Unions push Jim Chalmers to make room for ‘workers perspective’ on new RBA board

Jim Chalmers is being pushed by unions to shape the RBA’s new rate-setting board to serve ‘workers’ perspectives, sparking a warning of possible election-eve politicisation of appointments.

Jim Chalmers is being pushed by the union movement to shape the Reserve Bank’s new interest rate-setting board to serve “workers’ perspectives”, as two of the RBA’s former governors warn appointments made in the shadow of an election risk being politicised.

After passing his long-stalled plan to split the RBA board in two, the Treasurer on Friday promised his appointments to the separate governance and rate-setting committees would be “first class” and made following negotiations with the Coalition.

The passage came as Dr Chalmers and Anthony Albanese turned their attention to December’s mid-year budget update, which could allow for a host of pre-election sweeteners.

But after Dr Chalmers confirmed the RBA’s new structure would be established following its February meeting, and giving the government the opportunity to appoint new board members before the looming election, former governors Ian Macfarlane and Bernie Fraser both raised the spectre of politicisation.

ACTU secretary Sally McManus urged the government to ensure the new RBA structure – which followed a sweeping review last year – retained members “with experience and knowledge of workers’ perspectives”.

“The current wait-and-see approach of the Reserve Bank to rates is harming working people on top of price gouging by supermarkets and insurers,” she said. “The longer the RBA waits to cut rates, the faster it will need to move after that to protect job gains and to stop the economy from stalling. It is time our Reserve Bank took action.”

With the ANZ and Bank of Queensland on Friday pushing out expectations of a rate cut from February to May and families reining in budgets amid mortgage stress, Mr Albanese acknowledged the government “has more work to do on cost of living”.

But while headline inflation has receded sharply in recent months thanks to federal and state power bill rebates, the RBA’s preferred underlying price growth measure has proved persistent and re-accelerated last month, threatening to keep the cash rate higher for longer.

Following the passage of Labor’s reforms, Mr Macfarlane, who served as the RBA’s sixth governor from 1996 to 2006 and previously described the changes as “a huge risk”, said the appointments process would now become “politically sensitive”.

“Before appointments to the Reserve Bank board were not politically sensitive. Now they will be very politically sensitive,” he said.

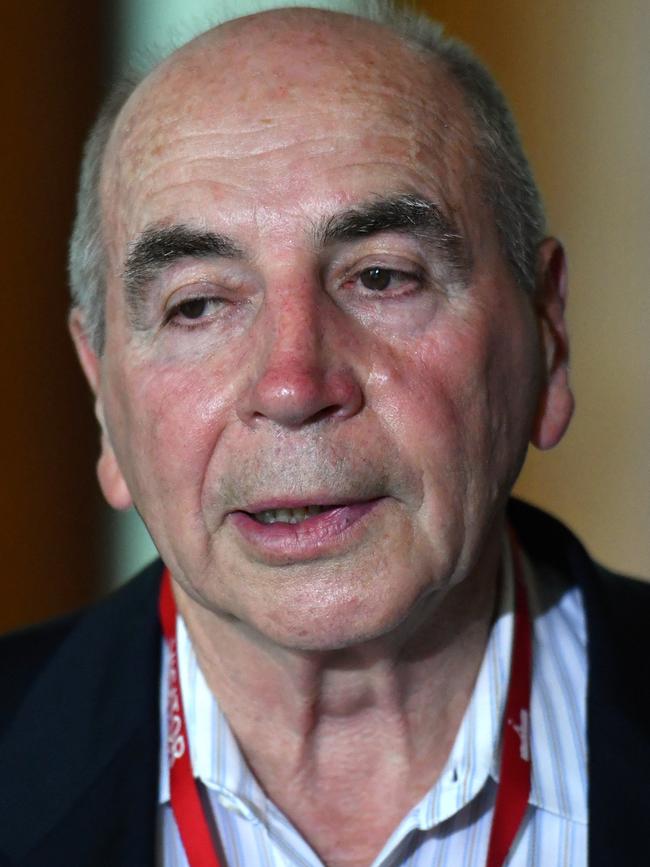

Mr Fraser, who led the central bank from 1989 to 1996 during the Hawke-Keating governments, warned against politically aligned appointments.

“I’m afraid that the politicisation of the public service and appointments has become a pretty serious crime over the last few decades,” he said. “I would hope that’s not repeated or demonstrated in the appointment of the RBA board members.”

Speaking in Canberra on Friday, Dr Chalmers committed to engage with the Coalition in “good faith” through the appointment process despite its opposition to the legislation. “Regardless of the irresponsible position taken by the Coalition, we will continue to be consultative where we can,” he said.

“We will continue to do the right thing and we will continue to make sure that the independent Reserve Bank is, as much as possible, beyond the party politics of this building.”

But opposition Treasury spokesman Angus Taylor warned the continuity of existing board members was now in jeopardy.

“This puts all positions up for appointment allowing the Treasurer to start sacking and stacking,” Mr Taylor said.

While RBA governor Michele Bullock, her deputy Andrew Hauser and Treasury secretary Steven Kennedy will transfer to the rate-setting board under the new arrangements, the capacity in which the six external board members will serve under the dual board structure is yet to be announced.

Dr Chalmers has previously committed to automatically transfer the current external board members onto the new rate-setting board, however at least one has expressed an interest in transferring to the separate governance board, The Australian understands.

That would give Dr Chalmers the opportunity to make at least one further appointment to the new rate-setting board, and several to the governance board, before the next federal election.

The tenures of four current external board members – economist Ian Harper, business executive Carol Schwartz, Wesfarmers director Alison Watkins and CSL director Carolyn Hewson – will expire in the next term of parliament, enabling Dr Chalmers to make further appointments to the RBA should Labor win the next federal election.

The remaining two members – AustralianSuper board member Elana Rubin and former Fair Work Commission president Iain Ross, both former ACTU officials – were appointed by Dr Chalmers last year meaning their terms will expire in 2028.

ANU distinguished professor Renee Fry-McKibbin, who co-wrote the 2023 review into the central bank, said it was critical the treasurer of the day discussed appointments with his opposition counterpart.

“The review made some recommendations on implementation, with the most important being that the government consult with the shadow treasurer on the implementation of the review, especially on the appointments to the governance and monetary policy boards,” she said.

Speaking on Thursday evening just prior to the passage of the reforms through the Senate, Ms Bullock said the RBA was already progressing many of the review’s recommendations that didn’t require legislation.

“There’s clearly going to be some structural things that are going to go on, but I think that the monetary policy board … we’re already moving that direction, so we’re just going to keep on moving … and basically being agile,” she told the Committee for Economic Development Australia’s annual dinner.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout