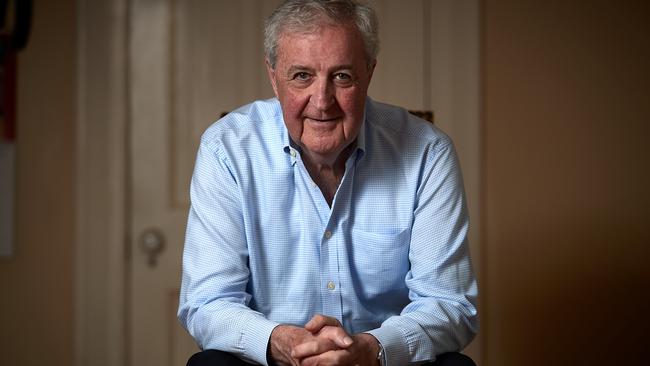

‘Waste of everyone’s time’: new RBA governance board should be scrapped, says Ian Macfarlane

Former Reserve Bank governor Ian Macfarlane says the proposed new RBA governance board would be a ‘B Team’ potentially stacked with Labor mates.

Former Reserve Bank governor Ian Macfarlane has called on the federal government to scrap plans to set up a new governance board for the central bank, in addition to its current monetary policy setting board.

In an interview with The Australian, he said Jim Chalmers should not be pushing ahead with legislation before the Senate to set up the new board, despite the recommendation of a review into the RBA released last year.

Mr Macfarlane, who was governor of the bank for 10 years from 1996 to 2006, said the governance board would be a “B Team” board that was “totally unnecessary and a complete waste of everyone’s time”.

“The sensible thing to do would be to drop the idea and just stick with the current board,” he said. “I don’t know anyone who feels strongly in favour of it.

“If it met, its first order of business would be to work out what it was going to do.”

Mr Macfarlane called on members of the existing RBA board to refuse any overtures to move to the new board if it were established, saying it would be a “complete demotion” for any of them to move from the monetary policy board to the “useless” governance board.

He warned that any moves by the government to use the creation of a new governance board to “stack” the powerful interest rate setting monetary policy board with “Labor mates” would risk undermining the credibility of the RBA.

He said the two appointees to the board by the Albanese government in April last year, Elana Rubin and Iain Ross, were both former ACTU executives.

His comments follow questions about the need for the new board by former treasurer Peter Costello at a recent Senate committee hearing, and warnings by the opposition that the government should not use the establishment of a governance board to “stack” the monetary board with its “mates”, ahead of what could be a tight election campaign next year.

The government has already begun advertising for members of both boards, which will be made up of six independent members, plus the RBA governor, the deputy RBA governor and the Secretary of the Treasury. If all six current members decide to stay on, it gives the government the opportunity to appoint six new members.

Mr Macfarlane said all existing members of the board should be allowed to serve out their terms on the monetary policy board.

Appearing before the Senate recently, RBA governor Michele Bullock expressed her desire that there be some “continuity” of membership in the monetary policy setting board.

But when asked about her views at the RBA press conference this week, she said she would like to see “continuity with respect to both boards” – a comment which could leave open the potential for some existing board members to move to the governance board.

Mr Macfarlane said there was no need for “continuity” of membership with respect to the proposed governance board, as it was not in existence.

He warned that any attempt by the Treasurer to encourage members of the existing board to serve on the governance board would be overstepping his powers.

He said Dr Chalmers had no powers under the RBA Act to ask board members to leave ahead of their term and sit on another board, and the review itself had recommended current board members be allowed to make their own decision on which board they would like to serve on.

Mr Macfarlane said the government should just rename the existing board as the monetary policy setting board and not make any further changes. His comments come as the Senate is considering the proposed changes to the RBA Act to set up the second RBA board.

He said the government should not use the establishment of a new board to add new members to both boards.

His comments also follow those of former Treasurer Peter Costello, who also criticised the proposal at a recent Senate hearing.

In answers to questions from the Senate, Mr Costello said there was no need for the establishment of a separate governance board.

Mr Macfarlane said the proposals would effectively mean the RBA had “A” class directors and “B” class directors.

“Substituting two boards for one, will not make the Monetary Board better,” he said.

He said having two boards would create a need for a “careful demarcation between the responsibilities of the two boards to avoid the risk of duplication or conversely prevent issues from falling between the cracks.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout