banks are required to be prudent and diligent but that means they are acting in order to protect the bank - the bank is not advising the business or warranting the success of the borrower’s business, he said.

The borrowers were relying on third parties eg accountants for advice and these are the people borrowers should turn to for advice, he said.

This relationship might be undermined by slogans like “It’s possible to love a bank” but slogans were not legal obligations - although they contribute to community expectations about bank relationships with customers, he said.

These businesses failed not because of technical flaws in the loan assessment but because the business performance did not live up to the aspirations of the borrower, he said.

An increase in regulation would be premised on banks being too willing to lend to small business, which did not seem to be the case, he said.

It was not open to the commission to conclude it was desirable to increase the obligations of banks making small business loans, he said.

But he invited parties to give feedback on this view eg how much responsibility did a lender have in assessing cash flow forecasts and what are the limits of a bank’s duty to act with prudence and diligence?

Commissioner Kenneth Hayne AC QC interjected to say the issue was not just the limits of the duty to be prudent, but the content of the duty to be prudent.

Mr Hodge said there were two issues: the nature of the obligation to the borrower, and the nature of the content of the duty.

Mr Hodge also posed the question of whether the National Credit Act provisions that apply to consumer credit contracts should also apply to small business credit contracts and invited submissions.

2.30pm: Hayne invited to find BoQ failed to exercise care

Senior counsel assisting Michael Hodge QC has turned focus to Sue Riches, who bought two Wendy’s franchise outlets even though an adviser said the profit looked skinny.

The Bank of Queensland’s final letter of offer said the monthly repayments were almost double those in the conditional offer letter. Ms Riches felt stuck between a rock and a hard place and her business was quickly in default.

FOS found the bank misled her and there had been maladministration. BOQ had internally found maladministrations but still contested the complaint.

BOQ’s Doug Snell concluded this was inappropriate and gave evidence about the bonus scheme and said he did not know how this commission-based structure could align with the ABA’s Sedgewick review.

It was open to the commission to find BOQ failed to exercise the care and skill of a diligent and prudent banker and failed to provide effective and timely disclosure and failed to act fairly and reasonably in contesting the FOS complaint, Mr Hodge said.

Another issue was over the consequences of commissions for owner manager breaches, he said.

2.20pm: Hayne invited to find Westpac breached code

Senior counsel assisting Michael Hodge QC is looking at responsible lending as he wraps up.

Recall Marion Messih and her brother and sister in law who borrowed to buy a Pie Face.

Their accountant cast doubt on the business profitability but they pressed ahead anyway and the business was never profitable, then Pie Face went into voluntary administration.

She made two complaints to FOS including because Westpac applied the entirety of the proceeds of her property sale to pay down the loan. The second FOS complaint did not find in her favour suggesting she did not fully understand the nature of the guarantee she gave. But FOS found against Westpac for sending text messages with collection notices that made her feel overwhelmed.

Westpac had not explained if the texts were a normal practice.

It was open to the commissioner to find that Westpac breached the code of banking practice in failing to act fairly and reasonably towards Ms Messih in a consistent and ethical manner by continuing to undertake the collection activities - and that Westpac breached obligations as a member of FOS.

2.12pm: Responsible lending

Senior counsel assisting Michael Hodge QC has turned to responsible lending.

What obligations ought to apply to small business lending?

He submits that no additional statutory obligations should be imposed with respect to the making of loans to small business.

Remember the case study of a gelato shop where a husband and wife borrowed $220,000 from ANZ to buy the business, relying on optimistic forecasts.

The company complained to FOS, FOS ruled in favour, ANZ disagreed but complied with the determination.

ANZ’s Kate Gibson said bankers have to decide if business plans are reasonable but there was nothing in the file notes to make sure the borrower understood the business.

ANZ admitted in this case the bank did not exercise the skill and care of a prudent and diligent banker

ANZ staff at this time got bonuses for financial targets and the banker felt pressure to make loans to new customers. The bank has since changed its KPIs.

It was open to the commissioner to find that in assessing this loan ANZ may have failed to exercise the care and skill of a diligent and prudent banker as the code of banking practice finds, Mr Hodge said. He added that Ms Gibson did not agree with the reason for the FOS conclusion but was dissatisfied with the file.

2.05pm: Hodge starts to wrap up

Senior counsel assisting Michael Hodge QC has started to wrap up the fortnight of small business hearings.

He explained how he picked the case studies.

The commission reviewed the more than 630 public submissions received about small businesses, and spoke to FOS, legal aid groups, the Council of Small Business Organisation, ASIC and other groups.

Some 164 notices to produce were issued, returning over 75,000 documents, then more than 40 individual borrowers were interviewed to pick the best ones for the hearings.

‘The dealings between any small business borrower and a financial services entity is almost always complicated,” Mr Hodge said.

For the borrowers in question, business problems had their roots in the performance of the business - not necessarily a fault of the borrower but a reflection that business performance reflects on many factors, he said.

12.55pm: Hayne takes aim at ASIC

How does ASIC decide whether or not to pursue a court proceeding or infringement notice, senior counsel assisting the commission Michael Hodge QC asks. He is questioning

Tim Mullaly, senior executive leader of ASIC’s financial services enforcement team, at the banking royal commission.

Mr Mullaly said ASIC considers the nature and seriousness of the conduct, whether it was deliberate or inadvertent, whether the bank cooperated with ASIC, ASIC’s resourcing priorities and the market impact of the conduct.

There hadn’t been any uptick in the amount of court cases it brings in the last three years, Mr Mullaly said.

Does ASIC think it’s better to take large companies to court?

It depends on the facts of each matter and whether the outcome will have an impact on the market and change behaviour.

Don’t you think a Federal Court ruling is a greater deterrent?

“We recognise that it certainly is a deterrent,’ Mr Mullaly said. “I think there’s evidence to be obtained around whether or not particularly enforceable undertakings have a - or the amount or nature of the general deterrence message that is proffered by an enforceable undertaking.”

ASIC was funding academic research to work out the deterrent effect of enforceable undertakings but he did not argue that court action “provides a very strong general deterrent message”.

ASIC has brought court action once a week for the last 10 years, Mr Mullaly said. That is, 238 criminal proceedings and 277 civil proceedings - some of which are conducted by the DPP after an ASIC investigation.

Was there any change in appetite for bringing responsible lending cases?

If ASIC thought it necessary to bring court action for responsible lending it would do so, he said.

Did ASIC think it was better to take an enforcement or engagement approach?

“I don’t think ASIC has a preference for one or the other,” Mr Mullaly said.

ASIC counsel Peter Collinson QC had some questions.

Did ASIC get external advice about a section of the act that dealt with misleading conduct?

Yes ASIC had.

Commissioner Kenneth Hayne asked if that advice covered charging fees to dead people?

“Not specifically, commissioner,” Mr Mullaly said.

What about the average spend on proceedings against the banks, Mr Collinson asked.

Over the last three years about 25pc of ASIC’s enforcement budget or a little higher has been spent on investigations and enforcement action in relation to the banks, Mr Mullaly said.

12.18pm: ASIC’s Mullaly takes the stand

Tim Mullaly, senior executive leader of ASIC’s financial services enforcement team, has taken the stand at the banking royal commission to answer questions from senior counsel assisting Michael Hodge QC.

They have run through ASIC’s action over the past decade by the numbers.

Since January 2008, ASIC has taken 238 criminal proceedings, 277 civil proceedings and 587 administrative proceedings (eg banning someone from an industry or removing licences).

ASIC has issued 370 infringement notices totalling $12.5m and accepted 194 enforceable undertakings.

Over this timeframe ASIC has started 110 proceedings alleging an ASIC Act contravention or multiple contraventions - a bit over 10 a year.

A consumer protection breach could include a breach on the prohibition on unconscionable conduct. Another covers misleading conduct and would be relevant to the fees for no service that were discussed in the previous round of hearings but ASIC has never commenced a proceeding under this section because they never thought there was “sufficient evidence for us to be able to bring an action”, Mr Mullaly said.

ASIC has obtained more than $700m in compensation, remediation or return of funds to investors over that time.

Banks agreed to $54.3m in community benefit payments.

For example in 2016 Westpac paid $1m to financial counselling and literacy programs after ASIC concerns about credit card limit increases practices and agreed to improve practices.

ASIC has commenced some court proceedings such as an alleged Westpac campaign to get people to switch their super, a responsible lending case, and one related to Storm financial.

For infringement notices, payers don’t admit they have contravened the ASIC Act.

11.50am: Has ASIC done enough?

The banking royal commission has considered whether ASIC could have done a better job in making banks follow unfair contract term laws. ASIC’s senior executive leader for the deposit takers credit and insurance team, Michael Saadat, has answered questions from senior counsel assisting Michael Hodge QC.

Mr Saadat is concerned that other lenders may not have made the necessary changes to comply with the laws yet.

Yesterday a Suncorp executive admitted he did not know if the bank’s contract terms were unfair or not.

So if Suncorp might not be compliant, had ASIC failed?

Mr Saadat said ASIC’s strategy to get the big four banks to comply was “the right way to go” as it was important that they set the standard.

“Making sure that the commitments were being made also went beyond the strict requirements of the UCT law I think that was a good outcome and i think it’s now something that we’re able to apply more broadly,” he said. “So ADIS like Suncorp… [will] be held to a much higher standard than what the law requires.” And ASIC was now working on making sure banks who aren’t ABA members were doing the right thing.

Could ASIC have done a better job?

If the body had been able to reach their position sooner than March 2017 they would have been able to get a result sooner, he said.

ASIC counsel Commences questioning Mr Saadat.

The banks have agreed to meet the unfair contract terms up to loans of $3m which is significantly higher than the $1m threshold in the law which was “a really good outcome for small business customers”, Mr Saadat said.

11.30am: ASIC had to chase banks to comply on contracts

Attention at the banking royal commission has turned to a report for the small business ombudsman into unfair contract terms, with this report and ASIC both finding clauses of concern.

ASIC’s senior executive leader for the deposit takers, credit and insurance team, Michael Saadat, is answering questions from senior counsel assisting Michael Hodge QC.

An ASIC media release referred to having already raised the issues of unfair contract terms with a lender, warning the body would consider all regulatory options if the lender refused to act.

Commissioner Kenneth Hayne AC QC: ‘Why work with the lender? Why not just say do it?”

Mr Saadat: “There was more than one lender that had these terms in their contracts… if a lender is prepared to make changes in response to the concerns we’ve raised, that can often be a faster and more effective way of getting that change in place as distinct form going down the path of court action.”

Mr Hayne: “Why say in a media release ‘We will work with those who are not complying’ rather than saying ‘Those who are not complying with the law should do so.’?”

Mr Saadat: “I think that was effectively what we were aiming to do but without the power to direct a business to behave in a particular way, I think perhaps our language was a bit more circumspect. But I think the clear message in this media release was that we wanted the banks to make changes.’

So what was ASIC’s strategy? Wait to review the contracts until later, while the ACCC did a review, then send generic letters to industry associations, then from September 2016 get copies of banks’ contracts, and then decide when the laws took effect in November 2016 that the banks were not in compliance, and then engage with the banks until a media release in March 2017 and also not take any court action?

Mr Saadat: “During this period we are looking to enforce the law by getting the terms within those contracts changed.”

Was this the first time ASIC told Westpac it thought the bank it was non compliant in April 2017?

No, Mr Saadat thought Westpac should have gotten the message from the media release a month earlier that said every bank was non compliant.

A joint media release with the Australian Small Business and Family Enterprise Ombudsman used the language ‘the big four banks needed to lift their game”.

This wasn’t typical ASIC language, so ASIC was in a position where the ombudsman was pushing it and pushing the language it was using in relation to unfair contract terms, Mr Saadat agreed.

Westpac has now made the changes ASIC wanted, Mr Saadat said. But the bank has published a waiver document but not new contracts.

All major banks said their changes would be retrospective to November 2016 so no small businesses would be disadvantaged, Mr Saadat said.

Otherwise the bank might seek to rely on the term and a small business would have to go to court to seek a declaration the term was void, he agreed.

He agreed ASIC could have gone to court seeking a declaration that some terms in contracts were void.

This would “perhaps” have set a benchmark for the rest of the industry but sometimes a litigated outcome “doesn’t necessarily have a broader applicability”.

11.02am: No court action taken on unfair contracts

Focus at the banking royal commission is on ASIC’s enforcement action on unfair contract terms, with ASIC senior executive leader Michael Saadat answering questions from senior counsel assisting Michael Hodge QC.

Some banks were taking a “minimalist” approach with the wording on their contracts, such as just inserting the word “reasonable” into particular terms, which ASIC was concerned was not sufficient, Mr Saadat said.

Commissioner Kenneth Hayne: “Did the banks’ approach surprise ASIC?”

Mr Saadat: “No.’

So when the law came into force ASIC thought a number of these contracts were potentially unfair and not in compliance with the law, which reflected the approach banks seemed to have taken to reviewing the contracts, Mr Saadat said.

He was careful to say “potentially unfair” because only a court could say a term was unfair.

ASIC would only say “unfair” without qualification “where we had formed a view that we were prepared to take that matter to court and seek a declaration on that basis if the bank were not to accept our position”, Mr Saadat said.

An internal ASIC briefing paper set out ASIC’s approach to enforcement - a consultative approach first, and then enforcement action if a business is uncooperative.

By contrast the ACCC was said to be taking a consultative approach but intended to take an enforcement approach once the law started.

He thinks the two institutions don’t have that different an enforcement approach to unfair contracts.

How many court actions had ASIC started on unfair contract terms?

“We haven’t commenced any court actions,” Mr Saadat said

But the ACCC had started court action against Europcar.

But the banks had terms in their contracts that may have been unfair when the laws started, Mr Saadat agreed. “It wasn’t surprising to us,” he said.

So why not go to court?

“We saw this as an industry-wide issue. It wasn’t just an issue confined to one institution and we were seeking to get an industry-wide outcome,” Mr Saadat said.

The banks were willing to consider further changes to contracts so “we saw that as an opportunity to get an outcome with the big four that we could then leverage across other financial institutions,” he said.

Commissioner Kenneth Hayne AC QC wondered if ASIC wanted industry-wide agreement or industry-wide compliance.

“I think probably both. An agreement that they would modify their contracts so that it would comply with the law and you know potentially go beyond the law,” Mr Saadat said.

10.45am: ASIC grilled on policing unfair contract terms

The banking royal commission has heard about ASIC’s work on unfair contract terms, with ASIC senior executive leader Michael Saadat answering questions from senior counsel assisting Michael Hodge QC.

ASIC made presentations to industry about the new unfair contract laws.

The ACCC wanted to do an industry report and media release that would include comments on banking sector contracts.

Mr Saadat did not disagree that the ACCC had done more work to engage with the new unfair contract term laws.

This was partly because the ACCC received extra funding, and also because banks had said their revised contracts would not be in place until later which led to ASIC doing the work later than the ACCC had done it.

An ASIC review found unfair terms in bank contracts included allowing one party to unilaterally terminate the contract, or penalising one party for breach of contract, or allowing one party to unilaterally vary the contract.

ASIC wrote to the Australian Bankers’ Association about the terms it found in bank contracts.

Why write to the industry association and not the banks?

It was more efficient, and the banks were very much aware of the laws, Mr Saadat said.

But if banks knew about the laws and had been lobbying against them, then shouldn’t ASIC very actively seek to make sure the contracts were fair by the time the law came into effect?

“I think that is what we ultimately did,” Mr Saadat said. “Through the work that we did after this period, after this letter was sent.”

An internal ASIC email from September 2016 proposes asking banks for their contracts - so was this a change of approach to review the contracts instead of waiting until the contracts were amended?

“I think at this point given that the legislation was commencing within two months we felt it was appropriate to obtain copies of those contracts,” Mr Saadat said.

10.20am: ASIC’s unfair contracts practices probed

Focus at the banking royal commission has turned to the unfair contract terms legislation, with ASIC senior executive leader, Michael Saadat answering questions from senior counsel assisting Michael Hodge QC.

ASIC proposed to raise concerns about unfair contract terms with businesses to get them changed, an email has shown. Mr Saadat said the body would usually ask the business for its contract and review it to see if there were unfair terms.

Why didn’t ASIC review contracts earlier?

ASIC wanted to review revised contracts to look at changes that banks were making, so there was not much point looking at old contracts that would be replaced, Mr Saadat said.

The banks were planning to use the full transition period to review contracts, he said.

In April an extra $127.6m of funding was announced for ASIC to help the body implement appropriate law and regulatory reform - after it had missed out on extra cash that ACCC received for work around the unfair contract terms.

ASIC did some internal planning about what to do with the extra money, including looking at unfair contract terms.

ASIC did a number of projects with the extra money but the work it did on unfair contract terms was not linked to the funding.

ASIC always had to judge how best to use its finite resources, he agreed.

9.59pm: Solving the code

ASIC senior executive leader, deposit takers credit and insurance team, Michael Saadat has answered questions about ASIC’s possible approval of the banking code of practice from senior counsel assisting Michael Hodge QC.

One condition of approving a code is it had to be independently reviewed every three years, and the review could make recommendations but ASIC would not be able to change the code — at most it could revoke approval of the code.

ASIC did not have a strict requirement that industry associations implement all recommendations but it was one of the considerations.

ASIC would also consider whether an industry made meaningful improvements to the code.

Focus turned to loan guarantees.

There was an issue over whether a lender could take into account a guarantor’s resources when deciding whether or not to make the loan. The code was modified to allow banks to consider guarantor resources but only if the guarantor had a connection to the borrower — although going guarantor for a borrower is considered to create a connection.

ASIC had not had feedback about the issue of making sure guarantors give properly informed consent.

Feedback around parental guarantees had largely been around the consequences if banks did not comply with the code, with some stakeholders saying the guarantee should be made void if the bank did not comply with the pre-execution loan requirements. This had not been adopted into the code but this was not in contention with the ABA.

9.47am: ‘The last big issue to solve’

ASIC senior executive leader, deposit takers credit and insurance team, Michael Saadat has taken the stand to answer questions about the banking code of practice and unfair contract terms from senior counsel assisting Michael Hodge QC.

ASIC is still reviewing the code and has deferred the review while the commission hearings were going on.

The main sticking point is the definition of small business and the monetary definition the ABA proposed, Mr Saadat said.

The regulator wanted to make sure that there was nothing in this round of commission hearings that would affect whether it should approve the code, he said.

An independent review of the code and other stakeholders said small businesses should be defined as loans up to $5m but the banking lobby group prefers a $3m figure.

This is “the last big issue to resolve”, Mr Saadat said.

Mr Saadat said there were concerns about the code’s provisions being applied to larger loans, or larger “covenant-lite” loans, which could make banks less willing to lend as they wouldn’t have the same ability to take default-based action.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout