Inflation, rate rises to take a toll on Future Fund performance

Australia’s sovereign wealth fund, chaired by Peter Costello, says some risk has been removed in its listed equities portfolio due to the run-up in prices.

Future Fund chairman Peter Costello has pronounced the end of an extraordinary period of fiscal and monetary stimulus, with market volatility in January likely to set the tone for 2022 as policymakers wrestle with a global inflationary outbreak.

Unveiling the fund’s December 31 portfolio update before the outcome of a key Reserve Bank board meeting on Tuesday, the former Treasurer in the Howard Government said the world had come through the “absolute high-point” of expansionary monetary and fiscal policies.

The unemployment rate, with a 4 in front of it, was “very low historically”, and inflation was “reasonable” at 3 per cent-plus.

“You’d have to say that extra stimulus is not going to be required in the years ahead and we should be going into a tightening cycle in monetary policy and a tightening cycle in fiscal policy,” Mr Costello said.

The January sell-off in equities amid expectations of a hike in near-zero interest rates highlighted that stocks trading on high multiples were likely to be early casualties.

The Future Fund chief singled out the tech sector, where some companies paid no dividends and offered returns which were “out in the never never” but had still been strongly supported by investors.

Mr Costello also backed recent calls for a review of the RBA’s policy framework, including its 2-3 per cent inflation target which he introduced as Treasurer but the central bank had failed to achieve in recent years as deflation took hold.

“(The RBA) is independent but not infallible,” he said.

“It has to be held accountable like other institutions in modern society.”

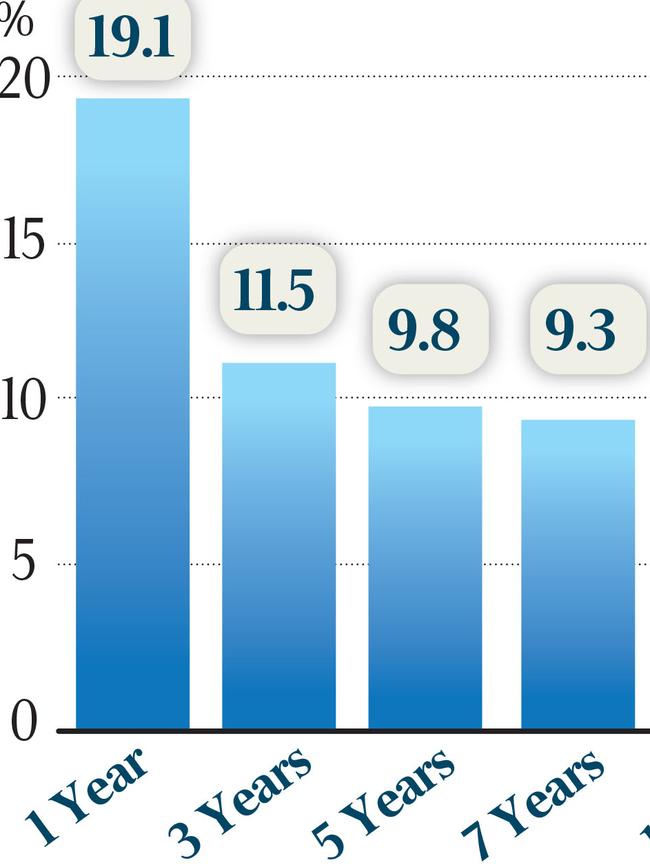

The chairman’s commentary came as the Future Fund reached a record $204bn in the December quarter, up $4.4bn from the September quarter, after returning 19.1 per cent for the calendar year against a target of 7.5 per cent.

This compared to a record, 22 per cent return for the 2021 financial year.

Higher inflation and rising interest rates, however, were now expected to take a toll on the fund’s performance.

Chief executive Raphael Arndt said the portfolio maintained its mid-range, neutral risk-setting, although some risk had been removed, particularly in the listed equities given the run-up in prices.

“We anticipate lower returns in the future,” Dr Arndt said.

“In response we are seeking out opportunities to access value from less liquid and more skill-based investments and working our relationships with partners to identify more focused opportunities both to secure returns and to manage risk.”

The Future Fund, seeded with a $60.5bn contribution from the Federal Government in 2006 but with no capital contributions since then, has now recorded a 10-year return of 10.8 per cent against a target of 6.2 per cent.

Investment returns have added more than $143bn over the life of the fund.

Mr Costello foreshadowed a “significant” adjustment as an era of exceptional monetary stimulus came to an end.

“The biggest challenge for investment at present is rising inflation, rising interest rates and the effect these will have on asset prices,” Mr Costello said.

“The board’s focus is on positioning the portfolio to be resilient to an environment of greater uncertainty and we expect future returns to be lower than in recent years.”

Dr Arndt said the fund remained focused on sustaining a portfolio that was as robust as possible, and balanced its risk and return objectives.

“Our work last year to analyse how the pandemic was accelerating changes in the investment landscape is proving valuable,” he said.

One thing which had surprised him about the current environment, he said, was the strength of the Australian economy, where unemployment was the lowest it had been for “several generations”.

The same applied to the US economy.

However, if “rampant” inflation emerged, it would be very difficult to control.

It was therefore necessary to change the policy settings, knowing there would be an impact on investment returns.

The Future Fund’s total funds under management, including ancillary funds, stands at $248bn.

Total funds under management stands at $248 billion.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout