Melbourne joins the $1m property club, says CoreLogic

An unexpected yet modest bump in the rate of property price growth across Australia through January caused another capital city to surpass the $1m median price.

An unexpected yet modest jump in property price growth has pushed another city into the $1m home bracket.

Despite typically being the quietest month of the year to buy and sell property, the cost of housing nationally rose 1.1 per cent over January, according to property researcher CoreLogic’s monthly housing data.

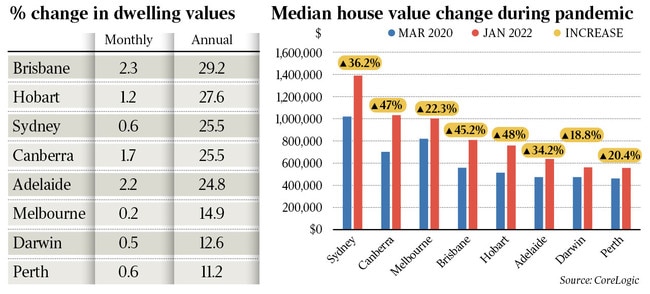

The result proved a 0.1 per cent increase on December’s growth rate, which was linked to gains in the two largest housing markets of Sydney (up 0.6 per cent) and Melbourne (up 0.2 per cent).

House prices in Melbourne – Australia’s third most expensive city – reached $1,002,464 last month, joining Sydney and Canberra in the $1m club.

CoreLogic research director Tim Lawless said the result might indicate a levelling in prices in Sydney and Melbourne.

“Even with this subtle rise we’ve seen in January, that was still on pretty thinly traded stock, so I’d urge a little bit of caution in interpreting it,” he said. “The trend still holds that we are seeing the broader market softening compared to where he was early last year.”

AMP chief economist Shane Oliver believes prices in the country’s two largest cities look likely to peak by mid-year. But he expects the strong gains seen in Brisbane (up 2.3 per cent) and Adelaide (up 2.2 per cent) last month to remain elevated this year. Despite a slowing over the past quarter, the theory seems to be supported by strong clearance rates achieved in spite of more choice in available homes.

Canberra rose 1.7 per cent last month, followed by Hobart (up 1.2 per cent), Perth (up 0.6 per cent) and Darwin (up 0.5 per cent). Prices across the combined regional markets were up 1.8 per cent.

AMP chief economist Shane Oliver believes Brisbane and Adelaide, and possibly Perth and Darwin, will likely stay strong over the next 12 months.

It is good news for Adelaide sellers Dana and Ben Pietsch, who are selling their home in Linden Park. The property is fully renovated, but the family has outgrown it.

After a tough few years looking to buy again, the couple finally found something for them and their children, Austin and Ryan, aged 5 and 3, and are now ready to move.

“The hike in prices really came out of nowhere,” Ms Pietsch said.

“It was tough pre-pandemic because there was no stock and then everything changed and people were going crazy with bids.”

The property will go to auction this Saturday with Ray White Norwood agent Brandon Pilgrim, who is confident it will sell under the hammer given the demand.

“The process of an auction will get you a better price, no matter the market,” Mr Pilgrim said.

“A property in a desirable location with a good school zoning will lead to a good auction.”

AMP has revised down its home price growth forecast for this year to 3 per cent, from 5 per cent, based on the expectation of a rate rise in September.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout