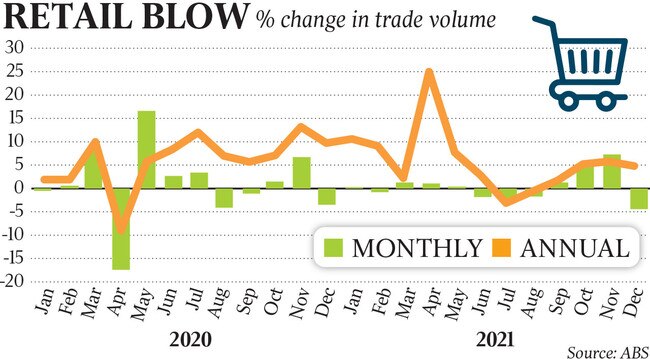

Shoppers pull back on spending after splurge as retail sales drop 4.4pc in December

Retail spending remained ‘strong’ in December, despite recording a big drop in the month as the post-Delta lockdown spending spree came to an end.

Australian shoppers sharply scaled back spending in December but retail trade stayed “strong” following two months of turbocharged shopping as a result of easing Delta restrictions and the November Black Friday sales.

Retail trade volumes dropped 4.4 per cent in the final month of 2021 – the largest monthly decline since the national lockdown of 2020, seasonally adjusted figures from the Australian Bureau of Statistics showed.

The $31.9bn in December sales were, however, 4.8 per cent up on a year ago, and ABS director of quarterly economy wide statistics Ben James said “despite this month’s fall, retail turnover remains strong”.

Retail jumped 7.3 per cent in November and 4.9 per cent in October as the two largest states exited Delta lockdowns.

Goldman Sachs chief economist Andrew Boak said December’s decline “was largely driven by a pullback in spending on discretionary goods after Black Friday sales in the prior month, although the surge in local Omicron cases towards the end of the month may have contributed”.

More up-to-date bankcard spending data pointed to consumer caution and another decline in spending through early January amid surging Omicron cases, although the hit has not proved as bad as feared and CBA internal data released on Tuesday confirmed a lift over the second half of the month.

The ABS figures showed Victoria recorded the largest monthly decline – down 8.4 per cent – but, again, this was off record levels in November. Victorians spent $8.2bn in December – the third most in history and 6.5 per cent more than a year earlier.

NSW turnover had the next largest fall, down by 4.2 per cent.

Five of the six retail industries tracked by the ABS fell in the month, led by a 21 per cent drop in department store spending, followed by a 17 per cent fall in spending on clothing and footwear. Spending in cafes and restaurants was slightly down, while “other retailing” recorded a 4 per cent decline. Bucking the trend was a 2.2 per cent lift in food retailing, which includes supermarkets and bottle shops.

Spending across industries was higher than a year earlier, besides department stores, where turnover was 9 per cent down.

Northern Territory was the only jurisdiction to report a lift in retail trade, up 3.6 per cent “as lockdown restrictions eased and the introduction of lockouts allowed more favourable trading conditions for businesses,” the ABS said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout