House prices will rise in 2022 even if the RBA hikes rates: CoreLogic

Property researcher CoreLogic is tipping the housing market will look through interest rate hikes – at least in the short term.

The market is all but certain the cash rate will move higher this year, but prospective homebuyers counting on house prices declining through 2022 may end up disappointed.

According to property research house CoreLogic, any decline in property prices is likely to be seen about a year after rates start to move.

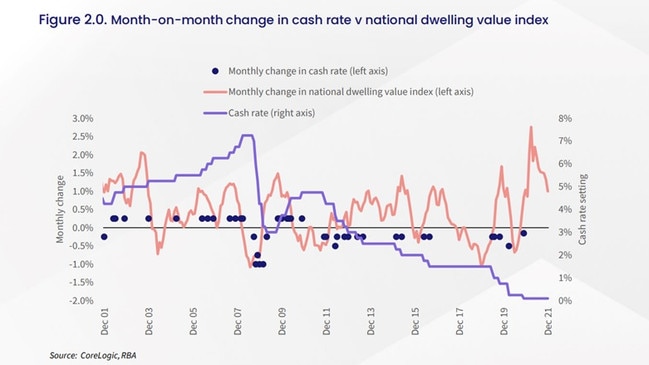

“There’s about an 84 per cent inverse correlation between movements in housing values and movements in the cash rate,” CoreLogic research director Tim Lawless said.

“Essentially what that means is when the cash rate rises, housing values fall about 84 per cent of the time. And vice versa, of course. But if you look at the lag component, it actually has the best fit about 12 months after a cash rate move.”

The lag between changes in the cost of debt and house prices is probably due to the cyclic nature of rate moves, Mr Lawless noted.

“Quite often it’s not just one rate hike or one rate cut – rate moves happen in sequences, or cycles. And that’s probably one reason for the lag in the correlation: once you see rates rising, generally that first move will be followed by one, two or three, etc, movements down the track.”

The research comes as economists and the market wait for the Reserve Bank to kick off the next hiking cycle, with an August move looking likely. CBA economists are among those that have pushed forward their rate hike expectations to mid-year.

“We brought forward our view on the first interest rate hike from November to August,” CommSec chief economist Craig James told The Australian.

“August is a favoured month because the RBA will have the next inflation figures at the end of July so they’ll have a bit more insight with that.”

Ahead of the RBA’s monthly rate-setting meeting on Tuesday, Mr James expects the central bank to emphasise the inflation drivers in the current market.

“Inflation in Australia is very much driven by petrol prices and by housing construction. Housing construction costs will resolve themselves over time and not everyone’s building a home out there, so it certainly doesn’t affect everyone,” Mr James said.

“The cost of building has gone up basically because demand is strong and supply of workers is not meeting the demand.

“The other thing is the cost of petrol, which is a worldwide situation that the Reserve Bank has no control over. So supply chain issues, once they do get resolved, and that would be the Reserve Bank‘s contention, do we still see the underlying factors driving inflation higher?”

With an expected delay in the impact of higher rates on house prices, CoreLogic is tipping home values will push higher through the course of 2022.

“We still think that over the full calendar year there will be a rise in housing values; we haven’t changed our views on that. But the rate of growth over the year will be remarkably less than the 22 per cent we saw last year,” Mr Lawless said.

“The consensus forecast among most of the mainstream economists would be growth this year of somewhere between 5 and 7 per cent, which we would certainly endorse.”

Rates rising faster than expected posed a downside risk to property prices, he cautioned.

Other factors that could impact the trajectory of the housing market include further interventions from the prudential regulator or from government policies designed to shore up any weakness, CoreLogic head of research Eliza Owen added.

The unprecedented take-up of fixed mortgages in the past two years would soften the blow from higher rates, she predicted.

“I think that will help shore up some confidence in the housing market and people’s ability to service their mortgages.

“It is worth noting that fixed rates have started to adjust for new borrowers, though, so that could reduce some fresh demand.

“But it’s not like we would see an influx of distressed supply off the back of changes in cash rate conditions.”

The extent of any downturn depended on how quickly rates moved and how high they went, Ms Owen said.

“It’s very uncertain at this stage but it’s fair to say that some of the dramatic reductions we‘ve seen in the cash rate have seen very strong upward pressure on house prices. So you have to assume that if we see a rapid rise in rates, then that would have more of an impact on the downswing phase.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout