Australia is an also-ran in the global debt stakes

The Morrison government’s historic debt surge won’t strip the nation of its near-top position in the global fiscal pecking order.

The Morrison government’s historic debt surge, which will push gross debt above $850bn within a year, won’t strip the nation of its near-top position in the global fiscal pecking order, according to the budget update.

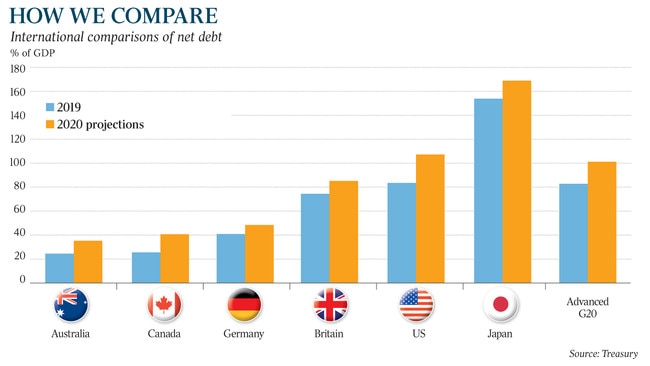

The $280bn deterioration in the federal budget last financial year and this caused by massive spending and revenue writedowns will push net federal debt almost to the equivalent of 36 per cent of GPD, the highest level in a generation, but still far short of that of other nations.

“Australia’s debt burden was low on a global basis going into the crisis, and even after the lift in debt this year and next, Australia’s debt burden remains low in comparison with advanced nations,” said CommSec chief economist Craig James.

Even before the pandemic struck, net debt across the G20 countries was a little over the equivalent of 80 per cent of GDP, including 75 per cent in Britain, 84 per cent in the US and 123 per cent in Italy.

Across the G20, which includes Australia, net debt is expected to leap 17 percentage points to just over the equivalent of 100 per cent of GDP.

New Zealand’s net debt will more than double from 8 per cent in 2019 to almost 21 per cent in 2021, according to the IMF.

“Given the low starting point, the projections still leave government debt lower than in many other economies,” HSBC chief economist Paul Bloxham said.

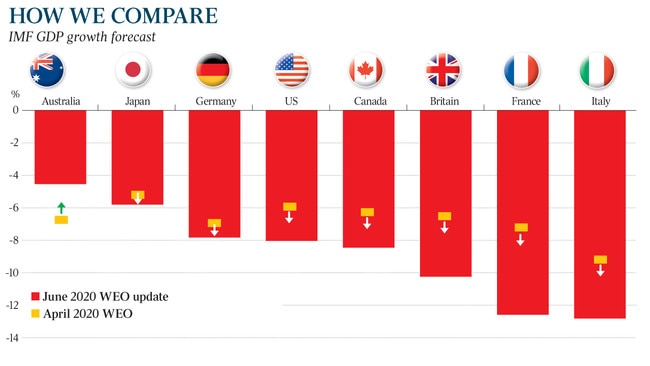

The budget update, which forecast a drag down on GDP of 3.75 per cent this year, also revealed Australia’s high level of trade with China would help the economy sustain one of the lowest declines in GDP internationally.

“With Chinese GDP expected to grow this year, albeit modestly, Australia’ external outlook remains in a better position than many other economies,” it said.

“All of Australia’s top 10 trading partners, expect for China, are expected to experience a contraction in GDP in 2020,” it said, pointing out the euro area’s economy would shrink 8.75 per cent this year and the US would experience a contraction of 8 per cent. Australia’s jobless rate will peak at 9.25 per cent this year before falling to 8.75 per cent by the middle of next year.

“There have been devastating health and economic consequences from the COVID-19 pandemic in the US, with the highest number of confirmed cases and fatalities in the world,” the update said.

In the US, jobless claims between March and July exceeded 51 million people, or about a third of total employment before the crisis struck. “Weekly new claims peaked in late March at 6.9 million. This compares with 695,000 in 1982 and 665,000 in 2009 during the GFC,” the Treasury said.

Australia’s budget deficit this financial year will balloon to the equivalent of 9.7 per cent of GDP, or $184bn, the biggest since World War II as a share of the economy, but smaller than most other nations’ increase.

Budget deficits across the developed world are expected to widen to about 14 per cent of GDP this year, which is 10 percentage points higher than in 2019.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout