PropTrack’s Cameron Kusher says home loans arrears won’t hit GFC levels

Home loans past due is on the rise, but PropTrack’s top economist does not believe arrears will hit 15-year highs.

Homeowners are expected to weather the mortgage repayments storm better than they did through the global financial crisis, avoiding widespread defaults and forced sales.

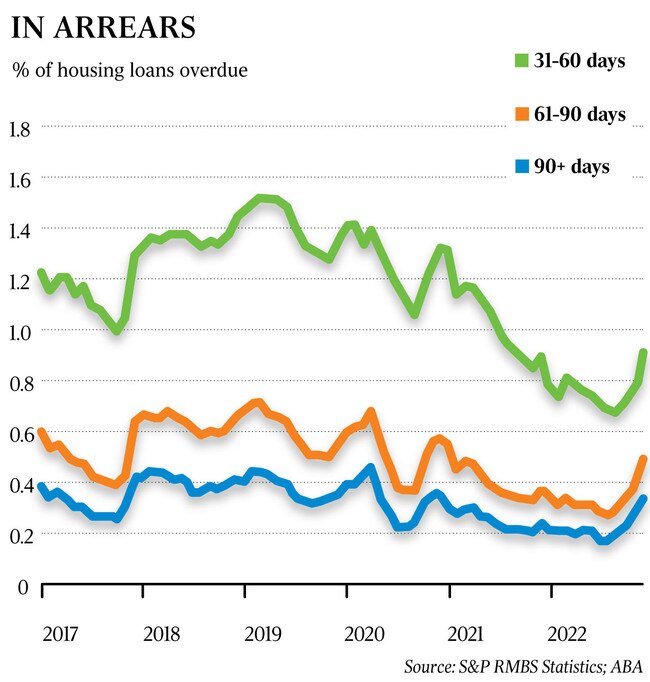

Increasing late mortgage repayments have been flagged by the Reserve Bank as one of the early signs some households are entering financial stress after 10 interest rate hikes in the past year.

New figures from the Australian Banking Association show the portion of loans three or more months past due nudged higher to 0.41 per cent through January, while repayments 31 to 60 days late have risen to 0.33 per cent across all banks.

While there have been some recent marginal increases, the mortgage market is tracking well below arrears levels recorded through the 2008 GFC, when 1.69 per cent of loans were past due. The previous long-term average sat about 1.4 per cent.

PropTrack director of economic research Cameron Kusher said cheap credit allowed buyers to overextend themselves through the boom, but that would not necessarily lead to an influx of forced sales.

“We came off a period where interest rates were the lowest they’ve ever been,” Mr Kusher said. “We came off a period where property prices were rising very quickly, so people were probably borrowing more they had previously or that they would have previously been comfortable with doing.

“Certainly, I don’t think we’ll get back to anything like the GFC.”

Westpac chief executive Peter King revealed last month that the major bank was sitting on about 200 homes after owners defaulted on payments, similar to levels 15 years ago.

About 880,000 loans are expected to move from fixed to variable rates this year, causing a 30- to 50 per cent increase in repayments for borrowers.

The consensus among leading housing economists is homeowners will continue to service their loans despite the higher interest burden. While listings may rise in the coming months as some confidence returns to the market following price rises, it will not be enough to cause a significant downturn.

Chief executive of financial planning platform Lifesherpa, Vince Scully, said Australians had clear money priorities.

Housing prices stabilise in Sydney, Melbourne ahead of possible rate pause

“Your home and utilities are the two things people will do anything to pay,” Mr Scully said.

“Arrears and defaults historically have been really low. Maybe this is the thing that brings us back to real standards, but I’m not seeing it.”

Rising late payments, coupled with increased credit card usage has the Reserve Bank concerned. Monthly purchases on credit cards rose 17 per cent – or $4.9bn – over the 12 months to January.

Mr Kusher said homeowners would prioritise paying off mortgages over other expenses.

“You would see late payments rise in credit cards, auto loans, things like that, earlier and by a larger magnitude than you would see with mortgages,” he said.

RateCity’s director of research Sally Tindall suggested homeowners were falling back into “bad habits” as they readjusted to higher cost-of-living expenses.

“Households are really feeling the squeeze from high rents, higher cost of living and could be reaching for their credit cards to make ends meet,” Ms Tindall said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout