The global debt pile will grow by $US20 trillion this year, S&P says

The world’s towering pile of debt will grow even higher in the wake of the pandemic, but will not topple over, at least not in the coming two years, Standard & Poor's says.

The world’s debt burden will surge to a record $US200 trillion this year, or almost 260 per cent of total global economic output, Standard & Poor’s says.

In a new report, the ratings agency said borrowing by governments, businesses and households through the COVID-19 recession will lift total debt by 10 per cent in 2020, before levelling off in coming years as an expected recovery takes hold.

Despite surging debt around the world, S&P said “a near-term debt crisis will likely be averted” provided economic activity lifts and rates stay low and finance easy to attain.

S&P said its forecast for “a continuing, albeit choppy, global economic recovery” was predicated on a vaccine becoming available from mid-2021.

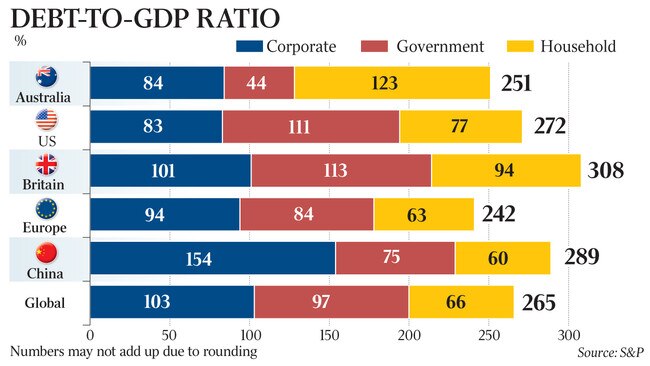

In Australia, total gross debt will lift by 19 percentage points to 251 per cent of GDP by the end of this year. Household borrowings will stay relatively steady at a lofty 125 per cent of output, or close to double the global rate.

Corporate sector debt will climb to 84 per cent in 2020 from 73 per cent a year before, and stabilise from there. Government debt will move from a relatively low 37 per cent pre-crisis to 44 per cent by the end of this year before peaking at 56 per cent in 2021, the report said.

While the sums outlined in the report are huge, S&P said “for governments, it’s important to recognise the feedback loop involved, as fiscal stimulus of unprecedented magnitude are helping to drive the very same economic recovery crucial to borrowers’ ability to pay off debt”.

Total public sector debt as a proportion of GDP will jump by 15 percentage points to 97 per cent by the end of this year, S&P projected, while corporate borrowing will climb by 14 percentage points to 103 per cent and household debt by five percentage points to 66 per cent.

In the aftermath of a wrenching downturn over this year and the next, businesses will default on their loans at twice the rate leading into the pandemic, S&P said.

As a result, banks worldwide will suffer credit losses of $US1.3 trillion in 2020 — more than twice that of last year — and will lose a further $US0.8 trillion in 2021.

The report coincided with the release of ANZ’s annual accounts, which showed the lender had tripled its bad debt charges, leading to a 40 per cent collapse in profit.

S&P was again optimistic this did not present a fundamental threat to the global financial system: “We expect most major banks should be able to absorb credit losses arising these two years.”