Treasury chief issues warning on spending spree

Treasury secretary Steven Kennedy says government spending will eventually need to be reined in, but not just yet.

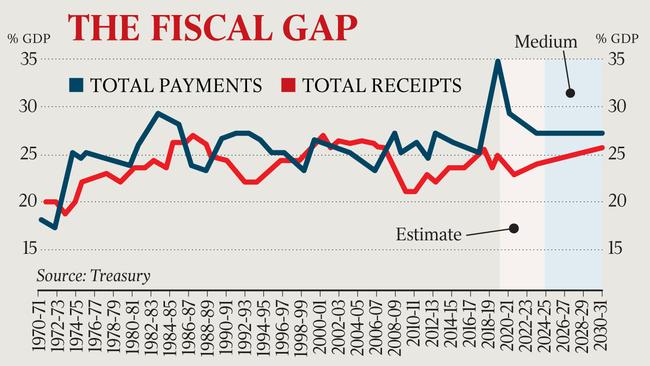

Treasury secretary Steven Kennedy says government spending will eventually need to be reined in to close a persistent gap of about $40bn between tax revenue and increased outlays on aged care, disabilities and welfare that will leave the budget in deficit for a decade.

With Canberra’s spending running at historically high levels in coming years, Dr Kennedy said budget repair would be considered at “an appropriate time” as part of the Morrison government’s two-phase fiscal strategy. After last week’s budget handed down a record $161bn deficit and predicted national net debt would approach $1 trillion, Dr Kennedy said the underlying cash deficit was projected to be a hefty 2.4 per cent of gross domestic product after four years of projected economic expansion. But he warned cutting spending now could endanger the recovery.

“There is an increase in the spending as a proportion of GDP, settling at about 26 per cent,” Dr Kennedy said. “That is an area that, at an appropriate time, governments would need to be thinking about if they, as I think they should, retain the objective of raising revenue of around 23.9 per cent of GDP.”

In an upbeat post-budget address on Tuesday, the Treasury chief said low debt-servicing costs meant Canberra retained the fiscal firepower to combat another crisis, while a return to open international borders and stable skilled migration was in Australia’s interest.

“Our success in managing the crisis to date is enabling us to look forward to the next set of challenges at a time when others around the world remain focused on the immediate threat,” Dr Kennedy said.

He noted GDP per capita had recovered to its pre-crisis level in a year, with only the US among rich nations matching Australia.

“We now have an opportunity to drive down the unemployment rate below its pre-COVID-19 level and to generate appropriate wages and price growth while maintaining fiscal sustainability,” he said.

The Reserve Bank in minutes from its May board meeting released on Tuesday said despite a strong recovery in the labour market wage rises and inflation could be slower to lift than expected “because of inertia in wage- and price-setting practices”.

Dr Kennedy’s speech came ahead of wage data on Wednesday. ANZ Bank economists expect the wage price index to rise by a subdued 0.4 per cent in the March quarter, with annual pay growth sliding to a record low of 1.3 per cent. On Thursday, labour force statistics for April are expected to show the unemployment rate unchanged at 5.6 per cent, despite the end of the $89bn JobKeeper wage subsidy on March 28, the most expensive program in Australia’s fiscal history.

Dr Kennedy noted that post-JobKeeper, between 16,000 and 40,000 people on the payment had lost their jobs from late March to April 11, way below the 100,000 to 150,000 his department had expected. Many had found new jobs or were working in other jobs.

In considering deeper fiscal trends, he said “the persistence of the deficit reflects both the slow recovery of receipts and the significant portion of government spending which is of a fixed nature and thus remains higher as a proportion of GDP for longer”.

“It also reflects the structural increases in spending the government has committed to essential services, particularly to aged care, NDIS and JobSeeker payments,” Dr Kennedy told an Australian Business Economists gathering in Sydney on Tuesday.

“There will come a time where it is prudent to accelerate the rebuilding of our fiscal buffers.

“However, an aggressive tightening of fiscal policy in the current context would risk long-lasting costs to the economy and could be counter-productive in maintaining and building fiscal space.

“We must manage public finances in a way that puts the highest priority on maximising the long-term performance of the economy. Australia has reduced its debt-to-GDP ratio from higher levels in the past.

“The key to doing so was a strong economy, restrained government spending and supportive economic reforms.

“It is worth noting that even when deficits are being used to support economic growth, the quality of decision-making is crucial. The cost of wasted spending is no less in a deficit than it is when a surplus is present”.

Dr Kennedy said that the budget projections illustrated the Morrison government was on track to stabilise and reduce debt even though it remained firmly in the first phase of the fiscal strategy, which involved maximising output and employment growth in the economy.

“Coupled with Australia’s debt to GDP being low by international standards, there remains fiscal space to respond again with fiscal policy if the need arose,” he said.

The Treasury secretary welcomed a return to a skills-based migration program that would boost the size of the economy, raise productivity, reduce ageing and spread the burden of fixed social welfare costs.

“Migrants — particularly skilled, working-age migrants — deliver an economic dividend for Australia, raising workforce participation in the longer term and likely productivity growth,” Dr Kennedy said.

“Open international borders also provide economic opportunities for specific sectors, such as tourism and education services, and provide broader benefits that flow from being able to travel and connect with others in person rather than electronically.

“COVID-19 is likely to be with us for many years. Therefore, preparing to live with COVID-19 seems to be the most likely future path for the globe and Australia.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout